What are the best plans or investment vehicles when saving for a child?

Here’s the bottom line:

- [US] Open a 529 College Savings Plan with Vanguard.

- [UK] Open a Junior ISA with Fidelity.

Invest into Vanguard FTSE Global All Cap Index Fund.

It’s important to understand the value of investments can go down as well as up so you may get back less than you invest. This is extremely unlikely over an 18 year period but not impossible. If you’re worried about risk, you can store money in a normal savings account, but inflation will erode the value over time.

Why Vanguard and Fidelity ? Are they safe?

Vanguard and Fidelity are two of the three largest investment services in the world. They are extremely safe. For 529 Plans and Junior ISA’s they come highly recommended because of their strong performance , and the customer service is great (and Fidelity is free in the UK, too).

When can my child access the money?

You or your child can only access the for their college education expenses – there is a fee if it is withdrawn earlier or for any other purpose (currently 10%). In the UK, the money can be withdrawn only at aged 18, but used for any purpose.

What is a 529 Plan and a Junior Stocks and Shares ISA account (JISA)?

Both are tax-advantaged investment accounts. You don’t need to worry about paying any tax on investment returns – they are tax free up to certain thresholds.

For the 529 plan in the US, you can put in up to $15,000 per parent annually without having to fill out any gift tax paperwork. States will have aggregate limits in the $250K-500k / beneficiary range.

In the UK, Junior Stocks and Shares ISA allows a maximum £9,000 each tax year.

For both accounts, you can invest a one-off lump sum or ongoing contributions.

Does it cost anything?

Vanguards average expense ratio is 0.14%.

In the UK, the Fidelity platform is free, the only cost is for the underlying fund in which you invest, which in this case, is a 0.23% annual charge. This is deducted from the account balance automatically and you will never personally have to pay anything.

Example:

If you invest $1,000 and the investment grows 10% after 1 year, it will be worth $1,100. Fidelity will deduct 0.23% from the balance each year, which would be $2.53. This would leave you with $1,097.47.

When should I start to save & invest?

The best time to start is the moment they are born – or at least once they have their birth certificate. This approach relies on the magic of time and compound investing. So, the longer the money is invested, the better chance it will grow significantly. This approach is not appropriate if your investment horizon is less than 5 years.

How much should I save?

Typically, you can invest a min. of £/$1000 as a lumpsum (one-off) investment, or smaller, regular monthly deposits.

You should invest as much as you can spare. With a new child, you will have other short-term financial needs to care for them. Only you can decide.

If you can save more earlier on, do so! It gives compound investing a better chance to work its magic.

Note that with this approach, the money cannot be accessed until the child is at college or 18 in the UK, so you may want to save a portion of your investment budget in a separate account if you would like them to have access earlier.

Do I need to do anything to maintain it?

Once the money is invested, you can literally leave it there for 18 years and not do a thing. It will grow over time by itself.

This is known as ‘passive investing’. Around 20-30% of ALL the money invested in the world is invested this way (trillions). It’s extremely popular because of the low fees, low effort required and (historically) great results.

You are free to top up the account as and when you can, with your own money or gifted funds.

What are we investing the money in?

The Vanguard 529 College Savings Plan, issued by the state of Nevada. You can pick a target-enrollment plan, based on the year you child will enroll in college.

In the UK, it is the Vanguard FTSE Global All Cap Index Fund.

They are both diverse, global index funds. An index fund essentially tracks the entire market performance around the world.

That generally means that in times of boom, the investment will grow, and in times of bust/recession, the value will fall. It is completely normal to fluctuate, but over 18 years the trend should be upwards. If it is not, the global economy has stalled, and we have bigger things to worry about!

Illustrative example from FTSE 100

The Vanguard fund is invested in more than 7,000 companies worldwide. It is a simple, ‘boring’ passive fund, and one of the most popular. It’s cheap to invest in.

It is 100% equities, which means it’s invested solely in company shares. This is good for growth but comes with risk. It might fluctuate a lot over the short term, but with a long investment horizon of 18 years, it’s a good choice.

You are probably already invested in a similar investment vehicle without realizing! All our private pensions (retirement accounts) are invested in shares and bonds. It’s because of the long-term investment horizon that means that, in the long run, our pensions will be worth a lot more despite any turbulence along the way.

Why not just put the money in normal savings account?

You absolutely can if you wish, and there’s nothing stopping you opening an account in parallel. These are ‘safe’ accounts, in that there is no chance the value will fall. But inflation will cause the real monetary value to fall.

The amount of interest you can get from cash savings accounts is currently a paltry 1.5% in the UK.

If inflation is at 10% (it is currently more than 10%). That means the spending power of $1,000 will be less next year.

Example:

- If a loaf of bread in 2022 costs $1, that means $1,000 can buy you 1,000 loaves of bread.

- Next year, because of inflation, bread costs $1.10. So you can now only purchase 909 loaves of bread with $1,000.

- Let’s assume inflation averages at 5% for the next 18 years. When your child gets her money in 2040, a loaf of bread will cost $2. She will only be able to buy 500 loaves of bread. Though she still has $1,000, because of inflation, her money has halved to the equivalent of $500 in 2022!

Investing into stocks and shares combats the eroding power of inflation.

So if we invest in the 529 plan / index fund, how much will the value be in 18 years time?

It is impossible to say.

If we had invested $1,000 18 years ago in 2004 and your child was turning 18 years old today, the money would be worth about $3.8k. But past performance is no guarantee of future performance.

We could invest the money today and it could be worth $500 tomorrow if there is a global economic crash, a war, a pandemic, a climate crisis, a mortgage crisis or any number of random events. Even in that unlucky scenario where our money falls to $500, looking at past performance, the value would still grow to be $1,900 when your child turns 18.

I would estimate the value of $1,000 invested today to be $2.5-5k in an average economic climate, but in the best times it could be as much as $8k and the worst times (recessions/crisis) as little as $1.9k – or lower.

You can play around with our investment return calculator to see the results of adding more funds, increasing the time horizon, and changing the year-on-year investment growth.

Anything could happen and there is always risk with investing. You should be happy and confident investing your money in this way, but if it’s important you understand there is a risk.

How/why does this work?

Ok, we’re getting a bit into the weeds here…feel free to skip.

It’s largely because of the phenomenon of compound investing. When your investment grows, the amount of interest you can get grows (compounds) over time.

Example:

- In year 1, the $1,000 investment grows by 10% to $1,100. The interest is $100.

- In year 2, the $1,100 investment grows by 10% to $1,210. The interest is $110.

As your money grows, the amount of interest you get each year grows. This is because you don’t simply receive 10% of your initial investment each year, you receive 10% of the initial investment plus 10% of the interest already received. So we received more interest in year 2 ($110) versus year 1 ($100) despite having the same 10% growth.

This effect compounds over time. So by the time your child is 18, if we have had 10% growth each year for 18 years (which would be very fortunate!), the interest alone in year 18 will be $569.17. That’s more than half of the initial investment, in interest.

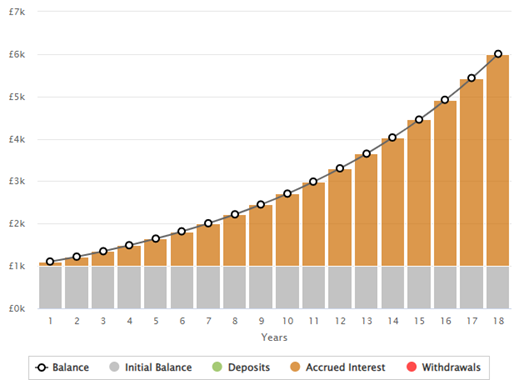

The upwards sloping growth is indicative of the compounding interest. The orange bars represent the interest – see how it grows (compounds) each year:

And here is what is breaks down to each year – we would have a balance of $6,004.69 on the child’s 18th birthday in this fictional scenario. The reality is that some years you might get +10% growth, some years you might get -20% growth, and other years you might get +30% growth! This is just an example.

Where can I learn more?

You can read through Fidelity’s own JISA brochure (UK) or go to the Fidelity learning center (US) here.

You can check out our guide to passive investing here.

If you really want to understand why, I recommend reading these books!