I’m going to show you how to get a better credit score in just 7 days, which is something almost unheard of.

Most credit agencies report changes after 1-2 months, which means seeing your credit score grow in 7 days is usually impossible.

But there are tools out there that do it much faster. They are easy to use and tick almost all the boxes of the FICO score criteria.

So, whether you’re applying for a mortgage, a loan, a credit card or whatever it is you need, it’s going to be worth boosting your credit score first as:

- you’re more likely to get approved and more importantly…

- you’re more likely to get a better and more affordable deal.

So how does this work?

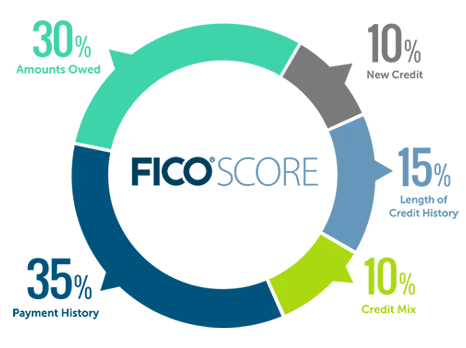

Credit score calculation

First, let’s do a quick refresher on how credit scores are calculated. This is important, and you’ll see why in a second.

The FICO score is the criteria the credit bureaus to determine your score. It’s made up of five chunks.

Payment history – 35%

Let’s start with the biggest chunk. 35% of your credit score, more than a third is down to your payment history.

Can you make payments on time, every time. If you miss a payment or have insufficient funds in your bank account it can seriously negatively impact your credit score.

Amounts owed – 30%

30% of your score is down to how much you owe. If you have a lot of debt, it’s a negative signal to lenders.

If you have a high debt-to-income ratio, i.e. a lot of your income goes towards servicing debt payments, this is another negative factor.

Together, these two factors discussed make up nearly 2/3rds of your credit score.

Length of credit history – 15%

15% of your score comes down to how long you have had these credit relationships.

How long have you had your credit card? How long have you had your car payment?

A long history of on-time payments is a positive signal.

New credit – 10%

10% of your credit score is how recently and frequently you have applied for new credit agreements.

Applying for a loan or a credit card often entails a hard credit pull. This means that your application is recorded on your credit report.

Applying for new credit, particularly in a short space of time, damages your score. So be careful when & how you apply for credit.

Credit mix – 10%

10% of your score comes down to the mix of credit types you have. Do you have a loan? A car payment? A mortgage payment? A credit card?

Having a range of credit types can be a positive signal that you are a financially stable person.

The tools for boosting credit fast

It’s important to understand the scoring system so that you can work on all the criteria at the same time.

That sounds daunting, but I feel I may have stumbled across a way to do nearly all of these at once.

I’m convinced it’s the absolute best way to grow your credit score fast.

Ava Credit Builder

Ava Credit Builder is genius.

It’s a credit card with a $2,500 limit that anyone can be approved for. But it can only be used to pay for regular bills, like a Spotify subscription. We have a full review here.

Here’s a stat that seems unbelievable given how credit reporting normally works:

“74% of Ava members see an improvement in less than 7 days.”

This is because Ava reports your on-time credit payments super-fast. That means that you can see changes almost immediately.

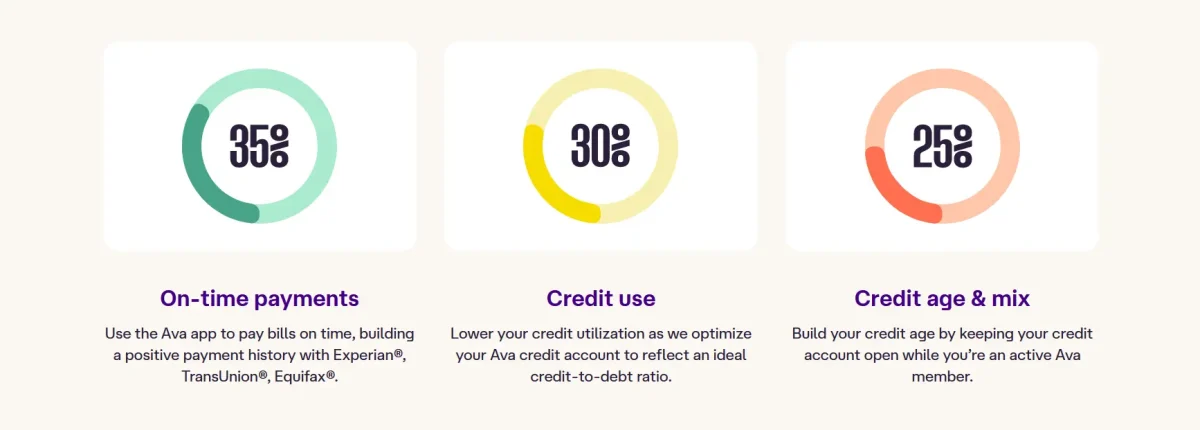

Your score can be significantly boosted because you’re effectively hitting all the criteria of FICO.

- On-time payments: Ava quickly reports your on-time payments to all three of the major credit bureaus.

- Credit utilization: Ava limits you to just 10% of the credit card’s total limit ($25), so you will have a low credit utilization percentage.

- Credit history: The idea is you set-and-forget this for at least 12 months to build up a credit history with ease. You can see increases in 7 days, yes, but holding the card for a long time is going to be beneficial.

- Credit mix: Ava offers two different ways to build credit. The second being a savings account which looks like a loan to the credit bureaus. You contribute $30 a month for 12 months, then get the whole lot back at the end. That’s all it is to you, but in the background it’s like you’ve successfully paid back a loan!

That is four out of the five FICO factors right there. But it indirectly hits the fifth factor (new credit) too.

That’s because they do not perform a hard search on your profile, which would otherwise negatively impact your credit score.

Furthermore, if the service does what it says and increases your credit score, you’re less likely to be rejected for your next credit application. If you’re not rejected for credit, you don’t need to apply again and risk harming your score!

Therefore, it’s indirectly helping to prevent you from applying for new credit too. It effectively hits 100% of the credit score factors.

What’s the catch?

There is a fee of $6 a month when signing up for 12 months. But the return-on-investment here (the money you will save by increasing your credit score and paying less interest on your future credit agreements) will far outweigh this fee.

People see their credit score jump more than 100 in less than a month.

Ava say that a 100-point credit score increase (from ‘fair’ to ‘good’) can save you over $3,000 every year on car, mortgage, and credit card payments.

That’s because a better score gives you access to better rates, which means paying less interest.

Take a look at Ava and get started today!

Grow Credit

If the $6 fee puts you off Ava, there’s a slightly more limited but effective tool called Grow Credit.

It also scored well in our review and it has a free tier, so you can try it out.

It has no savings account portion like Ava, and only a $17 limit on the free tier. Otherwise, it’s very similar to Ava.

Take a look at Grow Credit and get started today!

You might even want to use both tools to really give that score a quick boost. After all, as we have seen, having multiple lines of credit is a factor in your credit score calculation.

Usually, applying for multiple lines of credit at the same time can negatively impact your credit score. However, there is only a soft search performed when applying.

Other ways to boost credit

These tools work, there’s no doubt about it. But to give them the best chance of success, you should make sure you’re not dragging your score down in other ways.

Anyone can get to the coveted 800 credit score if they follow the tried-and-true principles.

Here’s how you can supercharge your credit score.

Pay off debt

Paying off small loans successfully, with no payments missed, is a strong signal that you are financially stable.

This is also likely to reduce your credit utilization percentage, as paying off debt frees up more of your income and that can allow you to apply for a bigger credit line.

Paying off debt hits on nearly 2/3rds of the factors that impact your credit score, so it’s a huge win.

Having lower debt can make you more eligible for loans and mortgages for example, as you have fewer other obligations.

Furthermore, its going to help reduce money stress and is one of the key factors early steps to take on our personal finance flow chart to success.

More credit lines

In complete contrast to the last point, if you have not had any credit cards, loans, car payments (and so on) you might want to consider taking out different types of credit.

You need to have demonstrated that you have, and are capable of repaying, a diverse mix of credit options. Having a wide range of loans & credit and successfully paying them off is a sign of a trusted and stable user.

You can also apply for multiple credit cards. The more credit cards you have the higher your line of credit will be. For example:

If a person with a single credit card with a $500 limit spends $100, their credit utilization would be 20%.

If that same person took out another credit card with a $500 limit they would now have a $1,000 total credit limit, just spread across two cards.

If this person were to keep their spending the same ($100) their credit utilization is now only 10% ($100 is 10% of $1,000).

The key is to keep your spending the same. Do not spend more because you have the credit line available to you.

This is a tricky tactic to recommend, as having more credit available means more temptation to spend, and we don’t want overspending.

So, to be clear, what this does not mean is you should take out as many loans as you can and extend yourself beyond your means financially. We are talking about small credit bills, small loans at best.

Furthermore, applying for too many things at once can be a negative factor, so spread out your applications.

Normally, we are completely against taking out loans and debt unless absolutely necessary. But for building credit history and improving your credit utilization percentage, it can be a necessary evil.

Be smart and sensible with the credit you get, it’s very easy to land yourself in debt.

Higher credit limits

What can we do instead of making multiple applications in a short space of time (which negatively impacts your score)?

Well, you could instead try calling your existing credit card provider and simply asking for a higher limit.

Once again, a higher credit limit means lower utilization percentage, even if it’s just on one card instead of multiple.

It’s worth asking, and the worst they can say is no.

Credit report errors

Check your credit report for errors. 25% of Americans have errors on their report (CNBC, 2023). These errors may be negatively impacting you. Check for:

- Missing accounts.

- Accounts being reported more than once.

- Reports that closed accounts were closed by the grantor and not the user.

Look for anything that seems fishy or incorrect. Contact the credit bureau to get these rectified asap.

You can get a free report from AnnualCreditReport.com.

Remove negative entries

If you have had credit issues in the past due to missed payments for example, but have rectified and paid off all the debt, you may have an option.

It’s a long shot, but these negative entries are keeping your credit score down, so it’s worth a try.

You can write to the creditor and ask that they delete the negative entry now that you are in good standing. Be honest and let them know why you (for example) missed a payment, and cite your otherwise good payment history.

Hopefully they will be amenable to removing it.

Summary: Is this all legit?

What have learned? Well, if anyone says boosting your credit score fast is impossible, know that it is a lie.

New companies like Ava & Grow Credit are changing the traditional way we build credit scores to something much more reliable and effective.

These tools hit on (effectively) all of the five FICO scoring factors, making your life a ton easier.

To give them the best chance of success, you want to make sure you’re not being dragged down in other areas, such as having errors on your credit report.

You’ll want to hold on to these credit tools for a long period if possible, as the length of credit history is a key factor.

Unfortunately, building a credit history simply takes time. There’s nothing you can do except start today and make sure you pay on time, every time, for a long time.

This is a perfectly legitimate and no-brainer way to boost your credit score, helping you get your finances on the right track, and fast.