What is FIRE (Financial Independence Retire Early)?

FIRE is a financial movement that focusses on extreme accumulation of wealth in a short period of time to enable early retirement. It is achieved by living a frugal lifestyle, saving a high percentage of your salary, and investing.

The ‘FI’ part – financial independence – is about having enough money to comfortably live at the same standard for the rest of your life, or least for an extended amount of time, without needing to work.

You might only need to work a low-stress, low-paid job or take part-time work to ensure you remain financially independent. Career breaks, redundancies or other breaks in income are of no concern, as you have the financial resources to sustain your lifestyle for a prolonged period.

The ‘RE’ part – retire early – is choosing to retire earlier than the traditional retirement age. When can draw down enough of your accumulated wealth each year to support the lifestyle you need for the rest of your life (without ever going broke) you can retire. We explain how below.

Why has FIRE become popular?

It has gained steam in recent years for a few reasons:

- People are becoming more financially literate. There is a wealth of information available on budgeting, investing and retirement planning. People are realizing early retirement is genuinely feasible; it does not need to be when the government says you can.

- Generally, living standards are the best they have ever been. Our overall economic welfare is high. Higher incomes enable people to pursue lofty financial goals.

- It is also due to society’s growing dissatisfaction with the 9-to-5 life in general. People are suffering from disillusionment at the thought of spending the majority of their fleeting life doing something they do not particularly enjoy.

How do people achieve FIRE?

FIRE is a movement defined by three lifestyle characteristics:

1. Frugality

This is not about being cheap. It is about deliberate, conscious spending on the things that truly matter.

Ruthlessly cut out anything that does not bring satisfaction or that is simply ‘keeping up with Joneses’:

- Minimize lifestyle creep. As your salary grows, it’s tempting to continually ‘level-up’ your lifestyle by shopping at more expensive places or getting a pricier car. This mentality will ensure you are never able to save as much as you could.

- Avoid falling prey to the hedonic treadmill. The rush of happiness from purchasing increasingly more (and increasingly expensive), products and services has diminishing returns. You will likely return to your baseline of happiness with nothing but a hole in your wallet.

2. Extreme saving

With your frugal mindset comes additional savings. If you want to retire early, there’s no escaping the fact that you will need to save a large proportion of your income.

We’ll look at true FIRE calculations below, but at a very basic level, consider this: If you need $1,500 dollars to live each month, then saving an additional $1,500 each month knocks 1 month off your retirement. Do this for 60 months in a row, and you have knocked 5 years off your retirement.

This example is assuming you are already saving enough to support retirement at the traditional age.

Now, there are factors such as inflation and your growing interest pot to take into account, but fundamentally, that is all there is to it.

The big debate is what percentage of your salary should you save? Some save more than 80% in order to start their retirement decades in advance. But you must remember to live your life while you are young!

3. Passive investing

Sensible, passive investing strategies using ETFs & index funds are common. You cannot hope to retire decades early through frugality & saving alone. Investments allow your money to gain interest and compound over time. It is this compounding effect that will ultimately permit your early retirement.

Why passive investing and index funds for FIRE?

Put simply, passive investing has performed exceptionally well historically, it is almost completely hands-off, and has the lowest fees.

These three factors combined make it almost a ‘no-brainer’:

- Passive investors outperform 80% of active fund managers. That is, simply tracking the market is likely to make you wealthier than using expensive, actively managed funds. Intuitively, you would think that the professionals would help you get richer quicker, enabling an early retirement. But you do not always get what you pay for in the investing world.

- Most people don’t have the time or knowledge required to invest ‘actively’. They have bridges to build, diseases to cure, and a life to live. Even if they do have the time, they likely won’t perform well (see point 1!). It is extremely risky, and you are gambling with your future here. Passive investing is not only simpler to set up, it also requires almost no on-going maintenance.

- You can get zero fee funds from Fidelity. You can also get low 0.10% expense ratios from Vanguard (our recommendation). Small differences in fees can have a drastic effect on your wealth over time. Low fees mean you can keep more of your investment return and retire earlier!

Passive investing is the secret to retiring early. It takes time as it relies on compounding interest to grow your wealth, but it has a fantastic success rate.

FIRE is about ‘great offense’ and ‘great defense’

We have discussed the need for frugality and a high savings rate about. This is having great financial defense; staunchly defending the wealth you have worked hard to acquire.

But you also need to have great financial offense. That is, you need to go out and get a high salary that can accelerate your FIRE ambitions.

Be it negotiating a raise, moving companies for a higher salary, or doing something entrepreneurial for a side income, you will need to do everything you can to increase your earnings.

Great offense and great defense are equally essential. A highly paid person that cannot save money is just as likely to fail at achieving financial independence as an extremely frugal, lower paid person.

If you can do both, know that you are a rare breed! FIRE is something you absolutely can achieve.

Harness lifestyle creep

We now know that striving for a high salary is equally important to achieve early FIRE. Luckily, most people’s salary grows as they age. They become more successful in their career and their compensation steadily rises.

But as discussed above, people tend to fall into the trap of lifestyle creep. Their income rises, but so do their outgoings. They treat themselves to a new car or start shopping at more expensive places. Their net gain in income is zero.

Understand this pitfall and harness it to your advantage. If you can keep your current lifestyle the same, the amount you can save increases naturally over time in line with your career compensation. It is much harder to scale back your lifestyle once you have become used to new comforts.

If you are new to the workforce and on a small salary, saving 80% of your salary is ill-advised (if not impossible). Instead, if you can broadly maintain your current standard of living as your compensation increases, your savings rate naturally goes up.

That doesn’t mean you should never increase your standard of living. Enjoy your life and treat yourself. But every time your income jumps, think carefully about where that extra money is going to go.

One simple strategy you can employ is the 50/50 approach. Half your raise is going to go to you, to spend on whatever you want each month. The other half is for future you – your retirement. 50% for now, 50% for the future.

This is perhaps not advice you would expect to find in a financial independence/retire early guide. But it’s important you treat yourself now to keep giving you incentives to progress in your career! If you are not going to see any immediate fruits of your labor each time you advance in your career, it is extremely demotivating.

When can I retire?

The shockingly simple math behind early retirement means you can very quickly and easily work out precisely when you can retire.

It is simply your savings rate as a percentage of your take-home pay. That savings rate is determined by how much you take home each year and how much you can live on.

To quote MrMoneyMoustache from link above:

“If you are spending 100% (or more) of your income, you will never be prepared to retire, unless someone else is doing the saving for you (wealthy parents, social security, pension fund, etc.). So your work career will be Infinite.

If you are spending 0% of your income (you live for free somehow), and can maintain this after retirement, you can retire right now. So your working career can be Zero.”

Of course, most of us are somewhere in between. What we need to do is live off the interest from our investments.

When our investments gain interest, we start to gain interest on our interest. Then we gain even more interest on that interest. This effect compounds over time, to the point where we are earning enough from our investment growth each year that we can sustain our lifestyle without depleting our investment.

How much can you safely withdraw each year without going broke? A major study looking at just this suggests about 4% annually with only very small chance of you going broke.

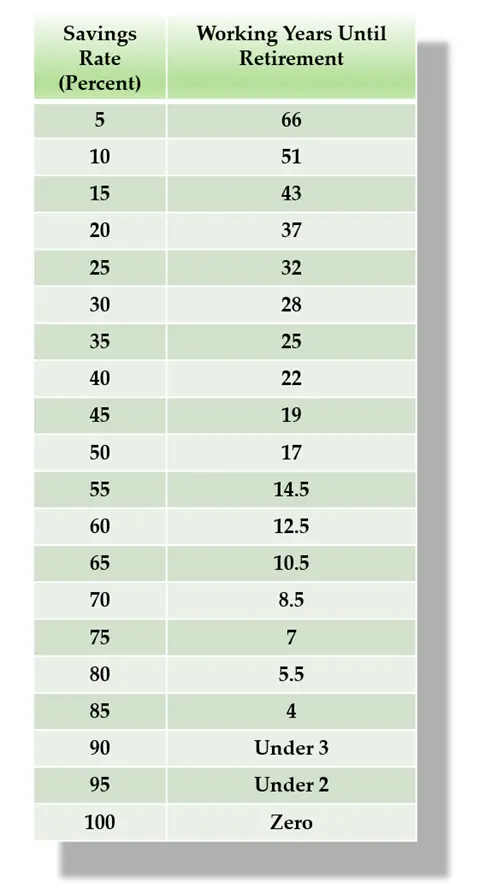

We’re going to assume your investments will grow at a modest 5% on average each year, after taking into account inflation. Using the chart below from MrMoneyMoustache, you can see exactly how long you will need to work until you can retire at various savings rates.

It is fascinating how much difference small changes in savings rate can affect your life. Someone saving only 5% of their salary for retirement will need to work 34 years longer than someone saving 25% of their salary. This is an insane difference; a motivator to increase your 401(k) contributions!

How much do I need to retire?

“That’s all great, but how much do I actually need in my investment account to retire?!”

I hear you. Let’s work out a concrete ‘FIRE Number’ that you can work towards.

Working backwards from the 4% rule discussed above, we can establish your ‘FIRE Number’. Your FIRE number is the total amount of money you need in your investment accounts so that you can retire.

If your lifestyle costs you $40,000 a year to maintain, your fire number is 25 times that, or $1,000,000. $40,000 is 4% of a million bucks.

It’s as easy as that – a super simple way to work out when you can retire.

Coast FIRE

Perhaps traditional FIRE isn’t quite for you. Luckily, there are a few popular variants that might fit your lifestyle.

Coast FIRE is where you invest enough money so that, without any additional contributions, the compounding interest on your investments will grow so that you can retire comfortably at a traditional retirement age.

You invest as much money as you can early on, then take the foot completely off the gas. You stop all additional contributions to your retirement investments for the rest of your life and let compounding do the rest – coasting to your retirement.

For example, if you were earning $100k and are saving $50k to fund your retirement, and that retirement goal will be met through compounding interest, you now only need to work a job that pays $50k to cover the same lifestyle. You will not need to contribute anything to your retirement accounts, it’s all for spending now.

This strategy can be appealing for those in highly paid (and likely highly stressful) jobs. They are willing to stomach this intense lifestyle for just long enough to hit their Coast FIRE number. Then, they can move to a lower paid but more rewarding job & lifestyle for the rest of their life.

As long as you do the compound interest calculations to ensure your money will grow to the amount you require at retirement age, you can coast most of your life.

Barista FIRE

Barista FIRE is slightly different to Coast FIRE in that you are going to start withdrawing from your investment portfolio before retirement age. However, you need to still work to cover certain expenses. To cover these expenses, you might decide to become a part-time barista, or a ski instructor in the winter season.

Problem: You are desperate to retire but have not hit your full FIRE number of $1m. You only have $750k. $1m is what you need to support your $40k per year expenses, using the 4% rule.

Solution: You withdraw 4% of $750k ($30,000 a year) and make up the rest working as a part-time barista, earning the remaining $10,000 after taxes.

The Barista FIRE community typically say they are looking for as little responsibility as possible, and as fast as possible. If you’re approaching burnout, this one might be for you.

Lean FIRE & Fat FIRE

With Lean FIRE, you are aiming to live a very frugal lifestyle for the entirety of your retirement. It still allows you to retire early, only with a much smaller nest egg.

If you can live on $12,000 a year, or $1,000 a month, you can retire today with only $300,000 in your investment accounts (using the 4% rule).

At the other end of the spectrum, you have Fat FIRE. For some, retirement is about travelling the world, doing whatever you want, whenever you want, and effectively not worrying about money too much.

Fat FIRE is about retiring with a much larger retirement pot that permits several holidays a year, new cars, fancy restaurants and so on.

If you want to spend $120,000 a year, or $10,000 a month, you can retire when your pot hits $3,000,000 (using the 4% rule).

These are very different, quite extreme goals. But both are legitimate financial independence/retire early strategies!

Playing with FIRE

This is one we have made up, because not everyone wants to be put in a FIRE box. We also recognize that people change and financial priorities change.

Playing with FIRE is not particularly scientific. It is for people that do not know when they want to retire or with how much. It is for people who don’t want to plan out every inch of their life until their death.

However, they do recognize that saving for retirement is extremely important and that someday FIRE might become a top priority.

You might love your job now, but you might hate it in ten years. You might be in good health now, but you might not be in 20 years. You might not want a family today, but suddenly you’re married with 3 kids!

Life comes at your fast – recognize this. It’s ok to play with FIRE; that means keeping the principles of FIRE in the back of your mind whilst being flexible about how much you are willing to live on in your retirement.

Playing with FIRE is dangerous (of course!) because you might not hit the goal if is only loosely defined. But if you follow the principles, you will inevitably be ahead of the vast majority of people when it comes to saving and retirement.

OK, you’re now 40 years old and retired. Now what?

This may seem like a ridiculous question on the surface. You’ve made it, and you’ve achieved a dream most people simply cannot. But what now?

Often, those who are aiming to retire early are planning on doing so relatively frugally.

Retirement in their mind might be sitting on their porch, waking up whenever they want, playing video games in their underpants all day, or a combination of all three. These are all things that a frugal retirement can afford. But is that going to bring you fulfillment?

FIRE is a race to the finish line, but you might find that your retirement becomes hollow after a year or two. Most humans need to feel like they are advancing or developing in some way to feel satisfaction. Make sure you have a plan for the rest of your life.

We are getting into subjective territory here. However, in our opinion, FIRE is about stopping the things you don’t want to do so that you can pursue your passions; write the novel you always wanted to write, get that PHD, or set up that art studio. It is about living life. It is not about doing nothing.

Thinking about your post-FIRE goals is important as, if your goal is to travel the world when you retire, your ‘FIRE number’ might need to be much larger than if you’re aiming for a frugal retirement.

If you retire at 40, you statistically still have most of your life still to live. Is living frugally with perhaps only 1 or 2 holidays a year good enough? It may well be, but it’s worth considering if you’ll be happy in the long term.

Here’s what you can do to start on the road to FIRE (early retirement)

- The best time to start was when you were 21 years old. The second-best time is now. Start today!

- Immerse yourself into FIRE communities, such as the Reddit community. Speaking to like-minded people reinforces the principles and helps you learn even more tips. You are not alone!

- Take stock of your financial situation. Make sure you have a clear budget. Pay off all high interest debt. Make sure you’re taking advantage of any 401(k) match. We have a handy flowchart here.

- Don’t be overwhelmed or feel intimidated by investing. Learning to invest is easy. There are some great, jargon-free books we recommend, and we also have our own starter guide for beginners.

Final note on FIRE and investing

The task seems enormous – almost insurmountable – but as the legendary investor Charlie Munger said:

“The first $100,000 is a bitch, but you gotta do it. I don’t care what you have to do – if it means walking everywhere and not eating anything that wasn’t purchased with a coupon, find a way to get your hands on $100,000. After that, you can ease off the gas a little bit.”

After the first $100k, your finances will snowball. Your interest compounds exponentially. Soon, you’ll find you’re earning more from the interest on your investments each year than your entire annual salary.

You can do it. Anyone can. If it’s not for you, at least take inspiration from the people saving 80% of their salary. If you’re only saving 10%, could you be doing better? Are you really doing everything you can for a comfortable retirement, even when you’re planning to work until the traditional retirement age? If the investing world seems daunting, we’ve got you covered. Check out our beginners guide to passive investing here and get started on your journey.