In this article, we are going to examine both sequence of returns and sequence of returns risk.

Understanding both concepts is incredibly important, regardless of which stage of your life you are in.

What is sequence of returns?

Sequence of returns is a concept that shows, during the accumulation phase of investing, the order of your gains and losses does not impact your overall portfolio, assuming you make no additions or withdrawals.

What is sequence of returns risk?

Sequence of returns risk is a concept that tells us, during the decumulation phase (i.e. drawing down in retirement) the risk of receiving negative returns early on can have a significant detrimental impact on your long-term portfolio value.

Why does sequence of returns risk matter?

Sequence of returns risk is an important concept to understand for two reasons:

- Market timing. Sequence of returns shows you that timing the market does not result in any discernible benefit in the accumulation phase BUT sequence of returns risk shows how market timing can be important during the decumulation phase.

- Retirement planning. Therefore, when you choose to retire is important. If you retire into a market downturn, you risk much poorer outcomes.

Let’s discuss both now.

Market timing & sequence of returns

Firstly, you should know that market timing is generally a fool’s errand.

Three quarters of the time, i.e., every 3 out 4 years, the market is up.

By waiting to invest your money until you feel the market is on the up, you are betting the minority position.

By waiting, you have a 75% chance of missing out on growth. Again, this is a fools bet.

Sequence of returns hammers home this point. Let’s look at an example.

Sequence of returns: Example PDF, Chart, Table & Excel

As mentioned, during the accumulation phase of investing, the order of your gains and losses does not impact your overall portfolio, assuming you make no additions or withdrawals.

This is illustrated below – or you can download the relevant PDF & Excel file with table & chart below:

Sequence of returns example

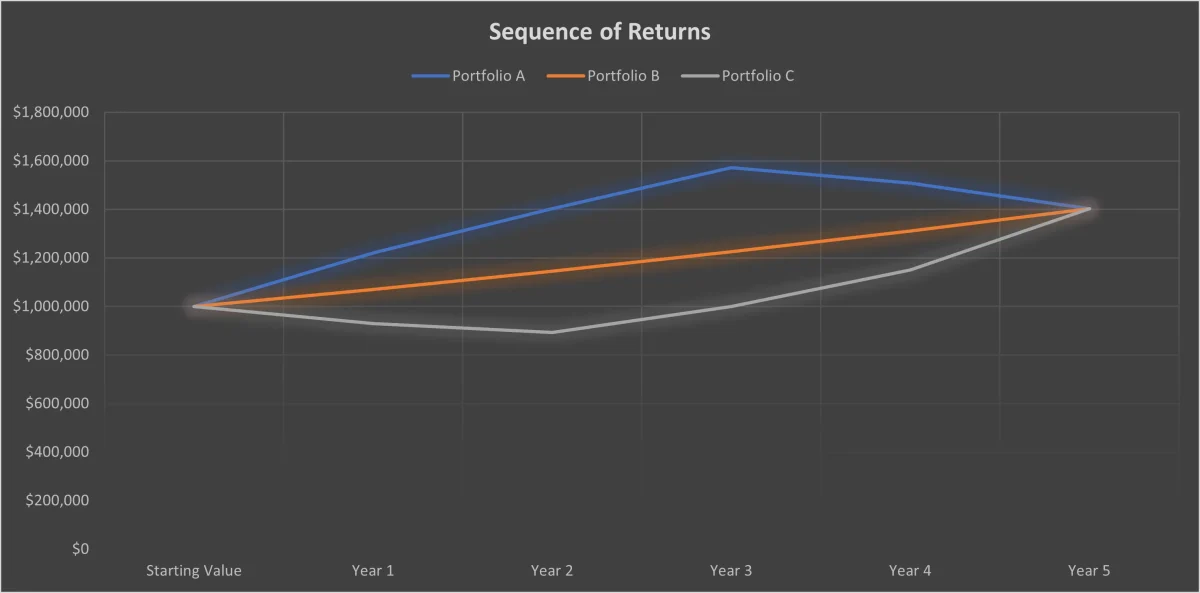

The below table and chart show three different portfolios, averaging an annual return of 7% over 5 years.

| Portfolio | Year 1 | Year 2 | Year 3 | Year 4 | Year 5 | Avg. Annual |

|---|---|---|---|---|---|---|

| Portfolio A | 22% | 15% | 12% | -4% | -7% | 7% |

| Portfolio B | 7% | 7% | 7% | 7% | 7% | 7% |

| Portfolio C | -7% | -4% | 12% | 15% | 22% | 7% |

Note that whilst they all average 7% return, their paths to get there vary wildly.

Despite their varied returns from year-to-year, their final portfolio value was the same because they averaged the same annual return across 5 years.

The sequence of returns did not matter. When their gains and losses happened did not matter. The amount of gain and loss in each year did not matter. Because ultimately, they each averaged the same 7% and ended with the same portfolio value.

Retirement planning & sequence of returns risk

On the other hand, sequence of returns matters a great deal when it comes to retirement planning and the decumulation (spending) of your amassed wealth.

If you lose 30% of your portfolio a year into your retirement due to a drop in the market, and you are spending 4% of your portfolio per year, you suddenly have a much smaller and shrinking portfolio.

The key issue though, is that when the market recovers (it always does), you will have much less capital that can grow as you have been spending it down.

Sequence of returns risk: Example PDF, Chart, Table & Excel

The risk associated with your returns coming out of sequence, i.e., the ‘down’ years happening too early in your retirement, is illustrated below.

Or you can download the relevant PDF & Excel file with table & chart below:

Sequence of returns risk example

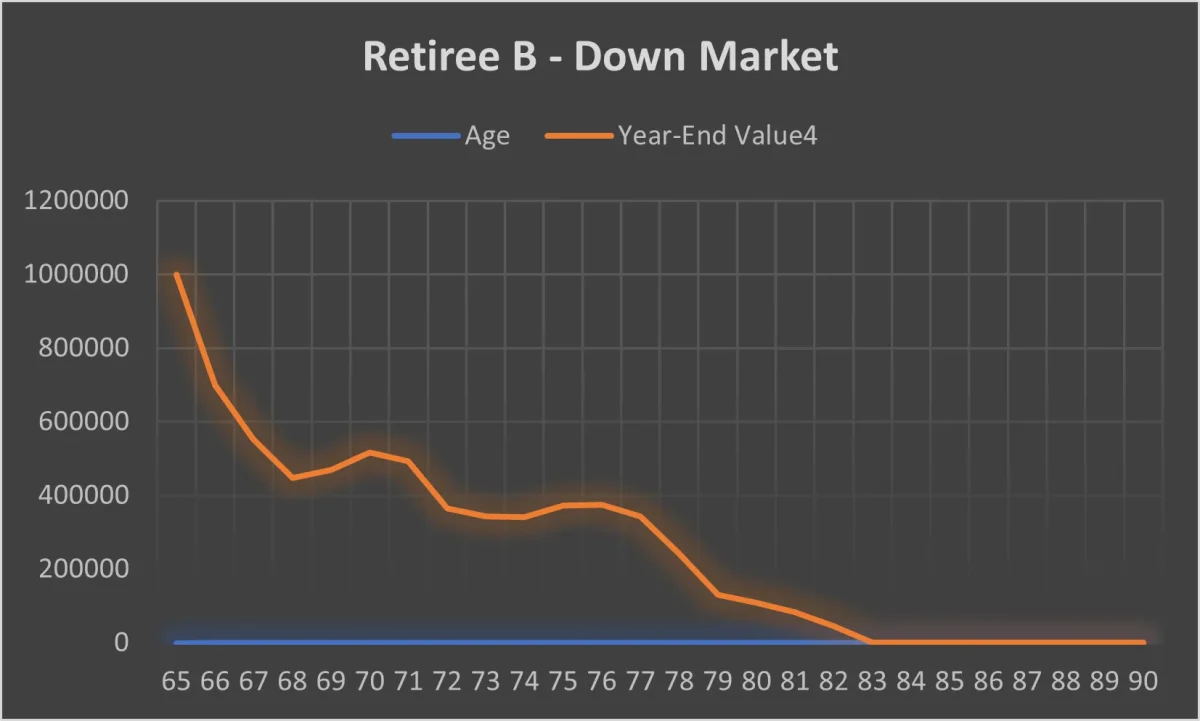

The below table and chart show two retirees, both retiring at age 65, but into different market conditions.

| Retiree A – Up Market | Retiree B – Down Market | |||||

|---|---|---|---|---|---|---|

| Age | 5% Annual Withdrawls | Annual Return | Year-End Value | 5% Annual Withdrawls | Annual Return | Year-End Value |

| 65 | $1,000,000 | $1,000,000 | ||||

| 66 | $50,000 | 5% | $1,000,000 | $50,000 | -25% | $700,000 |

| 67 | $50,000 | 28% | $1,230,000 | $50,000 | -14% | $552,000 |

| 68 | $50,000 | 22% | $1,450,600 | $50,000 | -10% | $446,800 |

| 69 | $50,000 | -5% | $1,328,070 | $50,000 | 16% | $468,288 |

| 70 | $50,000 | 20% | $1,543,684 | $50,000 | 21% | $516,628 |

| 71 | $50,000 | 19% | $1,786,984 | $50,000 | 5% | $492,460 |

| 72 | $50,000 | 23% | $2,147,990 | $50,000 | -16% | $363,666 |

| 73 | $50,000 | 9% | $2,291,309 | $50,000 | 8% | $342,760 |

| 74 | $50,000 | 16% | $2,607,919 | $50,000 | 14% | $340,746 |

| 75 | $50,000 | 23% | $3,157,740 | $50,000 | 24% | $372,525 |

| 76 | $50,000 | 22% | $3,802,443 | $50,000 | 14% | $374,679 |

| 77 | $50,000 | -26% | $2,763,808 | $50,000 | 5% | $343,412 |

| 78 | $50,000 | -15% | $2,299,237 | $50,000 | -15% | $241,901 |

| 79 | $50,000 | 5% | $2,364,199 | $50,000 | -26% | $129,006 |

| 80 | $50,000 | 14% | $2,645,186 | $50,000 | 22% | $107,388 |

| 81 | $50,000 | 24% | $3,230,031 | $50,000 | 23% | $82,087 |

| 82 | $50,000 | 14% | $3,632,235 | $50,000 | 16% | $45,221 |

| 83 | $50,000 | 8% | $3,872,814 | $50,000 | 9% | $0 |

| 84 | $50,000 | -16% | $3,203,164 | $50,000 | 23% | $0 |

| 85 | $50,000 | 5% | $3,313,322 | $50,000 | 19% | $0 |

| 86 | $50,000 | 21% | $3,959,120 | $50,000 | 20% | $0 |

| 87 | $50,000 | 16% | $4,542,579 | $50,000 | -5% | $0 |

| 88 | $50,000 | -10% | $4,038,321 | $50,000 | 22% | $0 |

| 89 | $50,000 | -14% | $3,422,956 | $50,000 | 28% | $0 |

| 90 | $50,000 | -25 | $2,517,217 | $50,000 | 5% | $0 |

| AVERAGE RETURN | 6% | 6% |

Both Retiree A and Reitree B achieve a 6% annual return from age 65 to 90. Not bad!

However, the sequence of their respective returns come in completely different orders.

Retiree A enjoys great growth early on. This catapults their already sizeable wealth to greater heights. When the economy falters later on, their large wealth is able to whether to storm.

Retiree B has unfortunately retired into an economic crash. This, combined with their spending of $50,000 a year, quickly reduces the size of their portfolio.

Despite seeing great gains later in their retirement, because their portfolio shrank so significantly early on, they were not able to recover.

Retiree B goes bankrupt by age 83.

How to mitigate sequence of returns risk

The unpredictability of the market means that planning the optimal month to retire is practically impossible.

But that doesn’t mean we can’t hedge against the risk.

Let’s explore some practical ways to mitigate sequence of returns risk.

Diversification

Stocks are inherently volatile. Moving 20-40% of your portfolio into bonds as you approach retirement is a great way to hedge against sequence of returns risk.

Depending on your risk tolerance, you might want to start this process of shifting allocation more than a decade before your desired retirement age.

Delay retirement

Simply continuing to work until the market recovers is an option.

It is perhaps not one most want to consider but given the drastic effect it can half on your wealth, if you don’t mind your work, it’s worth thinking about.

You can also consider going part-time to cover your expenses whilst also temporarily living slightly more frugally then you want to long-term.

Flexible withdrawal strategy

It’s generally good advice to follow the 4% rule in retirement.

That is a general rule of thumb that states that retirees can safely withdraw 4% of their savings in the first year of retirement and adjust that amount annually for inflation.

However, if you are unlucky in choosing the year you retire, its best to be flexible with this rule.

You should consider reducing draw down during times of economic uncertainty. While the market recovers, reduce spending significantly to give your investment a better chance of rebounding.

Consider annuities

To take the risk totally out of the question, you can consider a fixed income for life.

Don’t be too quick to dismiss the idea.

Research has shown that most retirees who draw down their money fail to the vast majority of their wealth. That is, they die with hundreds of thousands or even millions of dollars unspent.

It might be for fear of going broke, medical expenses or simply waiting for ‘someday’ that never came.

Whatever the reason, an annuity can help ensure you actually spend and enjoy the fruits of 40-50 years of labor.

This is part of the ‘Die With Zero’ philosophy.

Bucket Strategy

Another approach is to implement a ‘bucket strategy’.

That is, dividing your portfolio into different buckets based on time horizons.

The first bucket should hold enough cash or low-risk assets to cover several years of expenses, providing a buffer against market volatility.

The subsequent buckets can be invested more aggressively.

Top up via side income or part-time work

Returning to work is perhaps the last thing on your mind, so this is perhaps a last resort.

However, many retirees find that when they pursue a new passion in retirement, they can easily monetize it with little effort.

It might be a fishing rod repair business or perhaps a baking company. Whatever it is, you might find that your new hobby has value to others. If doing it makes you happy, it’s win-win.

Take a look at other ideas for retirement here.

Don’t panic

Perhaps most importantly, understand that market downturns are inevitable.

The worst thing you can do is panic sell after a drop in the market. This gives you no chance to recover and most likely, a much more inferior retirement.