Who is Robert Kiyosaki?

Robert Kiyosaki is a polarizing figure in the world of personal finance and investing, and not just for his doomsday predictions.

He has both a large following of dedicated supporters who value his financial advice and entrepreneurial mindset, as well as critics who question some of his concepts and strategies.

Kiyosaki gained widespread fame and popularity with his book “Rich Dad Poor Dad,” which has sold millions of copies worldwide and is considered one of the best-selling personal finance books of all time.

The book encourages readers to think differently about money, investing, and wealth-building, which has resonated with many people seeking financial independence and success.

If I were to be critical of Kiyosaki, it would be to say that his work can lack specific and practical advice, and some of his concepts oversimplify complex financial matters.

Nonetheless, I have (in the past) been a big fan of Robert, his book ‘Rich Dad Poor Dad’, and his other work for many years.

Moreover, I’m confident he will be right about an impending recession, but unfortunately only because a ‘broken clock is right twice today’.

Has Robert Kiyosaki predicted crashes previously?

As of now, there is no record of him successfully predicting a market crash.

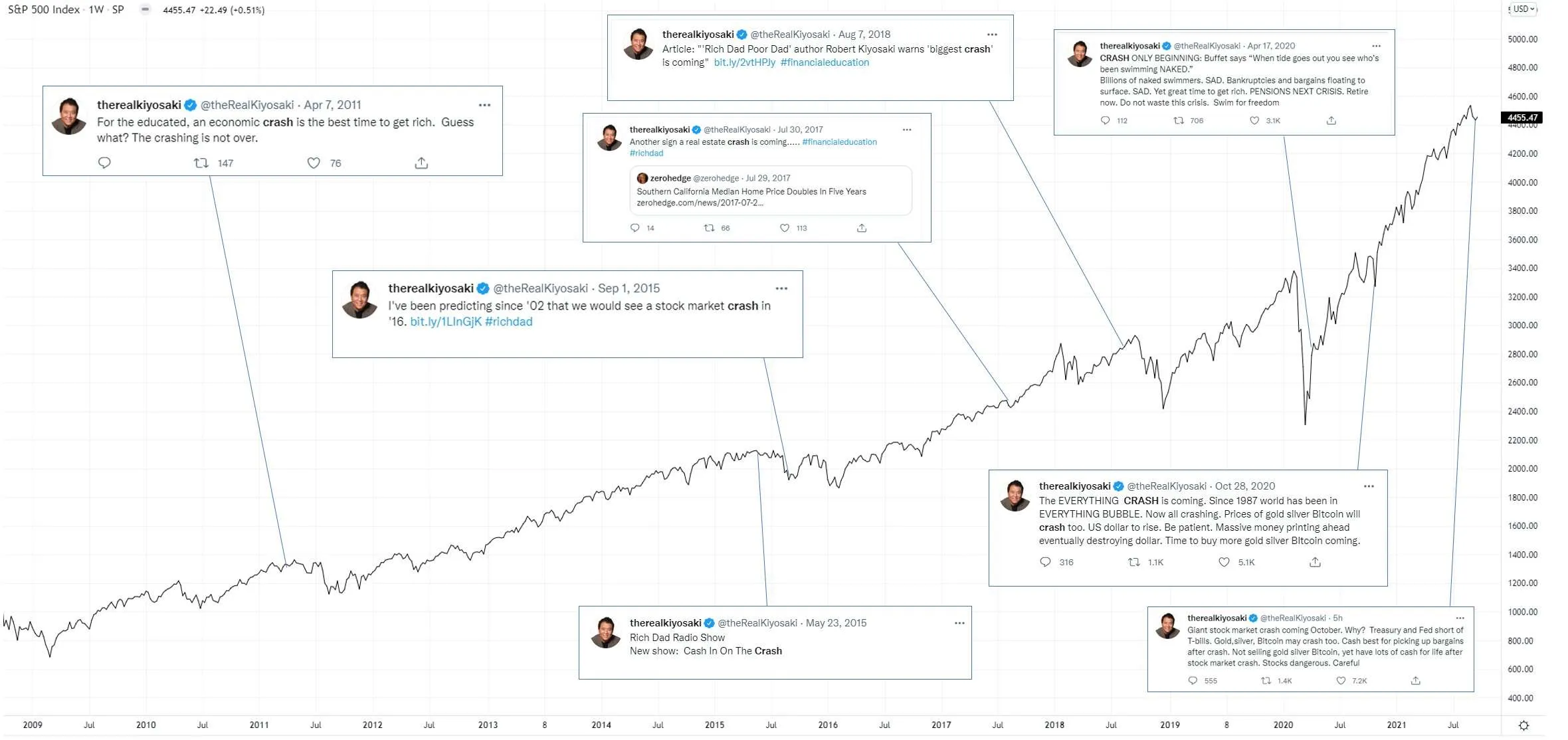

Economic recessions are a certainty. But it’s difficult to claim you are Nostradamus when you have predicted a recession is imminent for more than a decade, as this illustration shows.

The above maps Robert’s predictions of doom against the S&P 500 over a 10-year period (2011-2021).

Since his first prediction in 2011, the S&P 500 (a decent proxy for ‘the market’) has grown 228% from 1,380 to 4,455.

| Date | Tweet | Asset Class | S&P 500 |

|---|---|---|---|

| April 7th 2011 | For the educated, an economic crash is the best time to get rich. Guess what? The crashing is not over. | Equities | 1,339 |

| May 23rd 2015 | Rich Dad Radio Show New Show: Cash In On The Crash | Equities | 2,137 |

| September 1st 2015 | I've been predicting since '02 that we would see a stock market crash in '16. | Equities | 1,972 |

| June 30th 2017 | Another sign that the real estate market in the U.S. is nearing the top before the next crash. | Real Estate | 2,419 |

| August 7th 2018 | Article: "'Rich Dad Poor Dad' author Robert Kiyosaki warns 'biggest crash' is coming" | Equities | 2,850 |

| April 17th 2020 | CRASH ONLY BEGINNING: Buffet says “When tide goes out you see who’s been swimming NAKED.” Billions of naked swimmers. SAD. Bankruptcies and bargains floating to surface. SAD. Yet great time to get rich. PENSIONS NEXT CRISIS. Retire now. Do not waste this crisis. Swim for freedom | Equities /pensions | 3,230 |

| October 28th 2020 | The EVERYTHING CRASH is coming. Since 1987 world has been in EVERYTHING BUBBLE. Now all crashing. Prices of gold silver Bitcoin will crash too. US dollar to rise. Be patient. Massive money printing ahead eventually destroying dollar. Time to buy more gold silver BItcoin coming. | Whole economy | 3,390 |

| September 26th 2021 | Giant stock market crash coming October. Why? Treasury and Fed short of T-bills. Gold,silver, Bitcoin may crash too. Cash best for picking up bargains after crash. Not selling gold silver Bitcoin, yet have lots of cash for life after stock market crash. Stocks dangerous. Careful | Equities | 4,443 |

| September 26th 2022 | EVERYTHING BUBBLE into EVERYTHING CRASH. I warned in my books, the biggest crash has been building since 1990s. Rather than fix problems FED printed FAKE $. In Everything Crash everything crashes even gold, silver, BC. Your ultimate asset in giant crash, your financial wisdom | Whole economy | 3,693 |

| July 17th 2023 | I do not play the stock or bond markets. As an entrepreneur I like my hands on control too much. Yet too many signs point to a severe stock market crash. If your future depends on stocks and bonds please be careful, possibly ask for professional advice. Afraid depression coming. | Equities | 4,505 |

Robert’s turn to ‘doom predictor’ is not fun to watch. He has gone from being a hero to many disillusioned and financially illiterate young professionals, to giving eyeroll-inducing recession soundbites.

Fear sells when it comes to headlines.

Predicting market crashes accurately is extremely challenging. If you could do it accurately, you would be a billionaire. And that’s why there aren’t many.

Robert Kiyosaki predicted a big crash in 2023

Robert is predicted another crash in 2023. Perhaps the biggest crash of our generation. From his Twitter on July 17th 2023:

“I do not play the stock or bond markets. As an entrepreneur I like my hands on control too much. Yet too many signs point to a severe stock market crash. If your future depends on stocks and bonds please be careful, possibly ask for professional advice. Afraid depression coming.”

This may be the reason for his preference nowadays for gold, silver & Bitcoin. From his Twitter on February 17th 2023:

“For years I have been saying, “Saving money, & investing in a well-diversified portfolio of stocks, bonds, mutual funds & ETF’s is risky advice. Today, very risky advice. I still believe Gold, silver, Bitcoin best for unstable times, although prices will go up and down. Take care”

The commodities may still be hit during a recession, but are often seen as safe havens during troubling times.

Why did Robert Kiyosaki predict a crash in 2023?

The ‘signs’ or economic indicators Robert has referred to in 2023 included the rampant inflation issues, betting on artificial intelligence and the US debt rating being downgraded. From his Twitter on August 2nd, 2023:

“First shoe to drop. Fitch rating services down grades US credit rating from AAA to AA+. Brace for crash landing. Sorry for the bad news yet I have been warning for over a year the Fed, Treasury, big corp CEOs have smoking fantasy weed. Take care.”

The debt ceiling problem he has indeed been warning about for over a year (see the video in the next section from 2021). It may be a ticking time bomb, it may not.

Robert’s reasons for picking a crash are very much whatever is flavor of the month. It might involve real estate, pensions, or something else (see illustration at the top of the article).

Robert Kiyosaki is predicting a crash in 2024

Robert is keeping up his track record of predicting a crash (pretty much) every year. Right at the end of 2023, Robert tweeted:

“FYI. Bank Credit just sold off like 2008. Get some cash out of banks as you need cash. This may be the start of the biggest crash in history. Hope I am wrong yet no time to play Russian Roulette with your life.”

Though he does use the word ‘may’, so he is not committing to his prediction entirely. Just enough so that when a crash does eventually happen, he can say, “I told you so”.

How is Robert Kiyosaki investing to benefit from a crash?

If his statements above are to be believed, he is currently out of the equities and bonds market.

Robert is playing a market timing game. When the stock market does eventually crash (it always does), he will buy in.

For him, the sooner it crashes, the better. He can then buy stocks at a discounted rate.

From a YouTube video in September 2021 (where he predicts a crash that doesn’t come, incidentally) he makes no secret of his desire for a crash:

“I like crashes. So this next crash is going to be really really good. But it will bring down gold, silver, Bitcoin, stocks. But the good news is, a crash is a good time to get rich.”

Meanwhile, he misses out on years of market growth. It is a big gamble to be out of the market for such a prolonged period. Should a recession not hit this year, or within the next few years, his wealth will (continue to) be eroded.

Is Robert Kiyosaki alone in his crash predictions?

Now with all of that said, there are more people than Robert predicting a crash this year. Many are bracing for a deep, prolonged recession. So his claims, at least this year, have some merit.

I myself am concerned about a passive investing bubble (one that Michael Burry of ‘The Big Short’ fame is predicting), and have included his thoughts and mine here.

I cannot predict when or how the next recession will come, but like the sun rising, it is inevitable!