The average cost of financial coaching

Typical fees for financial coaching sessions are usually around $100-$300 per hour.

Personally, we rarely charge by the hour, and I don’t know too many money coaches that do.

Most financial coaches offer sessions or packages for a fixed price. That price may vary depending on the number of sessions, length, complexity of challenges, ongoing support required and more.

It can range from a few hundred to many thousands of dollars.

The beauty of coaching is that it is highly personalized to your situation; we tailor everything to your needs. But as a result, it’s difficult to give a set price.

Some clients need weekly sessions, some are happy with monthly. Others need an intensive short-term course. It makes quoting a set price difficult.

Most coaches, like us, offer a free consultation so that we can jump on a call together and understand more about your financial situation, challenges & goals. This also gives you the opportunity to meet a coach face-to-face over zoom, before committing to any cost, so that you can get a clearer idea of how we can help.

Financial coaching fee research

The national financial education counsel reviewed the pricing of 26 separate coaching websites and found that rates ranges from a few hundred dollars to $5,900.

Package services were the most common offering, which included monthly, quarterly or annual ongoing sessions & support from a coach.

Around half the coaches offered hourly rates, with an average of $257 an hour.

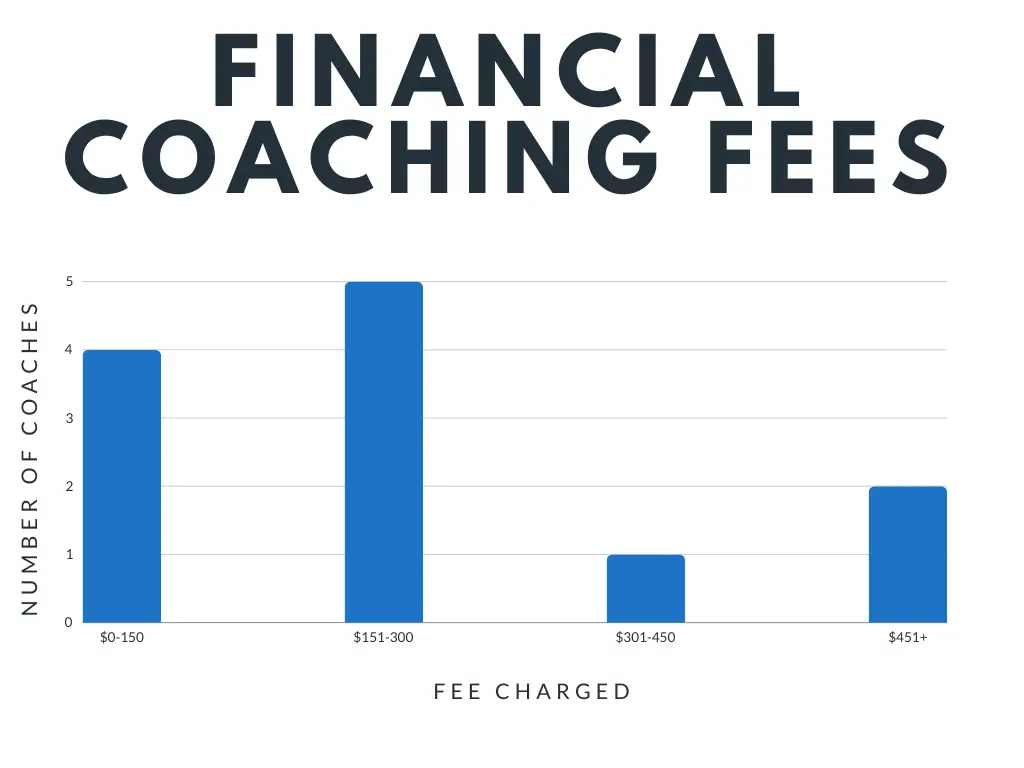

The below graph shows the distribution of fees by pricing group. Most coaches towards the lower end of the range with $600 an hour being a large outlier.

It should be noted that these were just the websites that listed their prices publicly. The vast majority of websites they looked at did not have pricing.

There may be a few reasons for this, such as the reason listed in the section above (it’s difficult to have one set price). It could be that these coaches are more confident in their pricing structure, believe it to be more likely a client will call if they list their price, or just that they think it is ‘the done thing’!

Price vs. Value

Any concerns about the cost of coaching are usually quickly alleviated when a client sees just how much value a coach is bringing them. Even small tweaks to finances can lead to huge benefits over time.

For example, a coach can examine your income and expenses and immediately see ways to improve your budgeting. Even just a $100 a month saving adds up to $12,000 over the next decade.

And that is a very modest example.

Financial coaching is one of the few professions that yields tangible, measurable value to the client. That value is realized almost immediately, at times.

Its value in the money being saved, the debt being reduced, the income being increased, the savings & investments growth, the tax payments being reduced, and much more.

There are also intangible benefits with a coach.

A lot of work is often done around your money mindset; your relationship to money and any self-limiting beliefs you have around money.

For example, “I can’t ever be rich”, “I don’t deserve a high paying job”, “I’ll never be debt free” and other lies we tell ourselves or subconsciously believe. These are nonsense (but all too common) glass ceilings that coaches can help you break through.

They might lead you to immeasurably higher earning potential and financial independence in the long run.

We are certainly biased as coaches ourselves, but the value is huge. If anything, most coaches greatly undercharge.

You get what you pay for

Financial coaching fees are usually reflective of the level of service you will receive.

Novice coaches with fewer clients may charge less than well-established coaches.

As coaches gain more clientele, they need to be pickier about who they take on out of necessity – there’s only so much time in the day!

Naturally, these in-demand coaches can charge a premium for their services.

Fees will generally go up based on things such as:

- Length of experience in the market & accreditations

- Having a large number of reviews or referrals

- Offering a wider range of services and therefore greater value

Look out for these premium coaches!

Individuals vs. couples vs. groups

Some coaches may charge additional fees for larger group sessions. However, generally, there is no difference in fee for an individual, couple, or family session.

Usually, the finances for these groups are tied together, and in fact it can make sense to have coaching as a couple or family unit so that everyone is on the same page and working towards the same goal.

The cost of coaches vs. financial advisors

A common mistake people make is thinking that financial coaches are the same as financial advisors. Perhaps that we are even a ‘worse’ or ‘cheaper’ version of advisors.

Financial advisors do very different things. They manage your money & investments on your behalf.

Coaches, on the other hand, are focused on giving you financial knowledge and applying that knowledge to build financial stability and independence over time.

Financial coaching pricing is generally very transparent. It is a fixed fee, usually a one-time fee, and it’s clear how much time and value you will yield.

Financial advisors on the other hand are much more expensive.

Advisors can offer flat fees too, but often will take a percentage of your portfolio annually or earn money off commissions based on products and services they recommend/use on your behalf.

There may even be ‘hidden’ fees, or at least, difficult to understand fee structures.

Advisors rarely provide good value for money unless you have a very high net worth or a complex financial arrangement.

More importantly, the big advisors and wealth managers often do not perform well compared to a DIY approach, such as using passive investing strategies. A big part of the problem is that their expensive fees eat in to any gains you make in wealth.

In fact, they are likely to underperform the average passive investor.

That’s why we, as financial coaches, are keen to spread the word that coaches are a great option for the vast majority of people and indeed much better value for money than advisors.

Summary: coaching fees & good value

If you’re in a tough spot financially, it’s reasonable to be wary of spending your money on a financial coach.

This is indeed a counterintuitive proposal. Spend all this money when money is my problem?

However, I truly believe that it may be the best money you ever spend.

I can tell you from years of experience helping transform people’s finances that the cost of a coach is usually miniscule compared to the gain.

There is a clear ROI (return on investment) financially, as well as improvements in mental health in the form of stress reduction and peace of mind.

Financial well-being, stability & success is an achievable goal for everyone. The cost of coaching is more than reasonable considering the tremendous gains to be had.