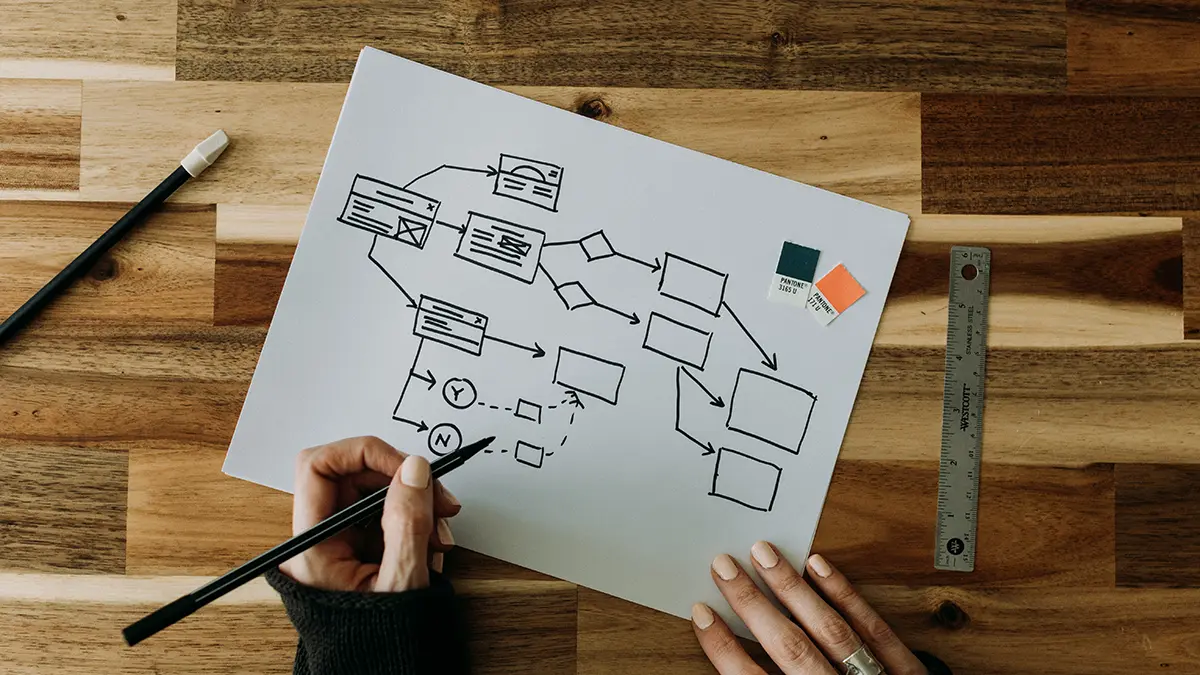

Personal finance flowchart – the 7 steps to financial independence (and FIRE)

The Flowchart is divided into 7 phases:

- Budgeting and goal setting. Truly understand your inflows and outflows, and determine what truly want in life? This is critical. See our post on personal finance and investing goals.

- Build an emergency fund. At least 1 month of your salary initially, but ideally 3 months of your salary. Store in a safe, easy-to-access account. Life happens. This is your safety net and it allows you sleep easy at night.

- Retirement accounts. First, make sure you are contributing at all. Make sure you are contributing enough to match any employer contributions. Future you will be glad you started today.

- Pay down any high-interest debt. You cannot take control of your finances and start to invest until you tackle your debt.

- Start saving & investing. Save for short-term goals in easy-to-access savings accounts. Invest for long term goals using a Roth IRA (see our passive investing guide).

- Supercharge your retirement savings. Save more of your pre-tax income. Increase contributions to your 401k or similar.

- Save for other financial goals. Finally, you can work on truly rewarding financial goals. Such as early retirement, college 529 plans for the kids, or the dream vacation home.

The Flowchart

Create a budget

It's important you understand all your inflows and outflows.

Make sure you have a surplus after subtracting your expenses from your income at the end of each month.

Set your goals

Are you saving for a house deposit? Do you want to retire early? Start a college fund for your kids?

Write down your life goals. It will help inform your budget.

Life Goals

Pay for the essentials

Pay the rent/mortgage. Buy your groceries and pay the utility bills.

Then, pay for your health insurance and other healthcare expenses.

Look after yourself first

Your budget should cover all of these essential payments.

If it does not, you will need to re-evaluate your expenses, such as your living situation or energy usage.

Make the minimum payments

Pay the minimums on all outstanding debt.

This includes student loans, credit cards and other obligations.

Paying in full is always better

This is the minimum payment required to keep you in good standing.

It's always best to pay off your credit card in full each month. But if you can't, just pay the minimum for now.

Build a small emergency fund

Set aside one month's salary. Keep it in your checking account or an easy-to-access savings account.

This is your first safety net

It gives you peace of mind when life throws you a curve ball. You'll be thankful it's there one day. Once this is in place, you can pay for your non-essential items, such as cable or your Netflix subscription.

Retirement account matching?

Does your employer offer a retirement account with an employer matching?

The power of the 401(k)

If your company offers a 401k, that's a great company to work for!

The tax-deferred status of the account allows you to put more of your pre-tax income into investments.

Match employer contributions

Contribute the full amount needed to get the full employer match.

If they contribute up to 5%, add 5% of your pre-tax salary.

This is free money

Your company is offering to top up your investments if you are willing to put money in the 401k.

Take advantage of this free money!

High interest debt?

Do you have any moderate or high-interest debt?

Moderate & high-interest debt

Take a look at all your credit card debt, student loan debt, car payments and so on.

Is it above 10% interest? Is it above 5% interest? You should consider paying this off.

Pay off the debt

You cannot save & invest effectively when your resources are being drained by high interest debt.

Snowball or avalanche?

You can pay off the highest interest debt first (avalanche method) or the smallest debt first (snowball method). Whilst the former is mathematically better, the latter has a psychological benefit.

Build a larger emergency fund

Set aside 3-6 month's salary. Keep it in your checking account or an easy-to-access savings account.

This is your second safety net

If you were to lose your job, need a career break or have an unexpected medical expense for example, this is what will pay for it.

Short-term goals?

Are you saving for any large expenses in the near future?

The next 5 years

Think about what you should be saving towards in the more immediate future.

This might be a wedding, a car payment or a housing deposit for example.

Savings account

Store any funds in a high-interest (easy-to-access) savings account, or a checking account.

Investing this money is not smart

You might be tempted to grow this money on the stock market.

But for any time horizons shorter than 5 years, the stock market is too turbulent.

Open a Roth IRA

Max the yearly contributions, currently $6,500 per year.

Income limitations apply.

Tax-advantaged retirement account

The Roth IRA can be filled with your after-tax dollars, and withdrawn penalty-free just before you turn 60.

Invest in a diverse index fund.

Investing Guide

Saving enough for retirement?

Are you saving at least 15% of your pre-tax income for retirement?

Save as much as you can

These tax-efficient retirement accounts are critical to building wealth.

Increase the contributions as much as you can, without harming other shorter-term goals.

Increase 401(k) contributions

Increase 401(k) or 403(b) contributions, if available.

Self-employed individuals can save too

Contribute to an individual 401(k), SEP-IRA, or SIMPLE IRA to reach the minimum 15% threshold.

Deductable health plan?

Do you have a qualified high-deductible health plan and are thus eligible for an investable HSA?

Save on healthcare expenses

A HSA can allow you to save money on a range of healthcare expenses.

Max yearly HSA contributions

This will reduce your taxable income.

Family savings

A family could save more than $2,000 a year on income taxes.

Saving for a child's college?

Do you have children and wish to help pay for some or all of their college expenses?

It pays to start early

The average cost of tuition and fees for the 2022-2023 school year is $39,723 at private colleges.

Start as soon as you can to allow the money to grow.

529 Plan

A 529 plan is a tax-advantaged plan designed to be used to fund future education costs.

Check it's right for you

The rules are strict, it must be for specific education expenses. You will be charged a 10% penalty if withdrawing for other purposes.

Other long-term goals?

Would you like to retire early, save for the dream vacation home or yacht?

No other goals?

Really? Well, one day you might them!

Check out our article on investing & life goals for ideas.

Investing Goals Brokerage Account

If your retirement accounts are maxed, open a brokerage account (subject to tax).

Don't invest for short-term goals

Remember, investing for short-term goals using the stock market is risky. Stick with a savings or checking account.