This article is for those that need a really simple breakdown of investing.

Maybe you have realized that you don’t want to work until your 70 years old, or perhaps you are starting to earn enough money that you feel you can afford to start investing. If you have absolutely no idea where to start, this one’s for you.

Why should I bother investing at all?

If you saved 4 dollars (or 4 pounds) a day from your early 20s, and invested that money wisely, you would retire a millionaire.

That’s based on the average annual return of the stock market over the last 50 years, which was about of 10% before inflation. This fact alone might be appealing enough to make you want to start investing. We’ll look at the full calculation below.

In terms of your overall goals in life, only you can decide what they are. But often, money is the tool used to achieve life goals, be it early retirement, a yacht or just financial independence & peace of mind.

Maybe you’re young and don’t have a long-term goal right now. It’s almost certain one day you will, and you’ll be glad you started passive investing today.

Learn more about passive investing goals here.

What is passive investing?

The opposite of active investing, passive investing is a hands-off, simple, cost-effective approach to growing your money.

When most people think of investing in the stock market, they think of buying shares in individual companies like Coca Cola or Apple.

That is the traditional way of investing; buying and selling shares in a few hand-picked companies based on their perceived future performance. This is known as active investing.

With passive investing, you are not trying to play the stock market. You’re not analyzing company performance and trying to guess which ones are going to grow in value.

An index fund is simply an investment product that allows you to invest in hundreds or thousands of companies with one purchase. The money you invest into the index fund is distributed between all the companies in the fund you choose. There are many different types of index funds, but they broadly aim to be representative of the entire market. So to put it simply; if “the market” is up, meaning most of the companies are doing well on average, your index fund will likely be up too. If the market is down overall, your index fund will likely be down.

You don’t just invest in a few select companies. Instead, you invest in thousands of companies using something called an index fund.

An index fund is simply an investment product that allows you to invest in hundreds or thousands of companies with one purchase.

The money you invest into the index fund is distributed between all the companies in the fund you choose.

There are many different types of index funds, but they broadly aim to be representative of the entire market.

So to put it simply; if “the market” is up, meaning most of the companies are doing well on average, your index fund will likely be up too. If the market is down overall, your index fund will likely be down.

With passive investing, you simply keep investing in that fund, unwaveringly.

The fund provider may do some rebalancing occasionally (move money around from different stocks to ensure there isn’t too much or too little money invested in any given company), but effectively, the stocks you are invested in are largely consistent.

As I said at the top, over a long enough time period, “the market” has returned about 10% (before adjusting for inflation). This is a great return. All you want from investing is the average.

We’re not looking to be overnight millionaires by picking individual stocks. That’s a great way to lose all your money. Most active investors who pick individual stocks fail to beat the market.

This includes professional investors too. In fact, 80% of active fund managers are falling behind the major indexes. That is, they cannot outperform the market (and therefore passive investors) 80% of the time.

Why should I invest passively?

There are three key reasons passive investing is so appealing and is the smart investing strategy for 99% of people. Unless you have 7 figures of wealth already, it’s probably the right choice for you:

1. Simplicity

Passive investing is simple. It’s accessible for the average person.

Our education system does a terrible job of teaching us about personal finance, which is why website like this are necessary.

The investing world is also intentionally obscure; it’s full of jargon and complicated products.

Passive investing is appealing because most people don’t have the time or inclination to learn about picking stocks. You have bridges to build, diseases to cure, and a life to life.

Even if you did have the time and inclination, as mentioned above, it’s unlikely you’ll be in the small minority of people able to not lose money doing so.

The great thing about passive investing is that, without any investing knowledge, you can very easily set yourself up with Vanguard, Fidelity, BlackRock or any of the other major investment providers and invest in to a high performing index fund with a few clicks.

It’s so simple, but more importantly, it requires almost no ongoing maintenance. Once it’s set up, you are set for decades to come.

2. High performance

We all want great performance out of our investments. Historically, passive investing into index funds has performed very well.

Now, past performance is not indicative of future returns and there are never any guarantees in investing.

But once again, over a long enough timeframe, the market has always returned.

Why? It is the self-cleansing nature of the market that means the good innovative companies in your index will rise to the top and the bad inefficient companies will fall away to be replaced by the next rising star.

If any one company in the index fund were to go bust, you wouldn’t lose all your money. In fact, you may not even notice a decline in your portfolio value if the other companies grow to compensate for it.

Passive investing is an extremely diversified investment strategy when it comes to stocks and shares, which helps to minimize (though never eliminate) the risk.

On average, over a long-time frame, it’s very possible you can perform better than professional investors using passive investing.

3. Low fees

Fees are your enemy when it comes to investing.

Small fractions of a percent can result in hundreds of thousands of dollars in fee payments over your investing lifetime.

No matter how you choose to invest, there will be a fee or expense ratio attached to your investment. This is an annual fee as a percentage of your entire investment.

So for example, if you have $1000 invested and your annual investment fee is 1%, you will pay $10 dollars in fees.

The low fees that come with passive investing help keep most of the returns in your pocket.

Incidentally, this is one of the main reasons active investment managers cannot reliably beat passive investors. Their fees are typically much higher, which means a greater-than-average return is required just to match the passive investor (after fees).

With passive investing, because you are not paying for an expensive fund manager and a team of analysts and transaction fees (and so on) you save a ton of money.

In conclusion, if you want to create true generational wealth (that is, wealth that you can pass down to your kids and their kids), investing is essential. Passive investing is a prudent strategy to get there.

Why isn’t passive investing more popular?

On the contrary, it is becoming very popular. It’s difficult to say exactly how popular. One estimate suggests 37.8% percent of the entire investment market is passive investment and that the number is growing.

Regardless of the precise number of passive investors, we know it is growing in popularity immensely – for all the reasons listed above.

Part of its obscurity, and a relative fear of the stock markets in general, might be due to the lack of financial education in schools. A lack of financial education might also lead to poor budgeting, and less income available to invest. It might be that there is simply not an awareness of the need to invest for the future, and the power of compound investment.

But for the people who do choose to invest, why are they investing actively when it performs worse most of the time?

Many reasons.

- People think they can beat the market. Or, they think they know an active investment manager who can beat the market for them. What they don’t realize is that, even in the unlikely event they do manage to beat the market, the fees they charge are likely to negate any net gain in performance.

- Some people give their money to active investment managers because they don’t understand investing. They think a professional will look after their money diligently, when really all they are likely going to do is take an enormous fee and deliver average performance.

- You could also put it down to people being uncomfortable with the perceived lack of control they have in passive investing. With active investing, it feels like you are choosing your own destiny and are the captain of your investment decisions. In reality, you’re more likely to go down with your ship.

Some people invest for a bit of fun. And some people truly are world class investors. But for the vast majority in between there is no excuse, because the data is clear that passive investing is optimal.

Whatever the reason, it is actually beneficial that passive investing is not completely dominant. If passive investing were to become even more popular, perhaps greater than 50%, it could make the markets less efficient. It could also, hypothetically, create a passive investing bubble. That might be too much detail for this guide, though.

Why shouldn’t I use a safe, savings account instead?

Saving is safe, but the risk-averse nature of saving means you are unlikely to become wealthy. In fact, Inflation will mean you are likely to lose money in real terms.

You might get 2-3% interest through a savings account if you’re lucky. That is still not close to covering inflation.

The cost of inflation is significant. If inflation is at 10% (it is currently more than 10%). That means the spending power of $1,000 will be less next year.

Example:

- If a loaf of bread in 2022 costs $1, that means $1,000 can buy you 1,000 loaves of bread.

- Next year, because of inflation, bread costs $1.10. So, you can now only purchase 909 loaves of bread with $1,000.

- Let’s assume inflation averages at 5% for the next 18 years. In 2040, a loaf of bread will cost $2. You will only be able to buy 500 loaves of bread. Though we still have $1,000, because of inflation, the value of the money has halved to equivalent of $500 in 2022!

Saving is ok for short term goals. Investing using a stocks and shares ISA combats the eroding power of inflation to build long-term wealth.

I will need the money in less than 5 years. Is passive investing for me?

No, this strategy is not for you.

This is the longest of long-term plays. Passive investing should be counted in decades, rather than years. You should have an investment horizon of at least 5 years, but ideally much longer.

That’s because time is your friend in passive investing. Time smooths out the peaks and troughs you will naturally go through in terms of the value of your investment.

As legendary investor Warren Buffet says:

“The stock market is a device for transferring money from the impatient to the patient.”

Make sure your goals are far in the future.

How do I make sure I don’t lose money?

Your capital is at risk and there is a chance your investments will lose money. Over the long term, it should go up.

You are likely aware that our economy regularly goes through recessions. Boom and bust cycles are completely normal in this world. You will have good years and bad years.

The market has returned on average +10% since the 70’s as we saw above. That means some years may have had +20% returns, some years -30% return. It will be bumpy.

Recessions can last years, and this is why passive investing is a long-term play. You need to stay in the game long enough to enjoy the (hopefully) many booms.

An important note. Whilst the value of the investments will go up and down, the investment itself is ‘safe’ in the sense that you’re not going to be somehow defrauded out of all your share holdings.

In the extremely unlikely event that your investment company of choice goes bust, you would still own the underlying shares of the companies you have invested in. You cannot suddenly lose all your money this way.

The only way you can lose ALL of your money through passive investing in index funds is if all 7000 of the largest companies in the world go bust. This means the entire world economy has completely collapsed. Needless to say, if this were to happen, you would have bigger things to worry about than your money.

But you may see your money halve in some years, and double in others. The key is not to panic – more on this below.

What should I Invest In?

Passive index funds.

You’re not an expert, and you don’t need to be in order to invest. You don’t need to pick individual stocks like Apple or Meta, and there’s a good chance you’ll lose money if you try. Most people do.

Instead, you’ll be investing into an index fund. That is essentially, a basket of thousands of stocks. You’ll own a small piece of thousands of major global companies.

Passive investing into index funds is great because of the diversity. If Apple goes bust tomorrow, they will only be a tiny fraction of your overall investment, and the loss to you is small.

For exact fund recommendations, see below.

Should I invest via my bank?

Probably not. Your bank may offer the ability to invest, but it’s usually not the best option.

It comes does to the cost of investing, and options available.

- Usually, the fees banks charge are more than what you would be charged by investing services like Fidelity or Vanguard.

- Your bank likely has a limited selection of investment options (probably their own).

If you wanted to buy a new phone but weren’t sure what make to go for, you want a phone shop that stores all types of phones. Apple, Samsung, Google, Huawei and so on. You wouldn’t go into a Samsung store, as they only sell Samsungs.

Vanguard and Fidelity are the supermarkets of the investment world. Their available funds do vary, but the overall choice is much better than your typical bank.

How do I Invest?

There are three steps to investing passively with index funds.

1. Choose an investment company & account type

Firstly, you’ll want to invest your money with one of the major investment providers as they offer access to the widest range of index fund products.

My recommendation is the Vanguard platform.

You technically don’t need to use Vanguard to invest in the Vanguard fund above, but here’s why I think you should.

Vanguard traditionally has low fees. They operate at cost – meaning there is not the same drive as other companies to turn greater and greater profits. I like what they, and their original founder Jack Bogle, stand for. Jack pioneered index funds and the passive investing movement.

Practically, starting your investment journey is easy. Simply go on to their website and open an account just as you would with a bank.

In the US, you need to open a tax-advantaged account like a Roth IRA. In the UK, you would open a stocks and shares ISA. A lot of countries have these tax-efficient accounts and there are slightly different rules between countries.

It’s important to utilize any tax-efficient accounts available to you. This will help to reduce or remove any taxes due on your investment returns. Each tax-advantaged account will have yearly deposit limits and caveats, such as limits around withdrawing money, so do make sure you read the fine print.

Make sure you are maxing your retirement accounts, including any employer-matched 401k contributions, before opening a normal brokerage account (which is subject to higher taxes).

2. Choose a fund

The fund I recommend for the best global diversity, and affordable cost, is the Vanguard Total World Stock Index Fund (VTWAX). If you cannot meet the minimum investment amount for the index fund, there is an ETF equivalent called Vanguard Total World Stock ETF (VT). An ETF is essentially a cousin of index funds, it will get you the same thing.

For UK readers, you want the Vanguard FTSE Global All Cap Index Fund Acc. The “Acc.” Stands for accumulation. It means dividends are automatically reinvested, which is the best option for someone looking to grow their wealth.

Both of these are 100% equities, meaning you are investing purely in stocks, no bonds.

This is perfect when you’re in the wealth accumulation phase of life, with a long investment time horizon ahead of you. But the closer you get to your end goal, be that retirement or otherwise the more you might want to shift your allocation into bonds. A topic for another time.

3. Set up a monthly direct deposit

Finally, you need to set up a regular direct deposit, usually once a month, to invest money into your fund. Choose an amount that is manageable for you. You can schedule the amount to leave your bank account right after you get paid, so you don’t even notice it going.

You’re done!

How much does passive investing cost?

As discussed above, one of the key advantages of passive investing vs. active investing is the low cost. Fees are the enemy, as they can considerably decrease your wealth in the long run.

There are two fees to be aware of, a platform fee and a fund fee.

The platform fee is what you pay Vanguard, Fidelity, or another provider for using their investment platform.

The fund fee is the cost of investing in your chosen index fund.

Vanguard is great because of their low platform & fund fee.

In the US, you have a $20 brokerage account fee plus a 0.10% expense ratio (fund fee) for the Vanguard Total World Stock Index Fund mentioned above. A brokerage account is only needed if you are not investing via a tax-efficient account such as a Roth IRA.

In the UK, you’ll be looking at a 0.15% platform fee and, for the Vanguard FTSE Global All Cap Index Fund listed above, a 0.23% ongoing charge. So in total, you will be charged 0.38% of the value in your investment holdings annually.

Vanguard will simply sell some of your holding to cover the fee, so there’s no effort required on your part. They’ll let you know how much they’ve taken in fees in regular statements.

Read our full article about the cost of passive investing, and the most affordable passive investing platforms.

When should I invest?

Depending on when you are reading this article, you might be thinking one of the following:

- The market is really hot right now (a bull market/boom) – it’s too late to invest

- The market is on the way down (a bear market/recession) – it’s not a good time to invest

The good thing about passive investing, is that neither of these things matter to you.

- Just because the market is high, doesn’t mean it can’t go much higher. Do you want to miss out on all that growth?

- The market is low? Great! Stocks are on sale. To quote Mr. Buffett again:

“…bad news is an investor’s best friend. It lets you buy a slice of America’s future at a marked-down price.”

Market timing is impossible. If you could do it, you’d be incredibly rich. Don’t try and guess when the best time to buy is, you’ll almost certainly be wrong. Start today, if you can.

Two more quotes are relevant at this point:

“Time in the market beats timing the market”

“The best time to plant a tree was 20 years ago. The second best time is now.”

I can’t afford to invest much. Is it worth doing?

The reality is, not everyone is in the position to start investing yet, and that’s OK.

Sometimes we have high interest debt to pay off, sometimes we’re saving for a short-term goal like a house deposit, and these might all take priority.

But once you have a solid financial footing with a healthy amount of money saved in your bank account in case of emergencies (at least three months’ salary ideally), you should consider starting.

Even the smallest amounts of money invested over time can change your future dramatically – as we’ll see below.

How much should I Invest?

Most people add to their investments monthly. Like with your bills, they invest with the rest of their outgoings once a month.

The minimum monthly investment is typically around $100.

If you have come into money through inheritance, bonus or otherwise, you can also do a one-off lump sum investment.

The minimum one-off investment is usually around $500, and the maximum is theoretically unlimited. However, if you are investing a lot of money (more than the annual tax-free limit of the aforementioned accounts), you will need a slightly different account and this article may not be for you. If it is a very large amount, you might want to speak to a financial advisor.

How much you should invest is complicated. It depends on what you can afford, what your life goals are, and how much money you need & by when. This is up to you.

How much money can I make passive investing?

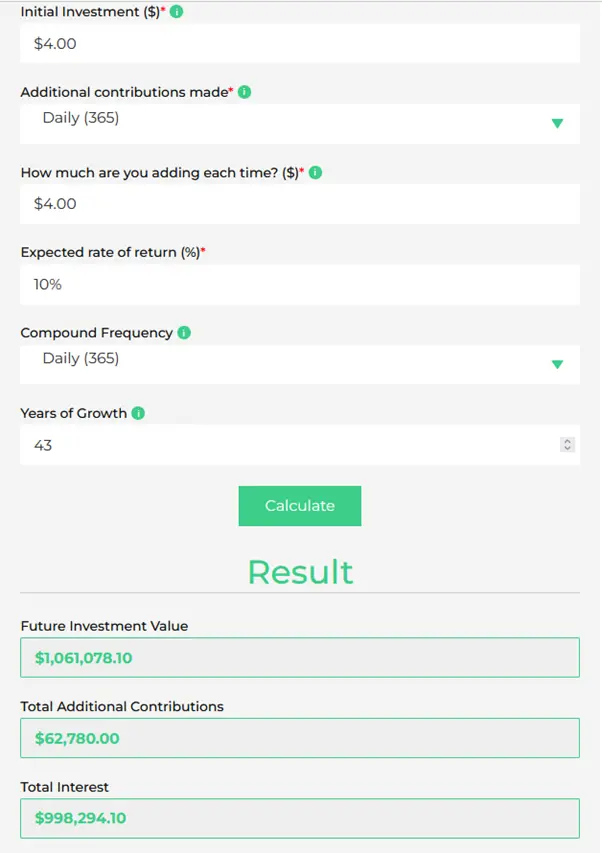

Here’s the real secret behind passive investing. It’s called compound interest, and it’s the reason you can invest just 4 dollars a day and retire a millionaire.

If you invest 4 dollars a day for 43 years, you’ll notice that only adds up to about $63,000 of your own money actually invested.

That’s 4 dollars x 365 days x 43 years = $62,780.00

And yet, you are somehow retiring as a millionaire. Where does the other $940,000 come from?

It’s coming from the 10% average annual interest from your passive investment compounding over time.

If you have $1000 and earn 10% interest on your money, you will now have $1,100 dollars – that’s $100 in interest.

Next year, if you earn 10% again you will have $1,210. You earn 10% interest on your original investment of $1,000 plus 10% interest on your $100 of interest. So this year you earned $110 in interest.

Each year, the amount of interest you earn grows or compounds and the effect is exponential – to the point that you are earning more interest on your investments than the amount of money you are putting in.

Here’s the full calculation showing how much interest you will earn from a $4 dollar a day investment over 43 years. You’ve actually earned nearly a $1m in interest alone despite only investing 6% of that:

Feel free to have a play with the numbers on our index fund investment return calculator. It’s a great motivator!

How do I track my investment?

Firstly, know that passive investing is just that – passive. Once you’re all set up, there is nothing you need to do until you need the money, or if you want to adjust your monthly investment amount.

There’s really no need to check it with any frequency, so don’t feel like you need to obsess over it as the value fluctuates.

With that said, if you do want to track it, the easiest & perhaps best way is within the investment provider’s website or app interface. You’ll be able to see your investment holding(s) and your personal rate of return. Your personal rate of return is unique to because of the time you entered the market, and the amount/frequency of your buy orders (monthly investments).

There is a recession, and my investment is down. What do I do?

The biggest barrier to success in passive investing, is you. In fact, we have a whole article on the common mistakes passive investors make.

In times of recession, your investment will go down. Expect it, and don’t panic.

It’s often said that the best investors are dead. Or at least, they have forgotten they have an investment account.

Humans have consistently shown we have a bias towards buying high and selling low.

The best passive investors are ones that don’t touch their investments for decades.

They don’t panic, they don’t try and time the market. They act as a dead investor would.

As mentioned above, time in the market beats timing the market. These inactive or deceased investors default to having a long time in the market, and their prize is usually a great average return.

Where do I go next?

If you would like to learn more, take a look at my recommended books on passive investing.

If you’re interested, you can read about how to set your children up with a nest egg that will grow through passive investing here.

Or head over to Vanguard to get started.