Empower vs. Personal Capital

Empower acquired Personal Capital in 2020. Since that time, Personal Capital had been operating as “Personal Capital, an Empower company”.

That has now evolved further. Personal Capital rebranded to become Empower in February 2023.

Therefore, Empower and Personal Capital are the same thing. So far, the offering is identical except for the change in name.

What is Empower?

Empower is many things, which is one of the reasons I had fun using the tool.

- It’s an account aggregator. It will take all your accounts (spread out across multiple banks and investment providers) and show them to you in one place.

- It’s a net worth tracker. Many find that visualizing their net worth growth over time as a source of pride, or a source of motivation, or even just a way to reduce money worries.

- It’s a budgeting tool. Because all your accounts are linked, it holds you accountable. You set a budget that you might actually be tempted to stick to.

- It’s a retirement planner. Everything from yearly expenses, sources of retirement income, tax estimation and strategy suggestions.

- Fee analyzer. Fees are the enemy, and Empower is transparent about their impact on your wealth. The fee analyzer also allows you to compare funds and visualizes the fees over time.

- Checking account. Yes, they even offer their very own checking account.

- Investment management service. The paid portion of Empower, for when you want someone to do it all for you. If you’re wowed by the previous 6 features, I could see why you’d be tempted by the 7th.

It’s worth reiterating, most of the tools I list above are free.

The big draw of Empower is their array of financial tools. You can sign up and take advantage of these at no cost to yourself.

They promise a user-friendly dashboard that aggregates all your financial accounts, providing a complete view of your financial situation. This is the golden goose in my opinion.

The investment advice and portfolio management services could be useful for those looking to invest in the stock market. There is of course a fee attached here. It is an optional part of their service and only available to those with a minimum of $100,000 in assets.

Empower themselves believe their differentiator lies in their use of technology.

They boast of the use of advanced algorithms and machine learning to provide personalized investment recommendations.

My overall experience with Empower

I have been using Empower for a few months now and have been able to really get under the hood of this mostly free financial tool.

Empower is often touted as the crème de la crème of automated net worth tracking services, and I can understand why.

Despite using many financial tracking tools and apps over many years, I somehow had not tried one of the most recommended tools in personal finance.

The main drawback has been the frequent & persistent upselling of their advisory & investment management services.

Overall, the insights their various tools provide, how it is presented, and how comprehensive it is as an all-in-one solution, mean that I will likely continue using it as my primary tool for managing money.

Empower Features Review

Let’s examine the many features of Empower in more detail.

Net Worth Tracking

The very first thing I was greeted with after connecting my accounts was a very useful chart showing my net worth growth over time.

It essentially takes all the positive assets in your account, minus any debt. I loved this macro view of my financial situation. I could then breakdown the data into specific accounts or look at specific transactions from here.

Transactions

The consolidation of transactions all in one place was also very useful.

The UI is a joy. I can filter easily between different accounts at the top, or even search for specific transactions. A 10/10 for execution on this feature.

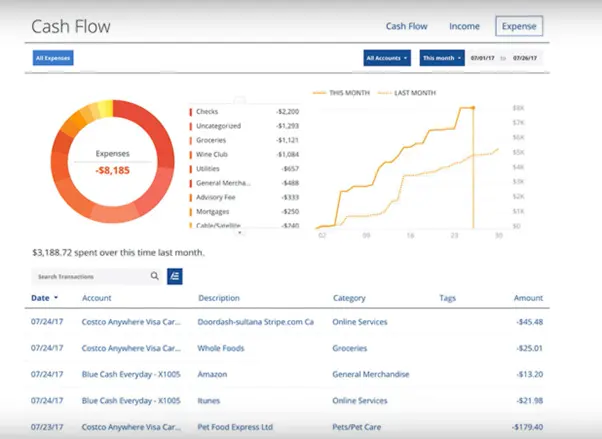

Cash Flow Visualizer

I’ve never found cash flow visualizers to be that useful, particularly when you have a variable or otherwise inconsistent income.

With that said, it’s another beautifully presented dashboard that gives you an at-a-glance, month-on-month indication of how you are trending with your spending.

Even if you spend just a few seconds a month using this feature, it’s probably doing its job.

Budgeting

If you prefer to be more proactive with your cashflow situation, you can go ahead and set yourself a budget.

See how much you’ve spent in the last month (1) against your monthly budget (2). Compare this to the previous month (3). See your top 5 expense categories (4) plus any other expenses (5).

Again, I have to credit the UX designers of Empower. It’s a joy to work with, easy to edit and crystal clear to understand at a glance. Sometimes simple is best, and they really nailed the design here.

Investing

Empower dedicate a whole area of the tool to their main offering (and the moneymaker!) – investing.

It does a great job breaking down your investments by account type. If you have a 401(K), Roth IRA, brokerage account, and so on, it will slice and dice to show you the percentage of wealth tied up in each.

Of course, like with the other tabs, you can click into each account to see that specific account’s return, any recent transactions and more.

“You Index”

Think you’re the next Warren Buffett? Empower will keep you honest.

Their “You Index” allows you to easily compare your overall investment return (across all your accounts) performance against some common indexes/benchmarks.

This is something sets the whole tool apart from a DIY spreadsheet solution. Could you achieve this in MS Excel? Maybe, but with tremendous effort.

Investment Checkup

If you’re not ready to pull the trigger on full advisory services, Empower will automatically analyze your portfolio and flag issues with asset allocation, individual stock choices (such as being overweight to a certain industry) and any high-cost funds you’re perhaps overpaying for.

I found the recommendations to be accurate, useful and generally sensible advice. It was somewhat generic in places, but for a novice investor it would absolutely add value.

Financial Planning

The financial planning area is essentially a sophisticated retirement planner that projects your future financial situation. Depending on how your investments perform, that could of course vary wildly.

The tool then spits out a number estimating your average monthly spending ability in retirement.

This might be a rude awakening for some, but it’s a great illustration of your future. Knowing your worst-case and best-case scenario might cause you to drastically change how you’re approaching retirement planning.

Debt Paydown

Watching investment returns go up is fun, but watching debt go down is sometimes more satisfying.

Paying off debt is crucial to becoming financially independent. In fact, if your debt is particularly high-interest, you might want to consider prioritizing this before you start on the investing side.

The Debt Paydown tab depicts a beautiful decreasing graph over time and is a great motivator if debt clearance is your primary objective.

Nothing is worse than when you add to your debt and see the graph jump up and put you back a few steps. It’ll make you question whether that purchase is really worth it. That’s a good thing.

Financial Advisor

I did not explore their advisory services, though they have reached out. Expect a call if you have a certain amount of net assets. This was actually one of the only major negatives of my experience.

This is, of course, what they really want you to use. If you’re prepared to pay the fee, it might be worth it for you.

For me, I prefer the DIY method. For many, this isn’t even an option unless you have $100,000 to invest.

Also be aware – their fees are on the high side. More on this below.

Empower Pricing

First and foremost, the financial tools offered by Empower are free.

Empower charges fees for its investment management services, with fees ranging from 0.49% to 0.89% of assets under management, depending on the amount invested.

You’ll be on the high-end of this fee unless you are investing a lot. I can really only recommend considering their services if you are a high net worth individual and their fees become more ‘affordable’ (0.49% of millions is still a lot!).

Remember, these are fees on top of any investment choices.

Empower Safety & Security

The security of your personal financial data is of course paramount. That’s why I wanted to do a deep dive on the steps Empower takes to keep all your information safe.

So much so, that it warranted its own post. You can find a complete analysis of their safety & security measures here.

But if you’re looking for a quick answer; Empower is perfectly safe for you to use. The risk to your data is minimal.

In fact, Empower themselves argue that checking your financial information via their interface is safer than you doing it via your bank on a desktop computer!

Competitors to consider

- Mint: Mint is a free budgeting and financial management platform that provides a similar range of services as Empower.

- Betterment: Betterment is an investment management platform that offers personalized investment advice and portfolio management services.

- Wealthfront: Wealthfront is another investment management platform that offers personalized investment advice and portfolio management services.

- Robinhood: Robinhood is a commission-free stock trading platform that also offers investment advice and portfolio management services.

High-level feature comparison

| Feature | Empower | Mint | Betterment | Wealthfront | Robinhood |

|---|---|---|---|---|---|

| Investment tracking | ✔️ | ✔️ | ✔️ | ✔️ | ❌ |

| Budgeting | ✔️ | ✔️ | ❌ | ❌ | ❌ |

| Investment management | ✔️ | ❌ | ✔️ | ✔️ | ❌ |

| Retirement planning | ✔️ | ❌ | ✔️ | ✔️ | ❌ |

| Tax optimization | ✔️ | ❌ | ✔️ | ✔️ | ❌ |

| Commission-free trading | ❌ | ❌ | ❌ | ❌ | ✔️ |

| Stock trading | ✔️ | ❌ | ❌ | ❌ | ✔️ |

| Cryptocurrency trading | ❌ | ❌ | ❌ | ❌ | ✔️ |

| Human advisors | ✔️ | ❌ | ✔️ | ✔️ | ❌ |

Empower Sign Up & Set Up Process

You can sign up for free with just your name, email address & a US phone number:

Then, you need to link all your accounts.

It perhaps goes without saying, but you need to link all your accounts to get the full 360 view and really make the most of the tool.

I personally found the setup process seamless, including the integration of my various bank accounts, investment accounts, credit cards and so on.

I have heard people that do have issues with accounts unlinking after a certain amount of time and needing to be relinked. I can absolutely see why this would be a chore.

I have also heard from people with dozens of accounts who simply gave up linking them all. If you have a lot of accounts, again I can see why it might be a chore. But short-term pain, long-term gain!

After your accounts are all linked, you’re greeted with your net worth dashboard overview.

And that’s it – you’re ready to go.

Who should use Empower?

I have no hesitation in recommending the free tools to anyone looking to manage their net worth, track spending and investments, or even for retirement planning.

The paid aspect of their service might be a different story. The high minimums and fees for their advisory services disqualifies many people anyway.

Even then, it might be tough to justify the fee, particularly if you are “only” investing six figures. I recommend modelling how much the fee would cost you per annum over time and comparing the cost with competitors.

Empower reviews from Reddit

What do real people say about Empower on Reddit forums, free from their inhibitions? I like reddit opinions as there is rarely any agenda attached to their ‘reviews’. Take them with a pinch of salt, though:

“It does a much better job tracking investments than Mint. I’ve found that the connections are more stable than Mint – there might not be as many options, but the options they have generally work.

As far as the financial advisers – I have received one call. I just politely stated I’m very satisfied making my own financial decisions, and they never called back.”

“I find mint to be more geared towards budgeting, [empower] towards big picture stuff.”

“I used their retirement planning tool. I think it’s pretty good. Better than most as you can put in multiple earning streams with different start / stop dates.

As a tracking tool, it has some limitations. For example, I received a payout from an investment that consisted of both a return of capital and earnings. Because it came in as one amount, I couldn’t find any way to properly categorize it. Another instance, I have some Treasury Bonds. PC thinks they are ‘unclassified’, so I have to put them in as Bonds myself. Kind of weird since it’s not some esoteric investment.”

The verdict – is Empower worth it?

We always advocate for having a complete, 360-degree view of your personal finance situation. Empower delivers that in a big way.

While you might be able to get more affordable investment advisory services elsewhere, I can see the appeal of having all your financial affairs, including your advisor, in one consolidated place.

Our advice: give it a try. It’s free to sign up and test most of the functionality on offer. For the investment management & advisory services, you might want to shop around.

Editorial note: We always strive to give unbiased, impartial reviews of each product and service mentioned on TinyHigh.com. Some (but not all) links within our content may earn us a small commission, which helps keep Tiny High running. Empower Personal Wealth, LLC (“EPW”) compensates Tiny High for new leads. Tiny High is not an investment client of Personal Capital Advisors Corporation or Empower Advisory Group, LLC.