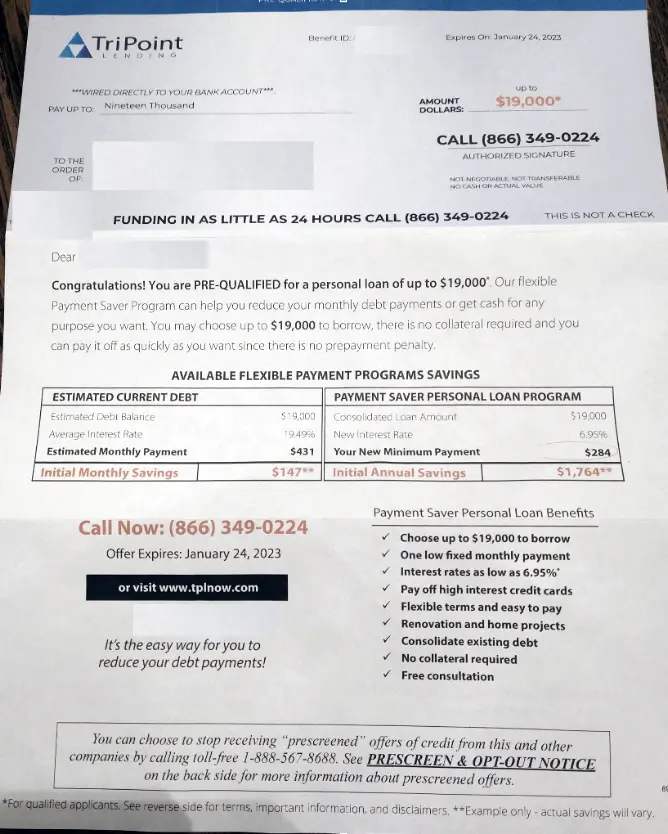

Have you received a letter from TriPoint Lending like the below?

Or are you simply interested in loans & debt consolidation from TriPoint Lending? Stop and read this before you make any decisions.

TriPoint Lending loan pre-qualified letter

If something seems too good to be true, it probably is.

If you have received this letter or one like it, know that you most likely are not ‘pre-approved’ for the listed amount with the listed rate of interest.

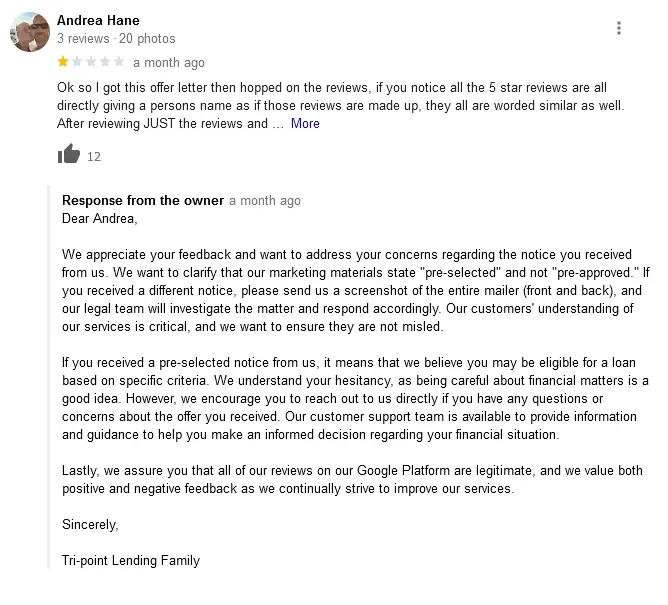

This is a marketing ploy, a hook if you will, for you to give them a call. In fact, TriPoint Lending themselves say (in response to negative reviews online) that you are not pre-approved but ‘pre-selected’.

That is a subtle but important difference!

When you call them, they will most likely tell you that you are not eligible for the loans, but instead try and get you on a debt consolidation program with them. They may be targeting you specifically as they know you to be in debt, though it may be random.

Who are TriPoint Lending?

TriPoint Lending were established in 2017 are a licensed lender in the state of California (CFL license 60DBO-79257).

They list their main office as 2600 Michelson Drive, Ste 1500, Irvine, CA 92612, but on Google & the BBB their address is listed as 4 Park Plaza Suite 1650, Irvine, CA 92612.

They claim to offer fast, fair personal loan ‘options’, with funding within 48 hours after approval.

Their business model is to provide ‘loan solutions’ – which is a little ambiguous. It’s not clear whether they provide loans or simply debt settlement products (more on this below).

Do TriPoint Lending offer loans or debt consolidation?

This is a difficult one to answer.

On the website, the business claims to offer Personal Loans between $5,000 and $100,000 with interest rates (APR) between 5.99% – 35.99%. Though their terms and conditions state the minimum loan amount is technically $1,000.

When we attempted to apply for a loan, we simply received a message saying we would receive a call back:

But user reviews of the business suggest they are actually offering some sort of debt settlement / consolidation, which is what we would likely be sold if or when they call.

Here’s most likely how it would work:

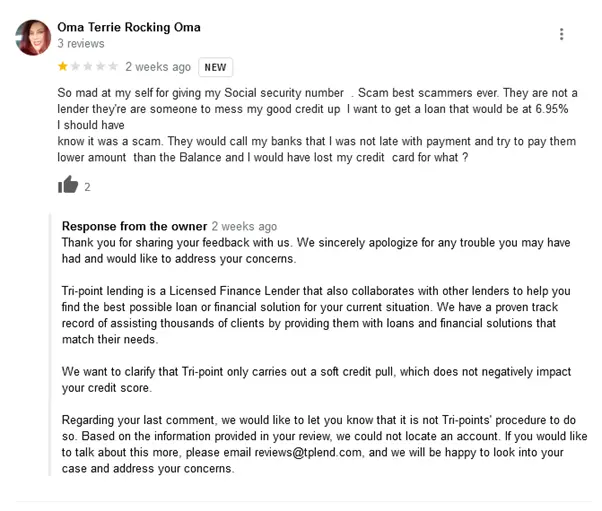

- They tell you to stop making payments on your loans and credit cards.

- After 3-6 months they contact your creditors on your behalf (the people you are in debt to). They tell them that you cannot repay your debt in full and attempt to arrange a ‘better deal’.

- This will most likely destroy your credit score for some time.

You will receive no loan funds in this scenario, but you will clear your debt, possibly paying a lower amount than you would have otherwise.

They are essentially ‘stealing’ you as a customer from the other creditor. They do it by offering you better terms (such as lower monthly payments).

But destroying your credit score is not worth it that vast majority of the time. You should try and arrange a better deal with your creditors directly, if you are struggling to make payments and become debt free.

Ultimately, we cannot be sure TriPoint Lending supply personal loans at all. It’s most likely they are using the allure of a personal loan with a low rate to get you to call, before converting you to their debt consolidation/reduction/settlement program.

TriPoint Lending reviews & BBB rating

Is TriPoint lending a reputable company? Yes, it is a legitimate company according to our search around the web. But some of the tactics used to improve their reputation seem a bit shady.

All the reviews for the company are either 5-stars or 1-star. This means that there is probably a ton of manipulation happening (fake reviews).

- All the 5-star reviews follow a similar formula, including thanking a representative by name.

- All the 1-star reviews claim the company is simply a scam – that they will destroy your credit rating by contacting your creditors (see section above).

The BBB (better business bureau) gives the business an A+ rating and it is an accredited business.

There are also over 300 customer reviews with a 3.97 / 5-star rating. Google also has hundreds of positive reviews leaving them with a 4.4 / 5-star average.

But we cannot be sure if many of the positive reviews are truly legitimate.

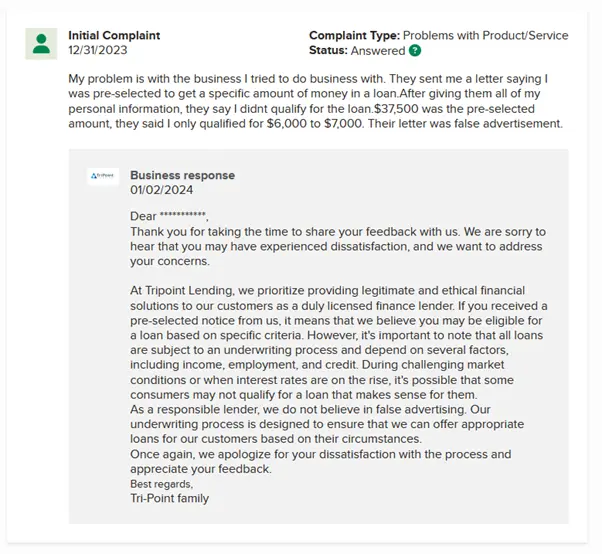

On the BBB, there have been 18 complaints in the last 3 years. The complaints generally reference the letters received with ‘pre-approved’ checks for personal loans, but when calling they are offered debt consolidation instead.

Credit score requirements

TriPoint Lending have no credit score requirements if you are applying on the website to ‘compare loan offers’.

However, if you are trying to get the amount & rate listed in the letter you received in the mail, you most likely will not be able to. Despite being ‘pre-approved’ or ‘pre-selected’, TriPoint Lending do have requirements and are not handing out money freely.

Complaints on the BBB suggest that many people are not eligible for the full amount advertised. TriPoint Lending say in response that they in fact do consider your income, employment and credit score.

But they are not clear what the minimum requirements are. This is perhaps just another way to move you on to their debt settlement program.

On the website, TriPoint Lending say that they only carry out a soft credit pull and that there is no risk to your credit score to see offers.

If you decide you want to go ahead with one of the offers, this will most likely entail a hard credit pull.

Summary: Are TriPoint Lending worth a Tri?

Our conclusion is that TriPoint Lending are not the best option for loans, if indeed they offer loans at all.

For debt consolidation, the 5-star reviews we see online are a little dubious. We’re not sure we trust the online reviews as genuine.

Despite the accreditation and A+ score on the BBB, we are simply not convinced that TriPoint Lending are a sensible option.

If you’re seeking a personal loan, check out some of the highly rated options below or connect with a lender here.

Recommended Loan & Credit Building Providers

4.9

Upgrade is a fantastic multi-purpose loan provider for those with credit scores of 560 or more.

4.4

PersonalLoans.com searches its wide network of lenders to find loans for those with low credit scores.

4.7

Grow Credit is not a lender. They offer a remarkably clever system to quickly build your credit score.