What is the Ava Credit Builder card?

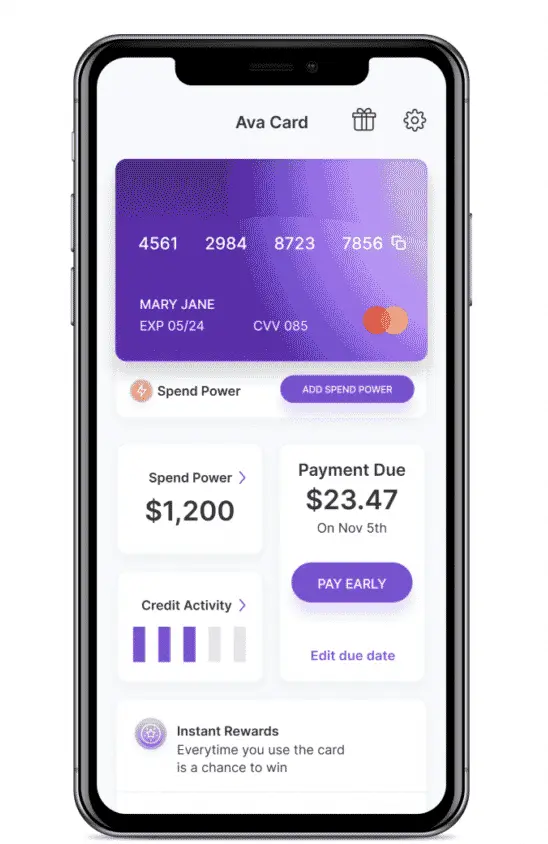

The Ava credit builder card is similar to a normal credit card, with some key differences designed to boost your credit score quickly.

Firstly, it can only be used to pay for subscriptions – your Netflix, Spotify, T-Mobile and other supported subscription services.

Secondly, Ava gives you a high credit limit and at the same time, limits the amount you can spend.

This is a legitimate trick to boost your credit score:

- Having a high credit limit, but spending a small amount, lowers your credit utilization percentage.

- Lowering your usage (i.e. not taking advantage of all the credit on offer) is a positive signal and can help your credit score.

Ultimately, the Ava credit card exists for two reasons:

- To build your credit score, so that…

- You will be offered better loans or credit cards with lower interest rates.

Lower repayments with better terms result in you paying less on your loans overall.

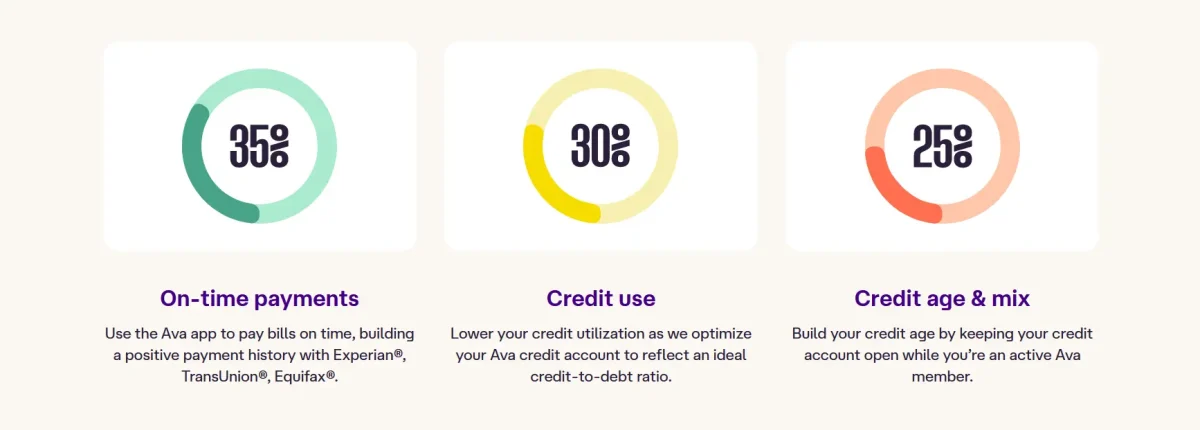

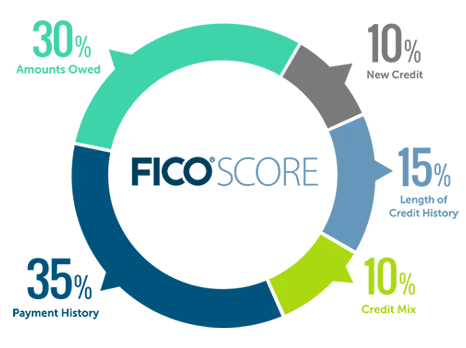

Ava addresses 90% of the factors that affect your credit score, providing you keep the account open for a while. Those factors are on-time payments, credit utilization, and credit age.

How the Ava Credit Builder Card works

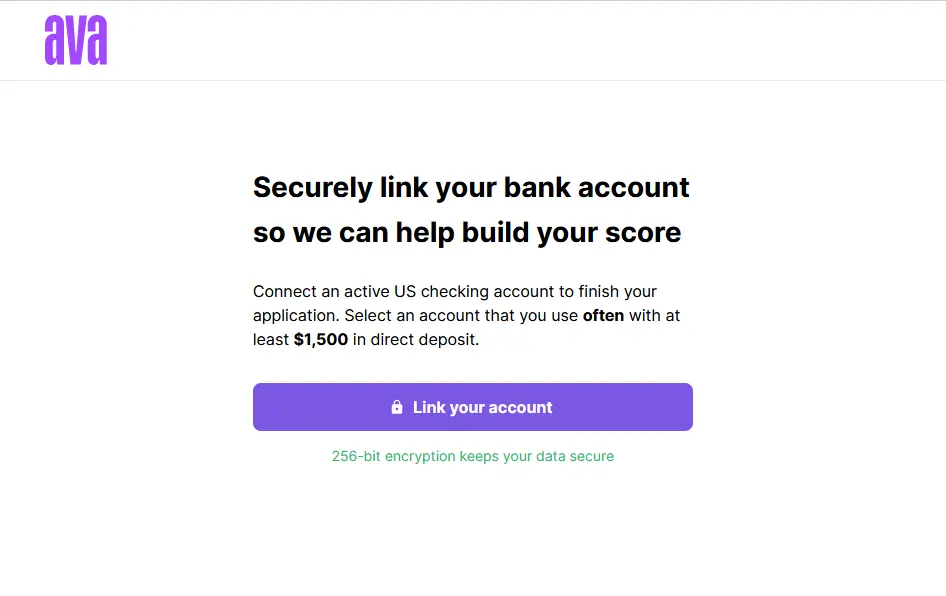

To get started, sign up on the website or app. Anyone can sign up, regardless of your current credit score.

Enter your address, then securely connect your checking account. This will be used for the repayments; it must have at least $1,500 in direct deposit.

If you’re concerned about safety entering personal information, see our ‘Safety and Security’ section further below.

You will be issued a card with a $2,500 credit limit but limited to the ability to spend only $25 on subscription services (this spending limit can increase later).

You set up a recurring subscription payment with one of the approved merchants (Spotify or Netflix for example).

7 days after the payment, the balance of your card is due, so make sure you have enough in the bank account you signed up with.

This is really important as, if you do not pay on time, your credit score will be negatively impacted.

Once Ava successfully takes the payment after 7 days, they report your on-time payment (as well as your low credit card utilization) to the three major credit bureaus (TransUnion, Equifax and Experian) within 24 hours.

This can build your score extremely quickly. According to Ava themselves, 74% of Ava members see an improvement in less than 7 days.

In fact, if Ava doesn’t show up on your report in 14 days, you’ll get your money back via their Money Back Guarantee.

Credit utilization and limits

FICO say that the amount of money you owe represents 30% of your credit score.

The amount of money you owe as a percentage of what you could owe, i.e., your credit limit, is known as your credit utilization.

Ava sets your credit limit to $2,500 but your spending limit to $25 initially. These can both increase with on-time payments.

Why do they do this? It’s because it locks your credit utilization to just one percent ($25 spent is just one percent of $2,500).

Remember, you are paying off that $25 automatically after 7 days. So, each month, your credit limit and spending limit resets; you will always have a 1% utilization rate or lower.

A credit utilization of just 1% signals to the credit bureaus that this person is not stretched for money each month. Of the vast amount of credit available to them, they are only using a small part of it.

This is a perfectly legitimate and downright clever way to improve your credit score.

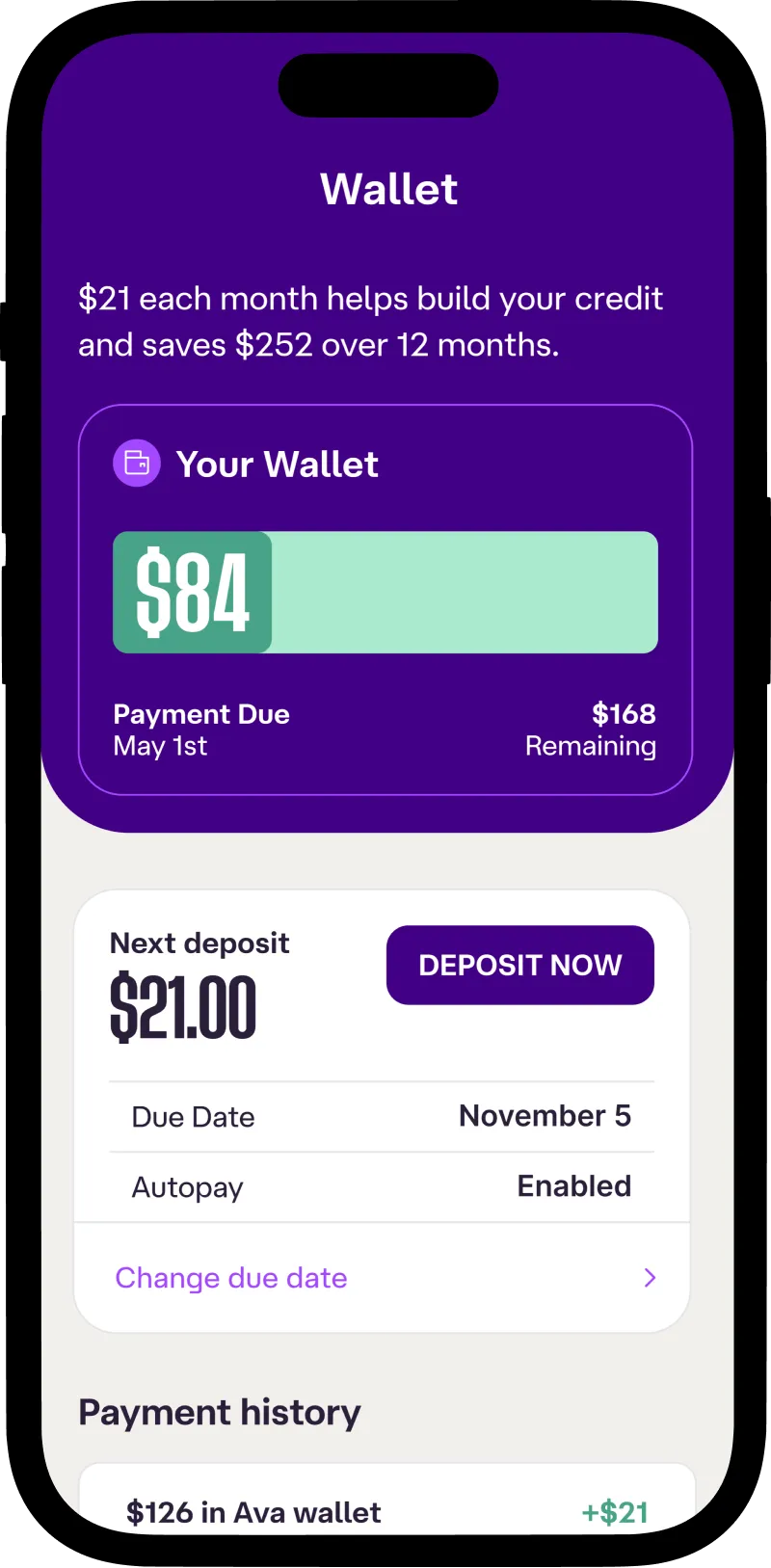

Ava savings builder account

Another super simple (and also downright clever) way to build your credit score is with the Ava savings builder account.

It works like this:

- Contribute up to $30 a month for 12 months.

- Ava reports each payment into the savings account as an on time payment.

- At the end of the 12 months, you get all your money back. That would be $360 if you save the maximum amount.

Why save up all that money for 12 months just to get the same amount back in the end?

In the background, Ava treats this like a loan – which is why they can report it to credit agencies.

It’s almost like a reverse loan. You pay off the loan first, then get all the money back.

There’s no fees or interest here. But there’s also no backing out once you start.

You must make your savings payment each month, like you would a credit card repayment, or it can negatively impact your credit score.

As long as you make the payments each month for 12 months, this could be a great way to build credit fast and put money aside for Christmas or anything else you’re saving for.

Your score can go up by 45 points on average, according to Ava.

So, if you’re signing up for Ava credit card, you should consider the savings builder account too. That’s because you’d be getting both a revolving credit account and an installment loan with the savings account.

That means two separate on-time payments being reported each month. This can help boost your credit score significantly.

The Ava credit app

The app is the perfect way to manage your credit account and savings builder if you choose this product too.

But it also offers some other useful services.

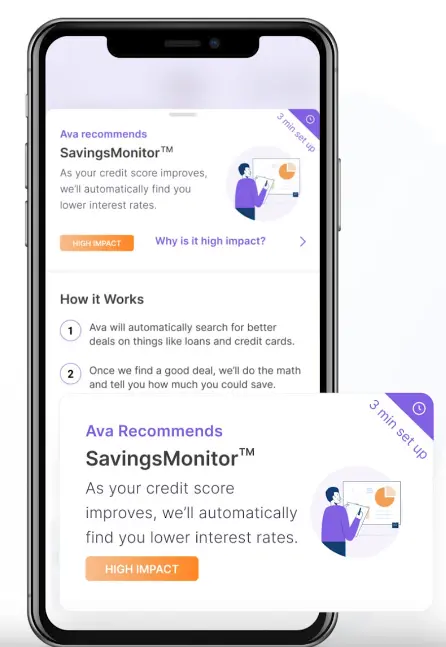

See your credit score at a glance as well as the changes over time. It’s important to track your progress – and Ava says you should see changes very quickly indeed.

They also can offer insights into what might be affecting your score.

They also offer savings monitor – a tool that is looking for better deals on your existing debt, allowing you to refinance and save money.

This relates back to the ultimate goal of using Ava – improve your credit score to get better terms on your loan agreements, which will save you money.

The Ava app does lots of small things to keep you on track, like give you bill reminders.

The App has plenty of 5-star reviews as we’ll see below and it is one of their key selling points.

Pricing: how does Ava make money?

Ava charge no interest and require no deposit. So how do they plan to make money from you?

Ava charge a subscription fee of $6/month when you sign up for an annual plan. The month-to-month subscription fee is $9. There are no other hidden fees or catches.

Is this a good deal? That depends.

If you need to build credit fast, it can have decent ROI (return-on-investment) when you consider the access to better loan deals you will receive.

A score of 700+ can save you over $3000 annually, according to research from Ava. That’s because of the lower interest rates & monthly repayments on the deals you will be offered.

Considering this, a short-to-medium-term investment into Ava’s service to get your credit score on track makes perfect sense.

Ava may also make money as part of their savings monitor system. The system finds you good deals on credit cards and loans. If you sign up to one of the deals they find for you, it’s likely Ava would get a referral commission for that.

It comes at no cost to you; it’s just something to be aware of.

Safety and security

Ava state that they never sell your data or save your banking login. All personal information is kept safe with 256-bit encryption.

Ava uses Plaid to connect your bank account. Plaid is FCA registered. It is industry-standard and is used in many well-known financial apps and services.

Plaid in the majority of cases does not store your login information. They use OAuth2 for most financial institutions.

The OAuth2 token is read only and does not represent user credentials.

For some connections, they will store your credentials and keep them encrypted. At no point will this data be shared with Ava.

It’s a slightly jarring experience at first, but our assessment is that it is perfectly safe to connect your bank account via Plaid.

Review roundup

The level & volume of positive reviews you can find about Ava is impressive:

- Trustpilot gives Ava a 4.8 / 5 with 591 reviews.

- The Apple App Store rates Ava as 4.9 / 5 with 8,408 reviews.

- Google play gives a solid 4.6 / 5 with 3,143 reviews.

That is a lot of happy customers.

Help and support

You can get in touch with Ava support with their email address: [email protected] or call them at (920) 287-0282.

Ava aims to get back to requests within 24 hours.

For the hundreds of reviews on Ava, we found hardly any mention of negative experiences with regards to customer support.

Given that people love to complain publicly when they have a negative interaction with a company, this is quite remarkable.

Summary: is Ava worth it?

If you have a credit score under 700, Ava is a great option to consider. You are part of the target audience that can benefit the most.

Particularly if you opt for the savings builder as well as the credit card function, your credit score can, as advertised, increase very quickly.

The monthly fee is worth paying in the short-to-medium term for the results that Ava can offer. However, after a year or two (after your credit score has been boosted), you might want to consider alternatives.

Don’t be caught out by the payments being taken every 7 days later – you must have enough in your account to cover it.

If you can do this consistently, Ava is an ideal solution to a common credit problem.

Learn more about how to boost your credit quickly: