Recommended Loan & Credit Building Providers

4.9

Upgrade is a fantastic multi-purpose loan provider for those with credit scores of 560 or more.

4.4

PersonalLoans.com searches its wide network of lenders to find loans for those with low credit scores.

4.7

Grow Credit is not a lender. They offer a remarkably clever system to quickly build your credit score.

Overview

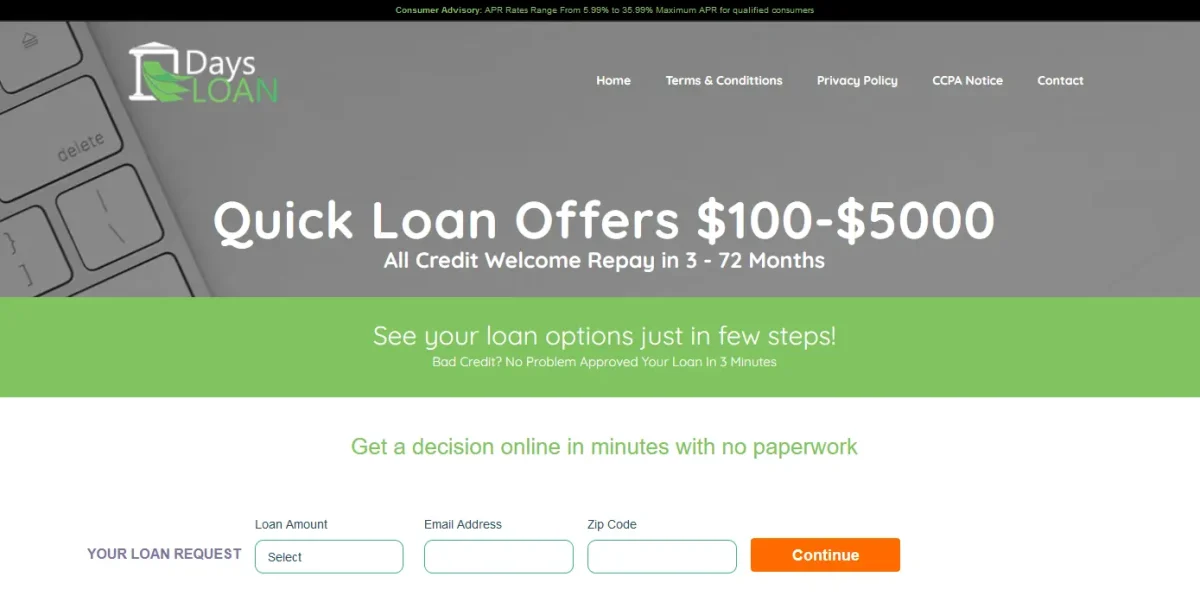

Days Loan is not a direct lender. They are a middleman service that will share your personal details with their network of lenders in order to find you a loan.

This style of ‘loan shopping’ service is not uncommon, but we have concerns around the transparency of the service, the reliability and cost – all discussed further below.

You can request they find you a loan between $100-$5000 with repayment over 3 – 72 Months.

Interest rates on the loan can be sky high – particularly for those with low credit. See our cost and charges section for more.

You can get a loan for many different purposes, with the only criteria being:

- You must be over 18 years old.

- A US Citizen.

- Have a valid checking account.

- Have a permanent address.

- Have a regular income via employment.

Be careful when taking out a loan. Only take a loan if you absolutely need it, if you can make the monthly payments and are confident you can pay the loan back in full.

How it works

One of the (very) few positives we had around the experience of using Daysloan.com was the application process. It is a single page and took us less than 5 minutes to complete.

To speed things up, make sure you already have all your personal information to hand including SSN, checking account information, and income/employer information.

After you submit your details, Days Loan looks for offers:

There is a ‘credit score check’ but you actually don’t need to sign up to Experian. Click the button then go back to the other tab and manually enter your score, if you know it.

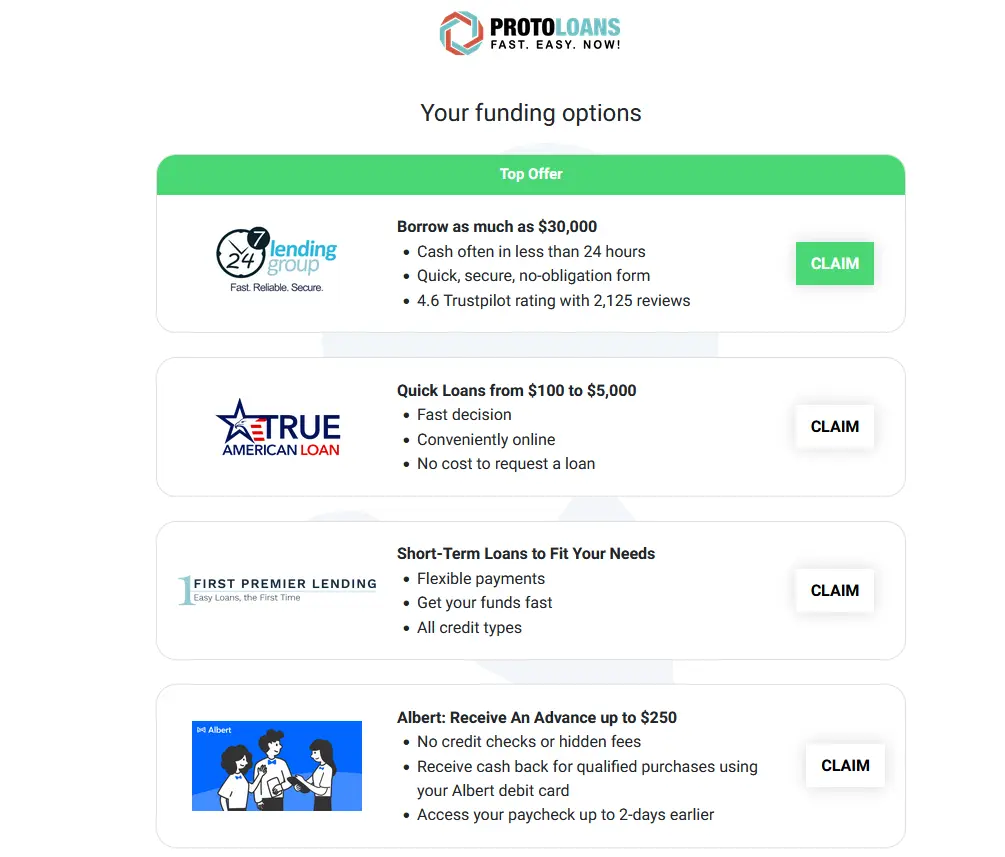

Then, you’ll be presented with your loan offers. We received fairly typical loan offers that are given to people with low credit scores. The APR on these loans will be extremely high.

None of these lenders are ones we have reviewed and/or recommended. That does not discount them, but do tread carefully (read the terms of the loan).

Safety & security

The biggest red flag for this company is that there is little-to-no information about them online.

There is no BBB (Better Business Bureau) profile, no Trustpilot reviews, and only negative discussion on internet forums.

There is also a lack of transparency regarding their lending network, which we mentioned above.

We cannot be sure who your details are being shared with, but it is likely tribal lenders if you have a low credit score. These lenders sit outside of state laws and can typically offer high interest loans that are deemed predatory (discussed in the next section).

A smaller issue (but one that is hard for me to get past) is that the homepage is littered with spelling mistakes and grammatical errors. This is something a reputable business simply does not allow to happen.

Cost and charges

Applying for a loan is effectively free, but there are many charges to be aware of when taking out a loan via a Days Loan lender.

The DaysLoan.com team state on the website:

“APR Rates Range From 5.99% to 35.99% Maximum APR for qualified consumers.”

I think this is a slightly disingenuous way of presenting APR numbers.

The three words at the end of that statement, for which I have added the bold, essentially means that if you do not qualify (your credit score is too low) the APR may be extremely high.

Tribal lenders have the ability to offer loans closer to an eye-watering 700% APR. This is a tactic pay day lenders previously employed and is now deemed a predatory practice, but tribal lenders sit outside the law here.

Read the terms of your loan carefully. Anything over 35.99% is deemed predatory.

To give you an example of how much it can cost, see the table below:

| Payment Number | Principle Amount | Interest Amount | Payment Amount | When Payment is Due |

|---|---|---|---|---|

| 1 | $3.60 | $94.25 | $99.00 | 10/16/2024 |

| 2 | $4.75 | $94.25 | $99.00 | 10/30/2024 |

| 3 | $6.26 | $92.74 | $99.00 | 11/13/2024 |

| 4 | $8.25 | $90.75 | $99.00 | 11/27/2024 |

| 5 | $10.87 | $88.13 | $99.00 | 12/11/2024 |

| 6 | $14.33 | $84.67 | $99.00 | 12/28/2024 |

| 7 | $18.89 | $80.12 | $99.00 | 01/08/2025 |

| 8 | $24.89 | $74.11 | $99.00 | 1/22/2025 |

| 9 | $32.81 | $66.18 | $99.00 | 02/05/2025 |

| 10 | $43.24 | $55.75 | $99.00 | 2/19/2025 |

| 11 | $56.99 | $42.00 | $99.00 | 03/04/2025 |

| 12 | $75.12 | $23.88 | $99.00 | 3/18/2025 |

| TOTAL | $300.00 | $888.00 | $1,188.00 | 3/18/2025 |

On top of these charges, there may be an origination fee. This can be around 10% of the loan value.

This is effectively a charge for processing the loan.

So, if you requested a $1,000 dollar loan, you may only receive $900 due to the 10% fee. You still need to repay the full $1,000 plus interest, though.

Furthermore, it’s a good idea to check the terms for early repayment fees. Paying back the loan early is a good idea if it becomes an option as it can save you hundreds or even thousands of dollars.

Ideally, there would be no fee for paying back the loan early. Many lenders allow this and even encourage this, but each lender will have different terms and there is no guarantee your chosen lender will.

Finally, make sure you make the payments on time each month as there may be late payment fees, plus a bad mark on your credit report.

It can be as simple as forgetting to leave enough money in your bank account for the payment to be taken, so do plan ahead to ensure you are not caught out.

Applying for a loan will incur a hard search on your credit profile, and that can negatively impact your credit score. The way to mitigate this is making all the on time payments.

Missing a payment will further harm your credit score. On the other hand, successfully making all the payments can boost your score.

Customer support & contact information

Another red flag is the lack of a phone number on the Daysloan.com site. Any reputable lending service would have phone support.

You can, however, contact them via email at: [email protected]

On the flip side, there is little need to contact the company themselves. That’s because your loan is actually being fulfilled by a loan provider within their network.

So, any support you need regarding your loan should be taken up with the lender themselves.

As we have no way of telling which lender you will be given, we cannot verify whether you will receive adequate customer support (should you require it).

Competitors & alternatives

Taking a loan is big decision, and it can be extremely costly, particularly if you do not make the payments. But if you are sure you need a loan, there are three options I would put forward:

- If you have a credit score of 560 or more, Upgrade is loan provider that ticks nearly all the boxes for a lender. You can read our Upgrade Review here.

- If your credit score is less than that, you can consider BadCreditLoans.com, which is a similar service to DaysLoan.com but far more reputable. The APR on the loans still may be high though, so do read the terms of the loan carefully. Read the BadCreditLoans.com review here.

- If the loan can wait, even just a few months, there are services out there to build your credit score. I have recently been impressed with Grow Credit, which offers a system to improve your credit score extremely quickly. Read our Grow Credit review here.

Check out our video on how to boost your credit score:

Summary: Is DaysLoan.com safe & worth using?

Our advice would be to avoid using Days Loan if you can.

There is not much at all that the company is doing to build trust or establish a good reputation. Furthermore, the interest on the loan provided may be astronomically high.

Our advice would be to look at alternative lenders we mention above or try to improve your credit score so you can get a loan from a more reputable provider with lower APR on the loan.