Overview

BadCreditLoans.com is a service for connecting borrowers with potential lenders. They were founded way back in 1999 and are based in Seattle, Washington.

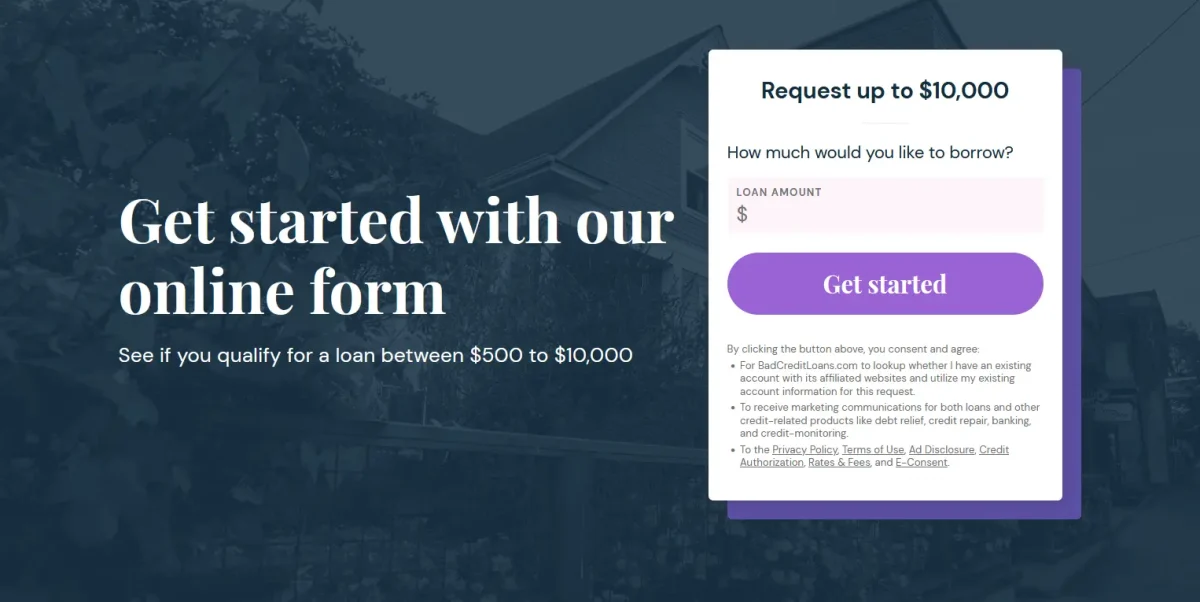

You can borrow between $500 to $10,000 and repay the loan over 3 to 72 months.

BadCreditLoans do not themselves supply any loans – they are simply a matching service.

If you have less-than-perfect credit, it may be difficult & time consuming to find a willing loan provider. What’s more, each application may negatively impact your credit score.

So, instead of filling out multiple loan applications, you can choose to fill out just one form on BadCreditLoans.com and they will search hundreds of lenders in their network on your behalf.

They will find you a lender, or perhaps even multiple competing lenders for you to compare offers.

Sounds great! What’s the catch?

- If you have poor credit, the terms of the loan offer(s) may not be great. That generally means high interest rates (APR).

- The service, by definition, requires your information to be shared with hundreds of lenders so that they can supply an offer. You may get contacted by different providers.

The most important thing to understand is that a loan can be expensive. If you decide to go ahead, make sure you understand the terms of the loan (the number of payments and total cost including interest) and be certain you can pay on time each month for the entire length of the loan.

How it works

The beauty is in the simplicity of the process. There are three steps:

First, select how much you would like to borrow.

Second, enter your personal details. It took us under 10 minutes to complete all the steps.

After that, you will be redirected to one or multiple loan providers to review offers.

Do BadCreditLoans perform a soft pull or a hard pull?

BadCreditLoans.com will perform a soft credit check initially, but the lenders they connect you with may perform a hard credit pull.

It’s common for a hard pull to happen when you commit to taking a loan. This can negatively affect your credit score.

However, if you make all the payments on time and in full, the overall affect may be positive for your credit score.

Minimum credit score requirements

There are no minimum credit score requirements for applying for a loan via BadCreditLoans.com.

However, that in itself does not guarantee you will get a loan. Furthermore, if you have a credit score under 560, you can expect the terms of the loans you will be offered to be quite poor.

Just because you are accepted for a loan, does not necessarily mean you should take it. Read the terms carefully and look for the internet rate – the APR.

Lending network & data sharing

There are 898 third party lenders in the Bad Credit Loan’s lending network.

These are the loan providers with whom your personal data is shared in order to find you a loan.

That sharing of data is the price we pay for an efficient service – filling out one form and finding a willing lender quickly.

But with that, these willing lenders may contact you over email & phone. This is not a deal breaker, but it’s something to be aware of.

We cannot verify the reputation of every lender in the network. The results of your application may include ‘Tribal lenders’ – who may skirt the law and offer loans with astronomical APR rates.

It’s really important you read the terms of your loan carefully, to ensure that the interest being charged is reasonable. Otherwise, you can quickly find yourself with mounting debt.

During the application process, you are given the opportunity to opt-out of various marketing related offers, including third party lenders. The may reduce the number of offers you receive, however:

Customer service and support

Because we cannot verify all 898 lenders in the network, we have no idea what their customer service is like.

BadCreditLoans.com is just the intermediary – they are the middleman service finding you a lender. When it comes to customer support for your loan, you will need to contact the lender from whom you accepted the loan.

With that said, BadCreditLoans.com has a decent reputation when it comes to their own customer service. Though they cannot help you with the loan, they can assist you with your application.

You can get in touch in the following ways:

Email: [email protected]

Phone: 800-245-5626

BadCreditLoans.com Reviews

The BBB (Better Business Bureau) has given BadCreditLoans an A+ rating, though they are not accredited.

There are just 13 reviews on Trustpilot and the reviews are mixed. That gives them a rating of 2.7 out of 5 stars.

The main reason for the negative reviews is that users do not realize they need to submit personal information and that this information is shared with the lender network, as we discussed above.

That is a fair gripe, but BadCreditLoans are very transparent about this happening – there is even a banner across the very top of the page saying so.

Overall, there are no reviews or complaints I could find that would dissuade me from using the service.

Safety & security

BadCreditLoans is a legitimate business and is perfectly safe to use.

It is a brand name of Great LLC, doing business as ITMedia, a Nevada limited liability company. They are essentially a financial advertising network.

They are part of the Online Lenders Alliance – a mark that represents the company’s commitment to the highest standards of conduct.

They have a sister site PersonalLoans.com which appears to offer a fairly similar service, except with a stricter credit score requirement.

The sister site also has a clean record. You can see our review of PersonalLoans.com here.

I have no reservation in saying that the company and brands within it can be trusted.

There is indeed an element of trust needed; trust that your personal information is shared with reputable lenders. As we mentioned, we cannot verify the reputation of all the lenders.

This may be a deal breaker for some, but it’s a necessary part of this kind of ‘loan shopping’.

Cost and charges

Applying for the loan is free on BadCreditLoans.com. The main charge to be aware of is the APR.

Because the loan is being issued by a third party, you should read the terms of the loan you are given to understand any other fees. According to BadCreditLoans.com:

- There will likely be charges assessed if you make a late payment.

- If you extend your loan, the finance charge for the original loan needs to be paid on the original due date.

- Should you intend to deviate from your payment plan, make sure that you contact your lender or lending partner immediately to establish a new payment arrangement.

- If your loan payment is rejected for any reason by your banking institution, the lender or lending partner may initiate collection procedures and you will not be able to receive future loans from the lender or lending partner until all of your payment obligations are fully met.

Many lenders will allow you to pay off the loan early penalty-free, but some may charge. Again, read the fine print of your specific loan offer.

They also note that peer-to-peer lenders often collect a loan origination fee of anywhere between 1 to 5% which is deducted from the loan amount given to the borrower.

Essentially, this is just a fee for processing the loan.

Again, the main fee to worry about is the APR. Here are some examples of the total cost of a loan at various interest rates and loan lengths:

| Term | Loan Amount | Rate (APR) | # of Payments | Monthly Payment | Total Payments |

|---|---|---|---|---|---|

| 2 Years | $8,500 | 6.99% | 24 | $380.53 | $9,132.68 |

| 3 Years | $10,000 | 8.34% | 36 | $314.93 | $11,337.64 |

| 4 Years | $15,000 | 10.45% | 48 | $383.69 | $18,417.05 |

| 5 Years | $20,000 | 8.54% | 60 | $410.72 | $24,646.98 |

| 6 Years | $30,000 | 7.99% | 72 | $525.85 | $37,861.25 |

Summary: Do we recommend BadCreditLoans.com?

Yes, BadCreditLoans.com are a fine option for those with less-than-perfect credit.

The APR of the loans offered may not be great. It’s really important that you read the terms of the loan, as we cannot verify the status of all the lenders in the network.

Anything higher than 35.99% would be considered a predatory ‘payday loan’. Some tribal lenders still offer these types of loans and should be avoided.

If the loan is not urgent, my advice (as always) is to increase your credit score first. You may then receive better loan offers.

With that said, if you need a loan and are sure you can repay on time and in full, BadCreditLoans.com is a solid choice.