Let’s start by clearing up some confusion in the terminology. You can have both active and passive income. You can also engage in active and passive investing.

What is Passive Income?

Passive income is any money that is generated without the need for much (or any) oversight. Whilst there may be some large initial costs and effort required to set up the passive income stream, the goal is ultimately to generate a regular income that does not require much ongoing work or labor.

Active Income vs. Passive Income

Active income is typically your job. It is the day-to-day work you carry out to earn a living. You can earn passive income at the same time as active income, as passive income is working for you ‘in the background’.

What are examples of Passive Income Investments?

Some examples of passive income streams include:

- Passive Investing

- Real estate

- Peer-to-peer lending

But anything that provides recurring income without much upkeep can be counted as passive income, such as the advertising revenue from a YouTube video or other digital content.

What’s the difference between passive income and passive investing?

Passive investing is just one of the ways to generate passive income. Therefore, passive investing falls under the umbrella of passive income.

You can create a passive income stream by passive investing into index funds.

What is passive investing?

Passive investing is a hands-off, affordable approach to investing which typically involves investing into an index fund.

Passive investing is usually done through a single index fund, which is a relatively static group of (usually) thousands of stocks. It aims to track the market and deliver average returns.

Active investing vs passive investing

Active investing is different from passive investing in that, with active investing, you take a much more involved role in the day-to-day management of all your investments.

Active investing may involve picking a few (10-20) stocks and regularly trading them throughout the year.

Because it is so hands-on, it is not considered a passive income stream.

There is a great deal more risk involved in active investing vs. passive investing. The highs and lows of your investment can vary wildly with active stock picking, whereas passive investing in index funds tends to have a smoother ride – especially if you have bonds as part of your asset allocation.

With passive investing, you can quite literally not look at your investment for years and be confident that it is still working hard to build your wealth.

You are invested in thousands of stocks when passive investing. If a few companies go bust, it will have a negligible effect on your wealth overall. The worst that can happen is those stocks can fall from 100% to 0%. But some of your stocks can grow from 100% to 10,000% – or higher.

Ignoring your actively-picked stocks, however, could quickly cost you dearly. Your overreliance on a basket of hand-picked stocks means that a few heavy losses can ruin you financially. You need to stay engaged all the time – actively investing!

What is the best way to create passive income?

Every passive income method has pros and cons.

Real estate has historically offered fantastic growth and high rental-yields. But the opportunities might not be as they once were.

Peer-to-peer lending promises excellent returns, but the risks far outweigh what we consider worthwhile.

If something has the potential to ruin you financially, no matter how small the risk, it is not worth it.

Our pick is passive investing.

There are always risks with any kind of investing. But historically, and over a long enough timeframe, passive investing through index funds has proven to be a reliable way to build incredible wealth and create a passive income stream for life. It’s so successful that the strategy outperforms 80% of active investment managers.

How much passive income can you earn through passive investing?

How long is a piece of string?

The real magic of passive investing lies in the beauty of compounding. Your money earns interest each month, and as your money grows, the interest you can earn increases. This is because you are earning interest on your interest! This effect grows (compounds) over time.

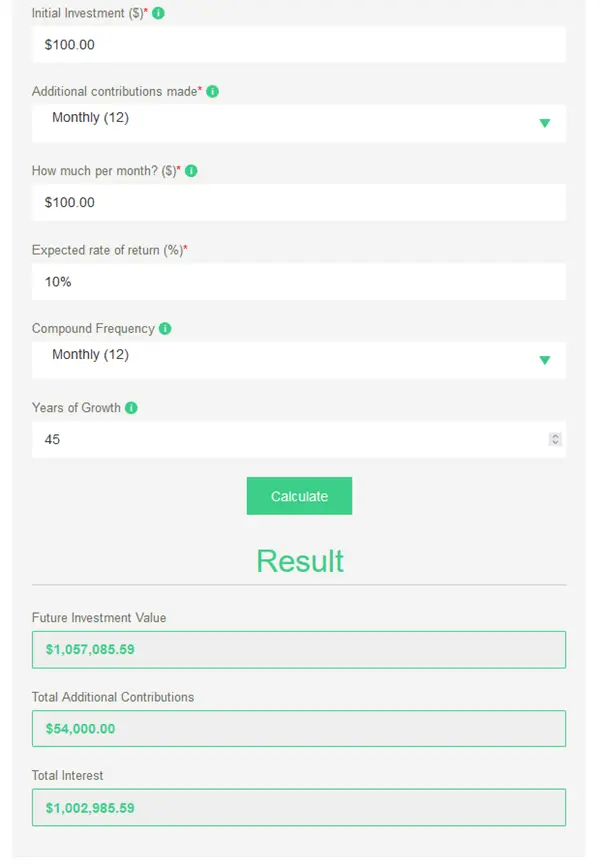

In fact, if you’re 21 right now and you invest just $100 a month, which is less than 4$ a day, for the rest of your life, you will retire as a millionaire. This is based on average stock market returns of 10% until your retirement age of around 65/66. See the calculation below:

See how despite only contributing $54,000 in your lifetime, you have earned over a million dollars in interest. You can try it yourself on our investment return calculator.

If you invest just a little bit more, you could retire even earlier and live off the interest from your investingfor the rest of your life. The ultimate passive income stream!

What are the pros and cons of this passive income stream?

Passive investing is very easy to learn and get started with. You don’t need any investing experience. You don’t need to pick stocks or study balance sheets. You are simply investing in the whole market using an index fund. It is extremely low cost. In fact, nowadays you can even get zero-fee funds through Fidelity.

They have historically performed extremely well. As mentioned above, with passive investing you can expect to outperform the majority of active investment managers over an extended timeframe.

People have their reservations about passive investing as a passive income stream for two key reasons:

- They think the stock market is gambling. Yes, there is always a risk in investing your money. Your money can and will fluctuate wildly. But over a long enough timeframe, the market will go up. The key is to make sure you are investing in a global, diverse index fund and do not panic sell when we enter recessions and the value of your investment falls.

- It takes too long. The obvious issue with this approach is that it is not a get rich quick scheme. As the billionaire investor Warren Buffett says:

“The stock market is a device for transferring money from the impatient to the patient.”

Whatever you do for work, whatever passive income stream you decide to pursue, passive investing is key to ensuring you retire wealthy. This is a passive income stream always working for you, in the background. If your money is sitting in a checking or savings account, it is not working for you.

Passive investing is a tool to combat the eroding power of inflation. If the money you make from passive income simply sits in your bank account or in a regular savings account, its value is almost certainly decreasing in real terms. See our explanation about inflation here.

How do I start passive investing?

Practically, it is as simple as opening an account on Vanguard or Fidelity and setting up a regular payment into one index fund.

We recommend Vanguard – VTWAX for its low cost, and because we like what Vanguard stands for. In the UK, we recommend Vanguard’s FTSE Global All Cap.

You should use a tax-advantaged account like a Roth IRA (US) or S&S ISA (UK) to ensure you do not pay any taxes on gains. There are annual limits, income restrictions and withdrawal restrictions to be aware of.

It’s easy to get started on your investing journey. To learn more about passive investing using index funds, including practical advice to get started, see our beginners guide to passive investing.