Recommended Loan & Credit Building Providers

4.9

Upgrade is a fantastic multi-purpose loan provider for those with credit scores of 560 or more.

4.4

PersonalLoans.com searches its wide network of lenders to find loans for those with low credit scores.

4.7

Grow Credit is not a lender. They offer a remarkably clever system to quickly build your credit score.

What is Explore Credit?

Explore Credit is a short-term loan provider with a twist.

They have ambitions to create a community feel in what is normally a dull, transactional arena (loans) by offering rewards and perks to their customers.

I raised an eyebrow at such a strange notion initially. But it is an idea with merit.

Making loan payments on time is critical to staying out of debt and maintaining a good credit score. Explore Credit encourages this by offering loyalty points for each payment.

Once you accrue enough points, they will offer a discount on your next payment.

Could this be enough to sway people towards using Explore Credit?

Maybe. But there is a past to this tribe-owned company that you should be aware of – more on this below.

How Does Explore Credit work?

Explore Credit offer low-value loans, between $250-2,000.

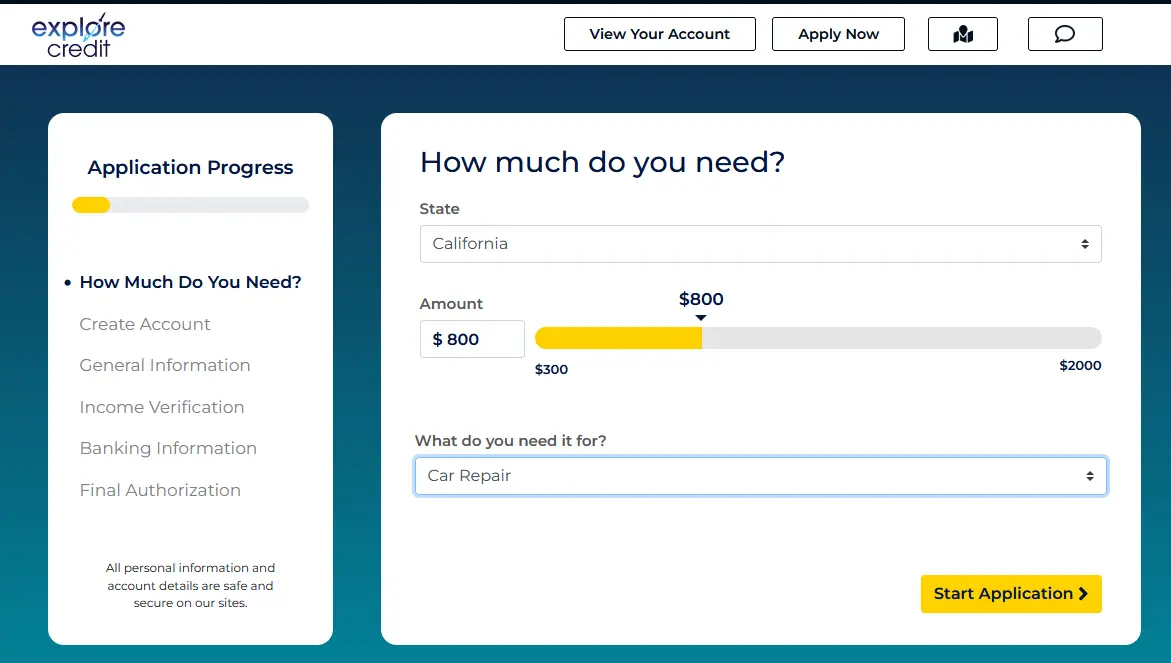

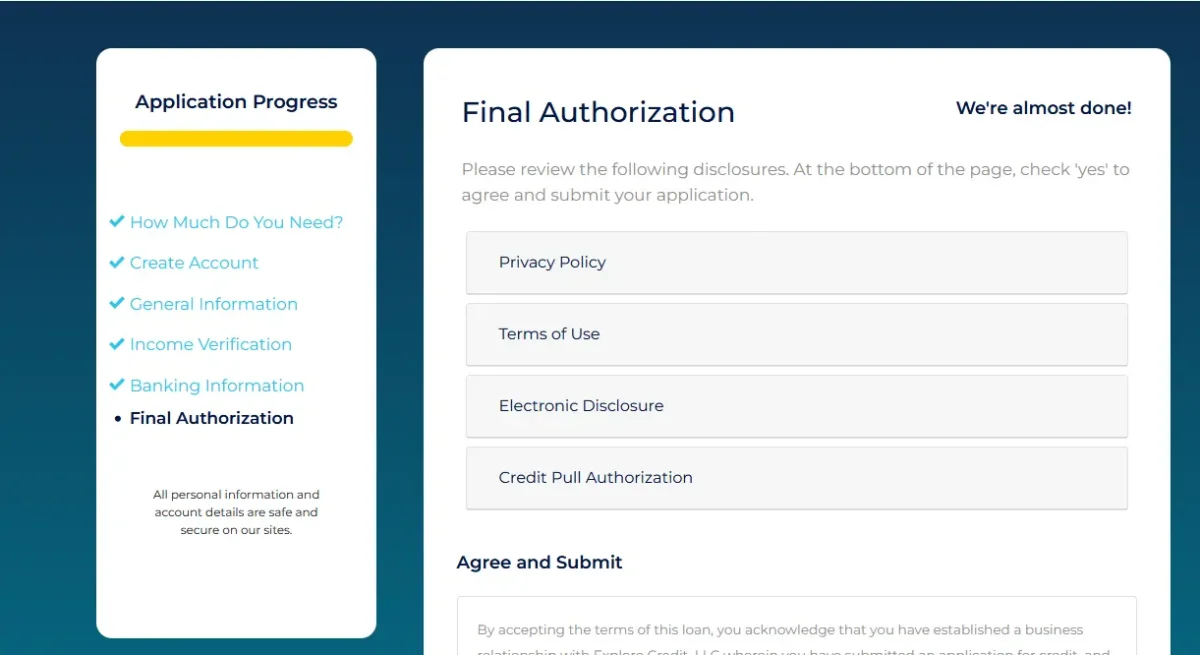

There are five fairly simple steps to securing your loan, which we had no problem completing.

1. Select the loan amount and purpose for the loan.

2. Enter your personal details.

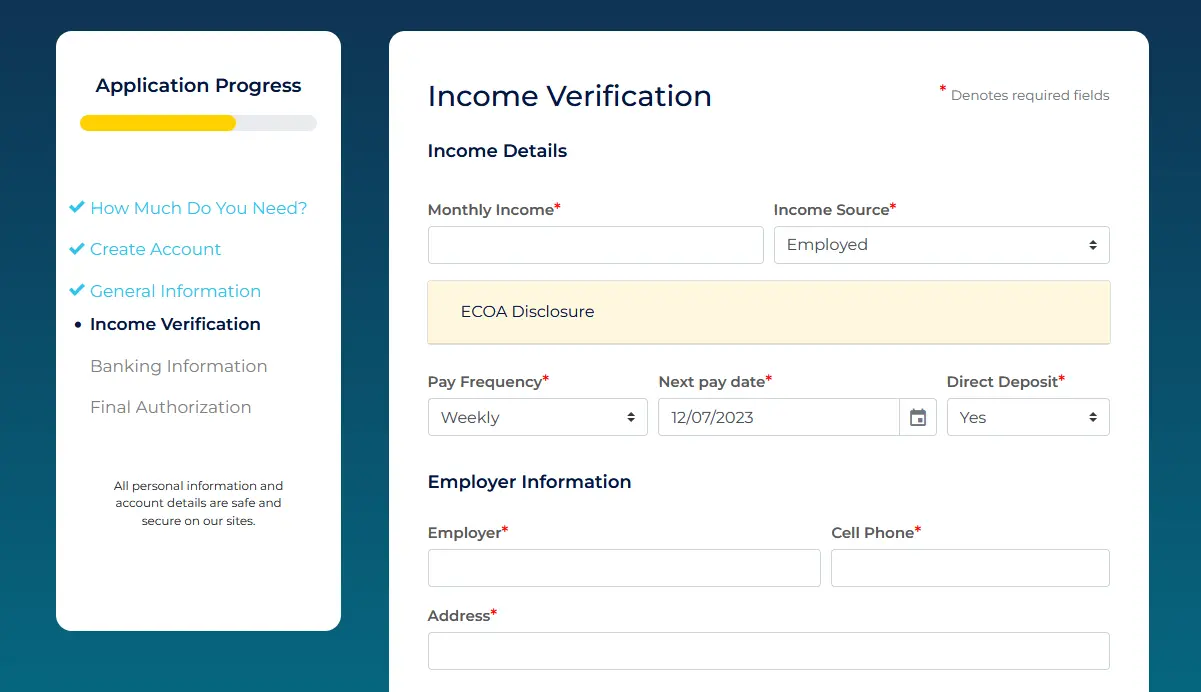

3. Enter your income and employer information:

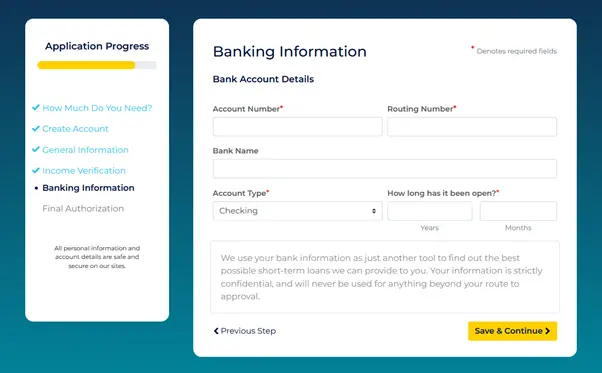

4. Enter your banking information (they use this information to help find the best possible loans for you).

5. The legal bit. This is where you review their terms and agree to them – do read them. They are also saying here they will pull your credit score, and this page is you giving them authorization. Remember, hard searches on your credit report will affect your score.

Next, you will likely be told immediately if you are denied the loan, including reasons for denial.

Explore Credit verify your information through national databases including Clarity and Factor Trust (as well as pulling your credit score) to determine your eligibility and ability to repay.

There may be additional information required if they cannot make a determination, so check your email.

Loyalty Points, Rewards & Perks

Explore Credit’s Loyalty Points Program gives you discounts on payments as you accrue points.

Every dollar you pay towards your loan with Explore Credit earns you 1 loyalty point.

Once you reach 1500 loyalty points, you will automatically receive a $25 discount on your next payment.

Overall, this is a nice incentive to repay your loan on time, and I appreciate what Explore Credit are trying to achieve here.

But remember, the most important factor is the APR on your loan. Discounts are worthless if you are paying sky-high interest – especially if you could have gotten a cheaper deal elsewhere.

What can you use the loan for?

Typically, these loans can be used for:

- Car Repair

- Medical Bills

- Home Improvements

- Vacations

- Other Emergencies

- And other cases

Remember, only take out a loan if you know you can afford the monthly payments, paying on-time each month and have a plan to repay the loan in full (including interest).

Is Explore Credit safe & trustworthy?

I went on a deep dive to find out who exactly Explore Credit are, with interesting results.

Oglala Sioux Tribe -owned

Explore Credit is an entity of the Wakpamni Lake Community Corporation (WLCC).

It is a tribal corporation operating within the interior boundaries of the Pine Ridge Reservation of the federally recognized Oglala Sioux Tribe in South Dakota.

Wakpamni Lake Community Corporation is a sovereign corporation and follows tribal and federal laws. State laws, regulations, and interest rates are not applicable.

This allegedly gives them certain immunities against any prosecution for predatory practices they may employ.

Payday loans and lawsuits

There are many other ‘installment loan’ companies operating under WLCC Lending.

There are accusations of these companies operating as predatory payday loan companies and using the tribe’s immunity to shield them from scrutiny.

- Bock v. WLCC Lending FDL et al.

- Brown V. WLCC Lending Fdl D/B/A Fast Day Loans Et Al

- Knotts v. WLCC lending ffg d/b/a falcon funding group et al

They generally allege that the companies are charging a higher annual interest on loans than what is legally permitted.

There are other companies that fall under the WLCC umbrella, for example:

Explore Credit claim to offer competitive rates with no hidden fees. We can’t be sure what rate you will be offered.

Our advice is to be cautious and read the terms of your loan carefully. High interest can destroy your finances quickly and plunge you into debt.

Anything over 40% APR is generally considered a predatory payday loan. Even 20-30% APR is very high for a loan.

Make sure you make regular payments on time and pay back any loan as quickly as possible.

Reviews and accreditation

Explore credit is not accredited on Better Business Bureau, nor is WLCC lending. This may be a result of their tribe-owned status.

The negative reviews we found cite common issues users have with loan providers – taking money out the account when it wasn’t expected for example. You see reviews like these across most providers.

The main negative issues surround the above parent company offering high interest loans which are predatory in nature, though I could not find evidence of Explore Credit engaging in this practice.

Cost & Fees

It is free to apply for the loan (be aware that applying may affect your credit score).

Explore Credit are very forthright about having no hidden fees – it’s front and center on the homepage.

Crucially, there are no early-repayment fees and so if/when you can pay your loan off early, do it!

The only fee to be aware of, as discussed, is the APR – the interest on your loan.

Customer Service & Support

You can contact Explore Credit:

- By phone on: 844-355-5626 8am-9pm EST every day.

- By email on: [email protected]

As well as phone & email support, you can manage your account and make payments through a self-service portal.

My interactions with the Explore Credit team (though limited) have been positive. The team seem earnest in their desire to build a community and grow the business.

Competitors & alternatives

A key reason you may be considering Explore Credit is due to having a low credit score, and that you are not being accepted elsewhere.

Explore Credit do offer loans to those with low credit, but your APR may be high.

You might want to first use a service to boost your credit score, and then apply for a loan. Ava finance is one such service, and they say 74% of their users see a credit boost within 7 days.

They do this through a rather ingenious method to report two on-time payments to the major credit bureaus – and fast. Read our full review of Ava here.

See how to boost your credit fast with our guide and video:

Alternatively, a loan provider which has scored high in our testing is Upgrade. This is a company we feel has higher trust than Explore Credit.

They also offer loans of higher value than $2,000 – up to $50,000.

You can read our full review of Upgrade here.

Summary: Is it worth exploring credit options with Explore Credit?

The bottom line is that if Explore Credit offer you a loan with an acceptable APR (and you have thoroughly read the terms and conditions so that the terms of the loan are clear) you can consider accepting the loan.

Some of the legal cases against the parent company, tribe-owned WLCC, are certainly concerning. Though Explore Credit appears not to have any issues reported at the time of review, I would proceed with caution.