Recommended Loan & Credit Building Providers

4.9

Upgrade is a fantastic multi-purpose loan provider for those with credit scores of 560 or more.

4.4

PersonalLoans.com searches its wide network of lenders to find loans for those with low credit scores.

4.7

Grow Credit is not a lender. They offer a remarkably clever system to quickly build your credit score.

What is Modo Loan? Is it a lender?

Modo Loan is a loan introduction service. That means that the company take your details and share them with lenders to find one that is willing to lend with you.

Fill out a few personal details, which took us about 5 minutes, and Modo Loan will find a lender for you.

To be clear, Modo Loan is not a lender. They are not the ones with whom you will have a contract with, nor will they provide you with the money or deal with the debt collection. They are simply searching for lenders on your behalf.

You could consider it a way to source payday or emergency loans, quickly. Instead of reaching out to multiple suppliers and likely dealing with multiple rejections, they will find a lender for you.

Is Modo Loan legit?

Modo Loan is a real, legitimate business. It was started in September 2020.

It is a brand created by Ping Yo Inc., a lead generation business. In this case the lead is you, a person looking for credit, and the lender is their affiliated partner.

Ping Yo Inc. is a registered company in the state of Florida.

The website bears the logo of the Online Lenders Alliance, which, “sets best practices and standards for online lending businesses and monitors the Internet.” The LA Times reports it was created in response to inaccurate information on lending websites leading to consumer confusion and complaints.

The lack of trust some have for Modo Loan is largely down to the lack of online reviews (perhaps due to their relative newness).

There is also possibly the confusion that comes from Modo Loan itself not being lender that actually provides the loan, as mentioned above.

But our deep dive across the internet and through their terms and conditions did not yield anything suspicious.

After our application, we were offered a loan from Transform Credit, which is also a legitimate business. The lender has a solid 4.7-star rating on Trust pilot.

! Be wary of scams when it comes to getting a loan. Modo Loan themselves have a page on how to avoid being scammed. For example, never pay in advance for the promise of a loan. !

The reason we flag this is, while we have tested the service and were referred to a legitimate company, we have no way of seeing all the lenders in Modo Loan’s network. Whilst we have no reason to doubt the legitimacy of their service, stay informed, and be vigilant.

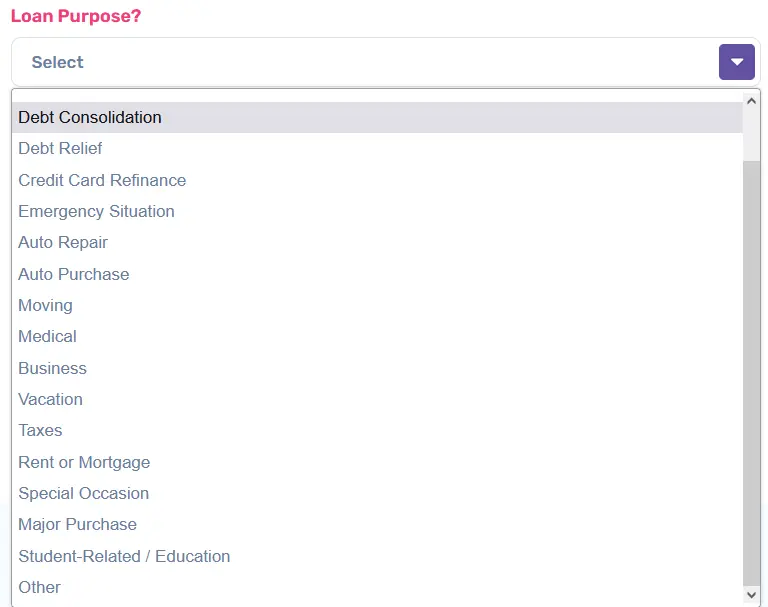

What can I get a loan for?

You can get a loan for any purpose. They do ask you to select a purpose, but there are no restrictions on what you can use the money for.

Some common reasons for getting a loan include home repairs, a vacation or an unexpected expense.

Remember, you should only take out a loan if you have the full means to repay it on time.

How much can I borrow from Modo Loan?

Typical amounts range from $250 to $3,000, but when applying, you can request higher or lower amounts, even though the slider doesn’t go further.

Use the pencil Icon and enter a custom amount:

Broadly, successful loan applications will offer will be small (<$10,000) amounts.

How does Modo Loan work?

You can send off your application with a few steps. It took us about 5 minutes to get ours.

- Select the amount you wish to borrow

- Select a purpose for the loan (or choose ‘other’)

- Select how much unsecured debt you currently have. That is, credit cards, revolving credit accounts, and unsecured loans.

- It will then ask if you have a checking account. You will need one to be approved

- Fill in your personal details

- You will then need to answer some questions about your income

- Finally, fill in your address and checking account information

And that’s it – you can now get your quote.

Moda Loan will search for a minute or so. Be patient!

In our case, the provider Modo Loan selected was Transform Credit.

They did not match the $9,000 we requested, instead offered $7,000.

It came with a hefty 35.99% APR. The monthly payments would be $252.94 over 60 months. This means that the total to repay would be $15,176.40 on a $7,000 loan. This is a lot!

Who is Modo Loan For?

The service is for anyone, with only a few caveats:

- You must be over 18 years old

- Have a valid checking account

- Have a permanent address

- Have a regular income via employment

Even if you have a poor credit rating, you can apply. In fact, Modo Loan say that they have many lenders in their network that are willing to offer loans to customers with a poor rating, or no credit at all.

Be aware that the APR (the interest on the loan) will likely be higher if you have a poor credit rating. Making on-time payments is critical to increasing your credit score. Even missing one single payment can harm your score significantly, so only take the loan if you can afford it.

If you do miss a loan payment, it’s best to call right away and explain it was missed and pay it as soon as possible. Some lenders, particularly on the first offence, will be willing to strike it from the record and not change any late fees too.

We believe the typical user is one that does have a poor credit rating. If you have a perfect credit score, you may not get the best APR from the providers Modo Loan work with, so do check the fine print.

How much does Modo Loan cost?

Modo loan is a free service. Their business model is commission-based, which means they will make money from you going ahead with a lender they found for you.

To be clear, that does not mean the loan itself they find for you is interest-free.

The APR of the loan can range from 4.95% to 35.99% APR – and that is only for certain customers that qualify. Some products offered may have different pricing.

When you sign a contract with a lender, you become responsible for the repayment of the loan including the interest.

So, it is free for you to use the service. But the products they recommend from their lender network are not.

Always make sure you understand the terms of the resulting agreement, including the monthly repayment amounts, the loan term (length), the interest being applied, the total amount of the loan, and any late fees.

Are there any other hidden costs?

Always remember, when a service is free, you are the product.

That means that your personal data will need to be shared with their lender network. For areas like California, you can submit a request for Modo Loan not to sell your personal information.

Another thing to be aware of is that the lenders may perform a credit check to determine your credit worthiness, credit standing and/or credit capacity.

If you miss a payment or make a late payment, this can impact your credit score.

Otherwise, there are no hidden fees from Modo Loan themselves.

Competitors and alternatives

The downside to Modo Loan can be the high APR – the interest rate you pay on the loan. These high APR offers are usually the result of having a low credit score.

One thing you might consider is a service to boost your credit score. Ava finance is one such service, and they say 74% of their users see a credit boost within 7 days.

They do this through a rather ingenious method to report two on-time payments to the major credit bureaus – and fast. Read our full review of Ava here.

Learn more about how to boost your credit quickly with our guide:

Alternatively, a loan provider which has scored higher in our testing is Upgrade. This is a company who themselves are offering the loan (unlike Modo Loan which is simply a service to find loan providers).

With Upgrade, you know upfront which company will be servicing the loan – them! With Modo Loan, it’s not certain who you will be “matched up” with.

Upgrade offer loans up to $50,000, and you might get a better rate from this provider. If nothing else, it’s worth getting another quote from them as a comparison.

You can read our full review of Upgrade here.

Summary: do we recommend Modo Loan?

If you are struggling to find a loan and do not have the time for endless credit applications, Modo Loan is a good option.

However, be aware that:

- This is a service typically for those with poor credit ratings. You might not get the best deal.

- A high APR can mean you pay back more than double of the loan value over time

- Only take out a loan if you are sure you can pay it back on time and in full.

- Read the contract carefully to understand all the terms of the loan.

We’d like to see better customer support options than just an email address that promises a response within 48 hours.

It would also be better to have a range of lender options, rather than just be directed to the one Modo Loan feels is the best fit.

Overall, Modo Loan offers a great free service. Thanks to its clean website user interface, you can submit an application in minutes and have a loan offer shortly after.