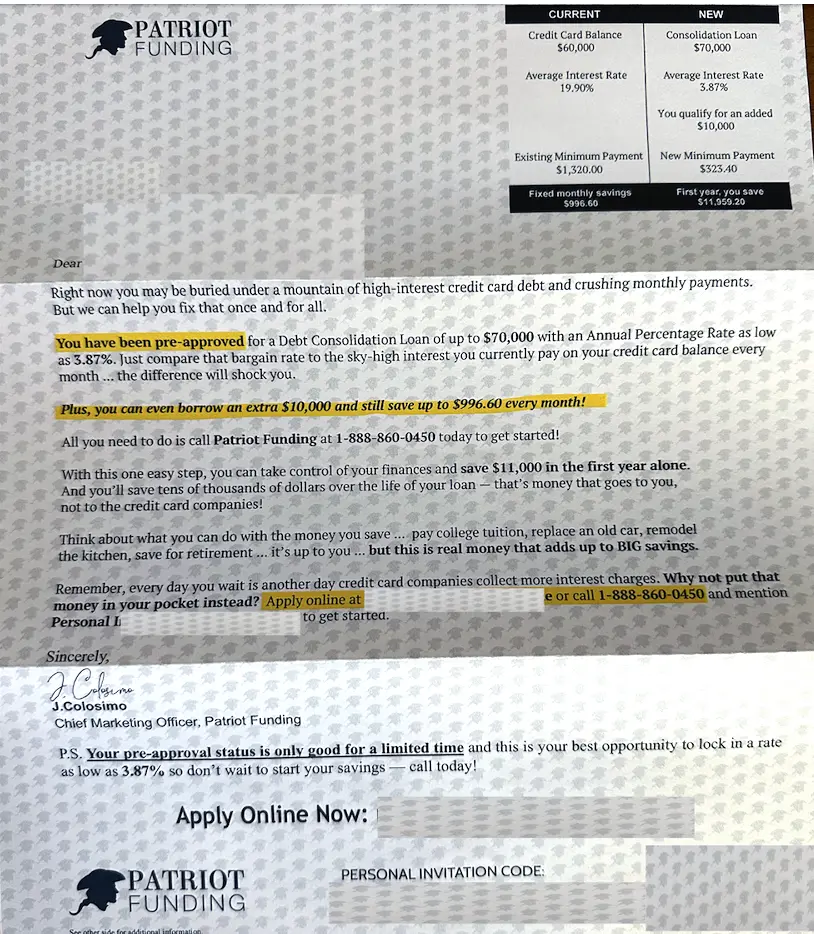

Have you received a letter from Patriot Lending like the one below? Or are you considering a debt consolidation loan with Patriot Lending?

Read our full review before you make a decision.

Who is Patriot Funding?

Patriot Funding is a paid marketing lead generator to find people who need debt consolidation loans. This is according to the information listed in the disclosures on their website.

Their business model is to send marketing letters like the one above, or attract visitors to their site online, and they will match you with a 3rd party lender.

Are the loan offers in the letters real? We can’t say for sure, but our belief is no.

It’s most likely that it is a generic offer sent out to everyone. When you call, they will attempt to move you on to a debt consolidation ‘program’.

Debt Consolidation Loan vs. Program

With Patriot funding, you most likely will not get a loan. You will not receive any funds.

Instead, you will simply be paying Patriot Lending (or their affiliate) until your debt is clear.

According to reviews (which we explore in detail further below), this is a classic bait-and-switch marketing ploy.

Here’s how it works with Patriot Funding:

- You receive a letter in the mail or apply for a loan on their website.

- When you call (or they call you), it’s most likely going to be an affiliated company that gets back to your application.

- This 3rd party will tell you that you do not have the credit score needed for a debt consolidation loan (whether that is true or not), but that they can put you on their own ‘debt consolidation program’ or something that sounds similar to this.

- Instead of paying your creditors, they tell you to effectively default on your loans and credit agreements and pay them instead.

- After a few months, they tell your creditors that you are unable to pay and attempt to negotiate a better deal on your behalf.

- They pocket the difference between the deal they strike, and however much you have agreed to pay them.

This can be very dangerous as it will undoubtedly destroy your credit score.

It is probably not the right option for the vast majority of people, except those perhaps who are really struggling with debt. Even then, there may be better options for consolidating your debt.

Risks with Patriot Funding

The above process may not work as well as you’d hope. Here are just some of the possible and likely consequences of using a strategy of defaulting on your creditors:

- Your credit score will be destroyed for a long time. This will make it difficult to get a loan, a mortgage, a credit card and more.

- The creditors could opt to sue you for lack of payment. They don’t have to accept the deal Patriot Funding try and negotiate for you.

- You may have debt collectors chasing you.

- You may end up paying more, over a longer period of time. Even if the total monthly payment is lower, you could be in debt for much longer and therefore pay back much more than you otherwise would have.

BBB reviews & complaints

Patriot Funding is not accredited on the BBB (better business bureau) and has an F rating.

One of the more common questions about this company is ‘is Patriot Funding legit’? As a lender, they are not legitimate in that they offer no direct lending, and no debt consolidation loans personally.

Furthermore, the BBB has flagged that they could not find a business registered under the address listed on their website.

However, the business itself does not appear to be a ‘scam’ as such. It’s a legal way to carry out marketing activity, though perhaps morally ambiguous.

The reviews of the company on BBB reflect this.

All three of the reviews are negative (though one appears to accidentally have given 5 stars). There are also 15 complaints, most of them citing the persistent letters and the ‘bait-and-switch’ discussed above.

There is a single 1-star review on Trustpilot, which also mentions bad customer service and rude staff.

We could not find a single positive review of the company online, and most of the social forums also were quick to scold the company.

Alternatives to Patriot Funding

If you’re struggling with debt, you can always try to reach out to the creditors yourself.

Tell them that you are struggling with the payments and ask if they can help with a more suitable payment plan. It won’t hurt to ask.

If you have no hope of paying your debt within 5 years, proper debt consolidation or ‘debt relief’ programs may be a good option (but not using a company like this one).

You can contact a nonprofit organization like the Consumer Credit Counseling Service (CCCS) who can help you find a workable financial solution to your debt problems.

If the stress of being in debt is causing you mental health issues, there are organizations that can help. We cover money stress in this article.

If you simply need a loan or are looking to build credit, you can choose from one of our recommended providers below. Alternatively, you can connect with a lender here.

Recommended Loan & Credit Building Providers

4.9

Upgrade is a fantastic multi-purpose loan provider for those with credit scores of 560 or more.

4.4

PersonalLoans.com searches its wide network of lenders to find loans for those with low credit scores.

4.7

Grow Credit is not a lender. They offer a remarkably clever system to quickly build your credit score.

Summary

Patriot Funding is not the best option for people in debt in the vast majority of cases.

In general, most offers you receive in the mail will be a bad deal at best, or an outright scam at worst. Tread carefully.

The lack of positive reviews, business registration details, and general business strategy means that this company is one to avoid.

Don’t stop trying to fix your debt issues, though. Start fixing it today with one of the alternatives listed above.