What is the quantum financial system?

The quantum financial system (QFS) refers to a theoretical new money system that uses quantum computing and blockchain technology to conduct financial transactions.

If that doesn’t mean much to you, let’s break it down a bit. Or even, a lot!

What is quantum?

Quantum comes from Latin, meaning “an amount” or “how much?” If something is quantifiable, then it can be measured.

‘Quantum’ has its roots in physics. Put simply, it means the smallest discrete unit of something.

For example, a quantum of light is a photon, and a quantum of electricity is an electron.

In the current finance system, we use traditional computing and calculate things using thousands of ‘bits’. These bits can be in a state of either zero or one (binary).

Everything you see on your computer screen or phone screen (unless you’re reading this in the quantum future) is the result of thousands of combinations of 1’s and 0’s.

It is not very efficient. It’s partly why you might describe our current financial system as ‘slow’.

Quantum computing in the quantum financial system

In the quantum financial system on the other hand, we would of course use quantum computers.

Quantum computing instead uses ‘qubits’. Rather than calculating results from two binary possibilities, 1 or 0, which is slow and hard to compute, the qubits calculate in varying degrees of 1 and 0.

To help understand qubits, it’s better to think about them like a wave. A qubit could be really likely to be zero (a lower energy wave) or really likely to be one (a higher energy wave).

Each qubit has a probability of being each.

A quantum computer processes the probabilities of each of these qubits as they interact with each other.

It can therefore find the most likely answer to complex problems based on how these qubits interact with each other.

This would mean that these extremely complex calculations, which our traditional computers might take years to perform, can be completed in a matter of minutes.

Suffice it to say, it’s a very different and very difficult to understand way of calculating & processing.

More than just ‘Super Computers’

So, understand that quantum computers are not just ‘super computers’. They are not simply bigger and faster versions of what we use now.

They are something entirely different. For example, they are kept at temperatures colder than outer space!

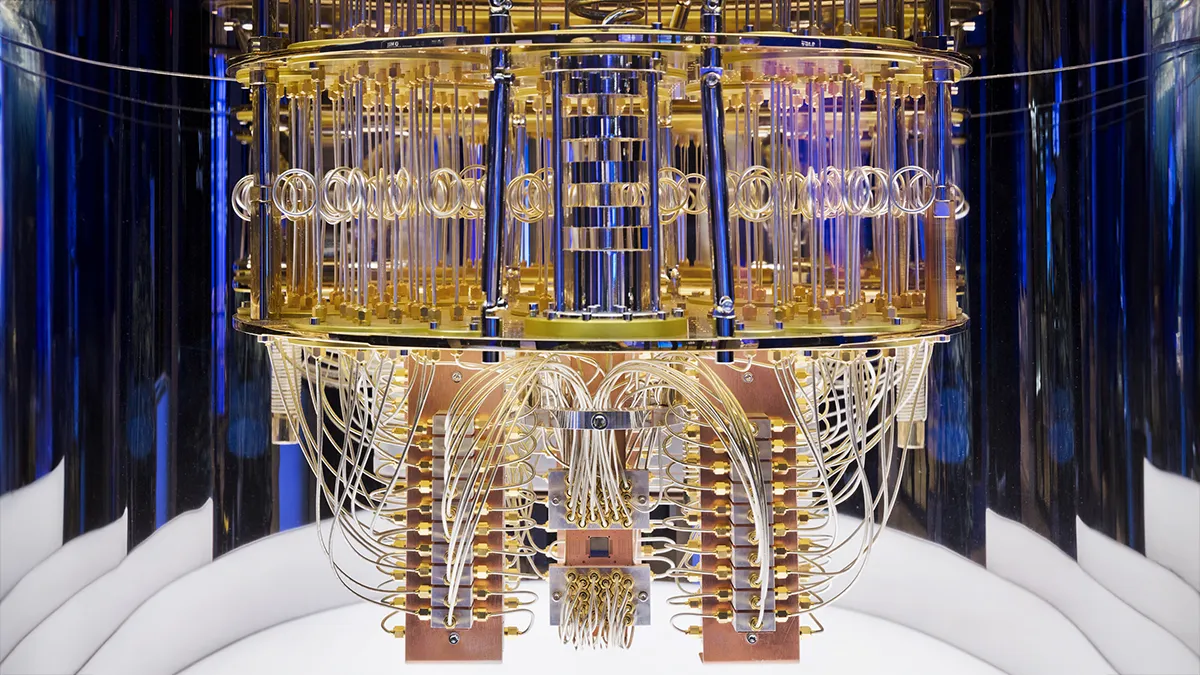

Here’s what one looks like – the world’s largest superconducting quantum processor according to IBM:

Knowing that quantum computers are not simply ‘better computers’ is a key point, as it is often the barrier that stops people understanding what quantum computers, and therefore the quantum financial system, actually is.

Because quantum computers do completely different things and they are in fact worse at some things than our traditional computers.

For example, a quantum computer in the finance world would be much worse at adding together a few values than a normal computer. That’s not what they will be used for.

Instead, you would use quantum computing to (for example) find structure in millions of disparate financial transactions.

As our financial system becomes ever more complicated, quantum computing could potentially solve problems our current computing could not.

The problems we are referring to are things like processing large amounts of transactions quickly. It could also make the financial system more secure.

So, in other words, quantum computing as the backbone of our financial system makes things move faster.

Because it moves faster, we have the potential to do more complex stuff, which we’ll explore in this article.

Is the Quantum Financial System active today?

Notice in the previous section we said ‘theoretical new money system’. The quantum financial system is not yet a reality.

There is a great deal of research and development around this subject because of its potential to transform the financial world.

Whilst the quantum financial system is not yet upon us, quantum computers are indeed real. Take a look at one here:

Barriers & Disadvantages to the Quantum Financial System

The main barrier is that the technology isn’t quite there.

Whilst quantum computing exists, the largest quantum computer has just 433 qubits.

It is theorized that for a true evolution in finance, a quantum computer with a million qubits might be needed.

It’s at this level that the computer has the processing power to break current financial encryption standards.

RSA encryption is complex enough that it would take traditional computers billions of years to crack by brute-force. A quantum computer with millions of qubits, however, could achieve that task in a few hours.

Necessity is the mother of invention. At this point, the financial system is vulnerable to whichever country develops quantum computing first.

A new encryption standard for financial transactions, and effectively an entirely new quantum financial system, is required.

Essentially, the barriers come down to money.

Significant investment in quantum computing technology is needed, and financial institutions are not willing to take the gamble on the tech themselves, at least not quite yet.

Benefits of the Quantum Financial System

Right now, it is such early days that there are most likely many applications that we simply haven’t considered and cannot conceive of just yet, such as the nature of this strange new technology.

However, there are some immediate applications.

Instant transactions

Theoretically, all financial transactions could become nearly instantaneous. Instead of waiting for sometimes days for them to be processed by intermediaries like a bank, they are processed in real-time.

Improved security

Though security is currently a big concern (RSA encryption), there is potential for greatly increased security.

Quantum Key Distribution (QKD) is a cryptographic technique that leverages the principles of quantum mechanics to secure communications.

It provides a method for secure key exchange, ensuring that financial transactions and communications remain confidential and tamper-proof.

While not yet widely adopted in the financial sector, QKD has the potential to enhance the security of financial transactions.

Digital currencies

The QFS may facilitate the roll out of central bank digital currencies (CBDCs). That is, money intended to function like physical cash but in a digital form.

This is not a cryptocurrency, as it would be centrally controlled (not decentralized like cryptocurrency). It is backed by assets.

This digital currency could facilitate faster, more efficient, and more secure financial transactions.

Risk Analysis

Quantum computing could be applied to more accurately model and simulate financial risks, enabling financial institutions to better assess and manage their exposure to various market fluctuations and economic events.

Greater transparency

A greater deal of transparency could be achieved in the QFS. This is very theoretical, however.

Currencies and transactions may be assigned a digital number, and the physical GPS position of each of these currencies can be tracked and monitored in real-time.

We can see where the money is, who has sent it and who it has been sent to, including the details of anyone who has accessed the account.

When will the quantum financial system start?

IBM believes in the next 5 or so years, we will be switching over to ‘quantum safe’ algorithms because of this threat to the system.

They are progressing at an incredibly fast rate. Problems they are saying they want to solve by ‘X’ date, have indeed been solved by X date.

It’s speculated that within the next 5-10 years, the quantum financial system could be a reality. More pessimistic predictions suggest it might be decades.

The exponential rate of change makes it difficult to comprehend and predict just where quantum computing might be in a few years’ time, let alone a few decades.

Much like the space race in the 1960’s, it is the national security threat that might cause society to make great leaps in this technology in this decade.

For now, it still feels far beyond our reach.