Is passive investing the cheapest option?

Passive investing via index funds is widely regarded as a simple, cost-effective approach to building wealth.

That is because the platform fee and fund fee combined often add up to small fractions of a percentage.

For example, with Vanguard’s Total World Stock Index Fund (VTWAX) you are paying a $20 annual brokerage fee for your account with Vanguard, plus a 0.10% fund fee.

In the UK, taking the popular Vanguard FTSE Global All Cap Index Fund Acc as an example, it results in a 0.38% total annual fee.

You can achieve sufficient diversification and build exceptional wealth through the purchase of a single index fund, such as the ones above. There is no need to buy/sell stocks regularly, therefore no other transaction fees apply.

Putting investment performance aside for a moment, if you’re looking for an affordable entry into the investment world, passive investing through index funds is it.

Is the cost of active investing worth it?

You get what you pay for in life. Except, perhaps not when it comes to active and passive investing.

Active investing is known for costing much more. And yet, history has shown us that the performance of active fund managers is sub-par.

It’s true that in any given year, some active managers may significantly outperform the market. In fact, over the last year nearly half of active managers did outperform the market.

But today’s superheroes are tomorrow’s villains. As that same article shows, when looking over a 5-year period, only 16% of active managers outperformed the market. After 20 years, you’re looking at just 5% of active managers who are able to outperform the market.

Picking the winning managers over a long timeframe is a lottery. The risk is high. Not just on picking an active manager who outperforms the market, but that is worth the increase in fees too.

A key reason active managers underperform the market is due to their fees. However, there are other factors at play. Often, active managers are shackled by their assigned focus area, or the limited investment options their specific company offers, for example.

The investing world is intentionally made obscure. A novice investor may not even truly understand all the hidden fees that come with an active manager. Passive investing is simpler and more transparent, which is why it is our recommendation.

Why are small differences in fees so important?

The difference of half a percent seems so negligible. Why do we quibble over such minor differences in passive investment funds? Isn’t paying slightly more for an actively managed fund worth it?

A big part of investment performance is not giving away your wealth in fees. The more money you keep for yourself, the more money you can reinvest. The more you can reinvest, the greater the effect of compounding; your money will grow exponentially quicker.

To illustrate the impact of slightly higher fees, let’s look at how just a 1.0% fee can eat into your wealth (though you can get cheaper & much more expensive actively managed funds).

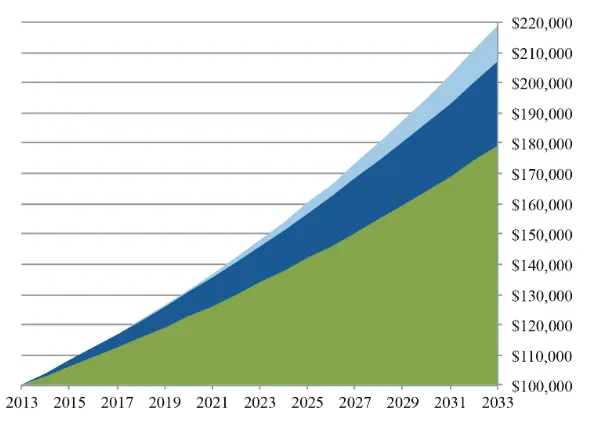

Illustration of 1% ongoing fees over 20 years with 4% returns

Source: sec.gov

The above chart shows a modest 4% average return on an initial $100,000 investment, over 20-year period, with a 1% fee.

- The green represents your return minus the 1% fee – around $180,000.

- The dark blue represents the fees paid – a staggering $28,000 dollars.

- The light blue shows you the additional return possible if the fees were reinvested instead – $12,000.

Fees are the enemy. If you are looking to retire off your investments, it can dramatically reduce your drawdown rate in later years (the amount you can afford to spend each year without going broke).

Furthermore, it’s important to recognize that this is a very conservative example. 20 years is a relatively short investment time horizon in truth. 4% is a low investment return. $100,000, without any additional top ups, is also modest relatively speaking. If you increase all of these factors, the amount of fees taken also increases exponentially.

That’s why the difference between a 0.10% expense ratio and a 1% expense ratio is extremely important.

Even in the unlikely event the active management fund beats the index, it would need to beat the index and cover the additional fee for it to be worthwhile. As we saw above, there is a low chance that active managers can beat the market at all, let alone by enough to justify their extortionate fees.

Tax-efficient accounts for passive investing

Don’t forget the worst fee of all – Uncle Sam.

Luckily, if your investment amount falls under a certain amount (and depending on your income/level of investment) there are tax-sheltered accounts you should use.

For example:

In the US, a Roth IRA can allow untaxed contributions of up to $6,000 per year.

In the UK, a Stocks and Shares ISA can allow untaxed contributions of up to £20,000 per year.

Make sure you take advantage of these accounts, as well as any tax-efficiencies from other retirement accounts, to avoid paying tax on your investment returns.

The best priced platforms & funds for low fees

This is of course dependent on the amount you invest, but we’ll assume we are starting lower starting figures.

We recommend passive investing using the Vanguard platform. This is for their low fees and because they are a business operating at-cost, meaning they have less incentive to price gouge with extortionate fees.

As mentioned above, through Vanguard you can open a brokerage account for a $20 annual fee. Then, opting for a global index fund like the Vanguard Total World Stock Index Fund (VTWAX) there is a 0.10% fee.

In the UK, you’ll be looking at a 0.15% platform fee and, for the Vanguard FTSE Global All Cap Index Fund listed above, a 0.23% ongoing charge. So in total, you will be charged 0.38% of the value in your investment holdings annually.

With that said, Fidelity have stepped forward with some enticing 0% expense ratio offers on some of their funds. This includes the Fidelity ZERO Total Market Index Fund.

These funds are operating as loss-leaders in the hope that you will also use other Fidelity products, which do have a cost attached. This is worth looking at, though note you cannot easily transfer your holdings to another provider if you wanted to (it would need to be sold first).

Both Vanguard and Fidelity are two of the largest investment companies in the world. Both are fine choices depending on your specific requirements.

The bottom line on fees

Always make sure you thoroughly understand ALL the fees that apply to your investing. Small fractions of a percent in fees, conveniently split out into even more obtuse fees, can be extremely damaging to your wealth.

Our recommendation is passive investing through index funds, using Vanguard or Fidelity. It has the lowest fees, extremely good diversification, and historically great results.

Are you interested in learning more about passive investing? See our beginners guide to passive investing to learn more.