What is Grow Credit?

Grow Credit does just as the name implies. This clever service is designed solely to increase your credit score.

And it’s free in most cases, too.

With Grow Credit, you will receive a Mastercard that can only be used for paying subscriptions or bill payments. In that sense, it is far from a normal credit card.

You’re going to be paying for your Netflix and Hulu anyway, so why not use those payments to build your credit score?

The goal is that eventually, you’ll be able to apply for a better card, with better rates, and higher limits, thanks to an improved credit history.

The average user sees their credit score jump by 48 points. Some customers see their score jump by 100+ in the first three months.

How it works

It’s three easy steps to get started.

My experience was pretty seamless; it did not take long to get set up:

Step 1: Create an account for free (some eligibility restrictions apply) and connect your bank account to the Grow Credit account.

Step 2: Add your subscriptions to your Grow Credit account. 100+ of the most popular subscriptions are available. I used Spotify.

Step 3: Use your new Grow Credit Mastercard to pay for these subscriptions.

And that’s really it.

Behind the scenes, your on-time payments are reported to the three major credit bureaus (Equifax, Experian, and TransUnion) so you can build a solid credit history.

Check your score & watch it grow

With the free tier, you will get access to your FICO score when using Grow Credit.

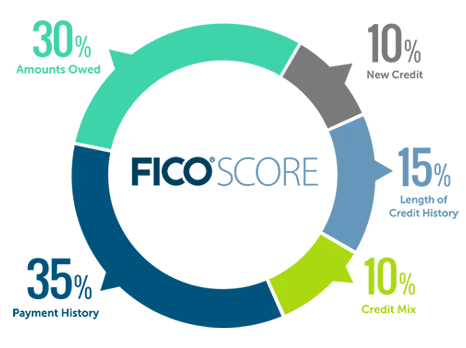

Payment history is the largest factor in building your credit score according to FICO, at 35% of the pie:

But Grow Credit also has low credit utilization built in (30% of the score). That’s because you can only access less than nine percent of the credit your Grow Credit card actually has.

What that means is that the credit bureaus will see that you have hundreds of dollars in credit but are only using a small part of it. This is a sign that someone has “good credit”.

Very clever!

Grow Credit say that it will take 60-90 days for your credit report to show ‘Grow Credit’ after your first payment.

Grow Credit Cost & Pricing Tiers

There are four pricing tiers, including a free tier:

- Free Tier (Build Free): Free with a $17 monthly spending limit.

- Paid Tier 1 (Build Secured): $2.99/mo with a$17 monthly spending limit.

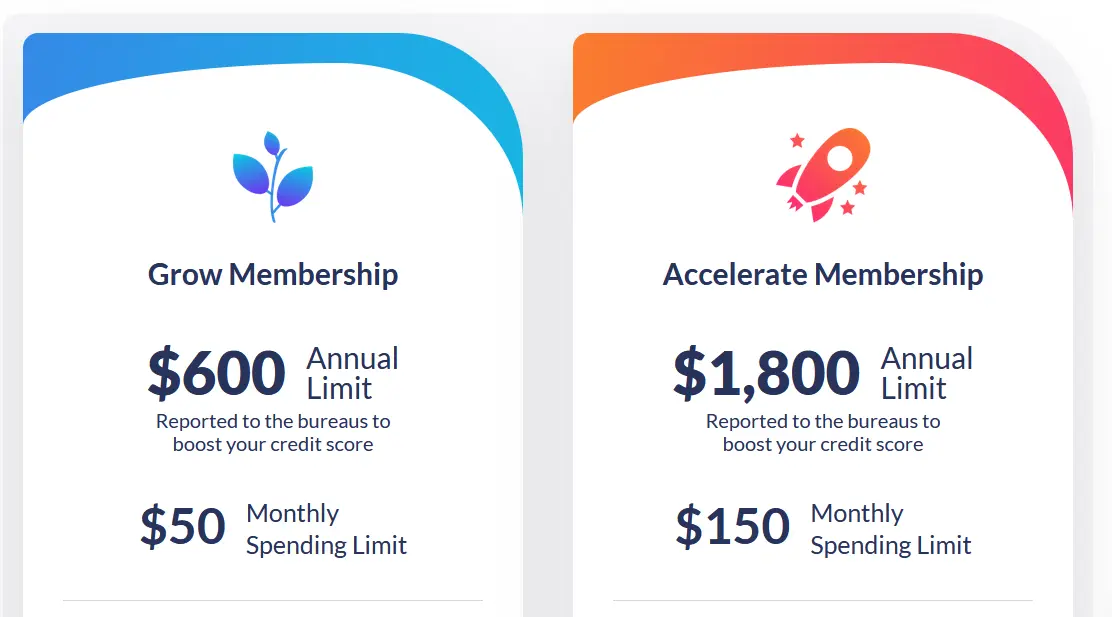

- Paid Tier 2 (Grow Membership): $4.99/mo with a$50 monthly spending limit.

- Paid Tier 3 (Accelerate Membership): $9.99/mo with a$150 monthly spending limit.

You save two months when paying annually.

Is it worth upgrading to the paid tires? That depends.

Firstly, not everyone will qualify for the free plan, so you may be required to use the first tier at a minimum.

Secondly, the higher spending limit on the upper tiers means you can pay for more subscriptions. A higher annual limit being reported to the credit bureaus means your credit score can grow more, and faster.

You also get access to ‘premium subscriptions’, ‘exclusive’ subscription discounts, and cell phone bill payments.

The value is debatable. If you’re not sure, I recommend starting on the free tier.

A question you might be wondering is: how can Grow Credit offer this great service for free at all?

The paid tiers offset the costs of their free users, but I imagine they are also making money when users select one of the various subscription free trials when they set up their account.

For example, if you take a free of Showtime, that may earn Grow Credit some affiliate commissions.

Grow Credit offer a number of free trials for various subscriptions you may not currently have:

You might want to take advantage of these free trials. But be aware that in order for your credit score to increase, you need to keep these subscriptions long-term.

If you plan on cancelling after the free trial, you will not build a credit history.

So, only sign up for the subscriptions you will actually use long-term, and don’t waste money on subscriptions you are not using.

Does applying for Grow Credit affect your credit score?

Applying for Grow Credit does not perform a hard credit inquiry when you apply. This is good, as hard searches can harm your credit score.

Instead, they perform a soft credit check simply for identification purposes.

Grow Credit does not use credit score as a determining factor when applying, so if you have a low credit score (which you may as you are interested in this service) you can be confident that you will still be accepted for the Grow Credit Mastercard.

You may not be eligible for the free tier, but every other tier is available.

Review round-up

Despite the quote on the homepage of Grow Credit being from a ‘James B.’ – this wasn’t me!

However, ‘James B.’ and others have had many many positive experiences. Looking around the web, you can see plenty of great reviews.

On the app store, the Grow Credit app has 4.8 / 5 stars from over 7,000 reviews.

When analyzing the negative reviews, I can see quite a few of the complaints people lodged have since been fixed – a good sign.

For example, a one-star review claims Grow Credit only reports to two of the major credit bureaus. They now report to all three.

Accordingly, it seems there has been a trend over reviews improving over time. I get the feeling this is a company that is on the up, and still innovating.

Customer Service & Support

Another good sign is that the customer service team actively respond to reviews – both good and bad.

Scanning reviews & the company’s replied, their customer support say they are very quick to respond, often within 3 minutes.

You can get in touch via email, which is [email protected], or via their phone number, which is (888) 244-5886.

Safety & Security

Grow Credit is a bank-regulated financial inclusion platform with tens of thousands of users.

They have an accreditation on the better business bureau with a B rating.

Grow Credit state that they use the most up-to-date industry protocols for storing personal data including bank-level 256-bit encryption.

For connecting to your bank account, they (like many similar providers) use Plaid.

Plaid is FCA registered and has become an industry standard in recent years.

In the majority of cases they do not store your login information. They use OAuth2 for most financial institutions.

The OAuth2 token is read only and does not represent user credentials.

For some connections, they will store your credentials and keep them encrypted.

Overall, Grow Credit takes all the precautions you would expect of a finance institution, and we see no reason not to trust them with our personal information.

Is this credit ‘hack’ legitimate?

You might be wondering if Grow Credit’s system for improving your score is authorized.

After all, they are artificially increasing your credit utilization by giving you a big credit line, but only allowing you access to a small amount of it.

The answer is that it is a perfectly legitimate and quite ingenious method for improving someone’s score. Other companies are using the same strategy (see below for competitors to consider).

The credit bureaus don’t mind this tactic at all. They like these services.

You are proving to them that you are responsible and make payments on time, every time.

The very fact that you care enough about your credit score to use (and maybe even pay) for this service is an indicator of a responsible credit customer.

So, if you have poor credit, take advantage of services like this to get your score on the right track.

Competitors to Grow Credit

A similar service we recently reviewed offers what Grow Credit has (and a bit more). That is the Ava credit builder card.

Ava scored slightly higher in our review thanks to the speed of the credit boost and options available.

Ava claim to improve your credit score within a week, but there is a small monthly fee. If you need your score boosted even faster, it might be worth a look.

Ava also offer a ‘savings’ account which functions as a loan repayment for credit reporting purposes (more on that in the review). So, they are offering two clever ways to improve your credit at the same time.

If you’re really keen to boost credit fast, you might even want to do both Ava and Grow Credit at the same time.

Having a thin profile can cause you to get denied credit, so having a few different lines of credit open is a good way to improve your score.

Make sure you only do this if you can afford the monthly payments for all these subscriptions, though. Don’t put yourself in a financially difficult situation for the sake of trying to build credit.

Summary: is Grow Credit the best credit score builder?

Ultimately, for a credit builder that offers a completely free option, it’s difficult to fault Grow Credit.

They tick all the boxes in terms of reliability, trustworthiness, features, customer service & security. My experience was seamless.

Competing services mentioned above might offer multiple & even faster ways to boost your credit score, but it comes with a small fee.

If you’re on the fence, I’d say give it a try. If you combine the free tier with a free trial of a streaming subscription, you can effectively try the service out completely free.

Overall, it’s two thumbs up from us.

Learn more about how to boost your credit quickly: