What is Upgrade?

Upgrade is a loan, credit card, checking account & savings account provider founded in 2016.

They call themselves a tech company but they are, for all intents and purposes, a bank.

More specifically, a neobank in that it has no physical branches; everything is done online.

Their core offering is providing loans with affordable monthly payments to those with lower credit scores.

These loans can be used for:

- Debt consolidation.

- Paying off credit cards (refinancing).

- Business loans.

- Home improvement.

- Certain other large purchases.

Upgrade loan overview

The features of an Upgrade loan are as follows:

- Borrow between $1,000 and $50,000

- Loan term (the length of repayment) varies between 24 to 48 months

- Estimated APR ranges from 8.49-35.99%

- There is also an origination fee between 1.85% to 9.99%, which is deducted from the loan proceeds.

The origination fee is a little frustrating but not uncommon. It means that if you get a loan for $10,000, and have a 5% origination fee, you will only receive $9,500.

Key benefits of Upgrade loans

Discounts

There are two key discounts to take advantage of with Upgrade. Saving a few fractions of a percent on the APR of your loan can save you hundreds or even thousands of dollars over the course of a few years.

- Autopay discount. It’s smart to set up an automatic payment, so that you don’t miss any of your monthly repayments. Upgrade offer a 0.5% discount for doing it, so it’s a no brainer.

- Direct pay discount. You can also avail yourself of a 1-3% discount when you have the lender pay off your debts directly. At least half the loan funds must be sent to other creditors to get this discount.

Early repayment with no-fee

A great feature is that you can pay off the loan early with no early pay-off fees, saving you unnecessary interest if you decide to exit the agreement before the end of the term.

Secured and unsecured loans

A secured loan is where you use collateral, such as a vehicle, to lower the interest rate on your loan.

Upgrade can in some cases offer a secured loan, which can provide up to 10% lower interest than an unsecured loan.

Most of the loans offered will be unsecured loans, however.

Long repayment terms

Upgrade offer long repayment terms – up to seven-years for loans over $30,000 and used for home improvements. This makes them one of only a few lenders that offer such a deal.

This is good if you are looking to spread the cost of a home renovation project, lowering your monthly payments.

But be aware even though the monthly payments are lower, spreading the cost over a longer period will cost you more in interest.

Rewards & complimentary accounts

By opening a Rewards Checking Account which provides cashback on purchases, you can sometimes receive sign-up bonuses.

Along with the checking accounts, there is an optional savings account with a competitive interest rate and no fees.

You can also apply for credit cards with large lines of credit and cashback functions too. The credit and checking accounts come with physical cards as well as the ability to pay via Apple pay.

Manage via the mobile app

Your loan balance, available credit, bills, cashback rewards and more can be tracked via the highly rated mobile app.

We found the app to be intuitive and helpful, prompting you with reminders, allowing you to check your credit score and notifying you of any credit report changes.

User feedback on the app is overwhelmingly positive:

- The iOS app has a rating of 4.8 / 5 stars with over 30,000 ratings.

- The Android app has a rating of 4.6 / 5 stars with over 16,000 ratings.

Eligibility Requirements

Luckily, Upgrade offers relatively competitive loans even to those with a low credit score or a low income.

There are many factors that Upgrade use to determine eligibility and the quality of the loan offer.

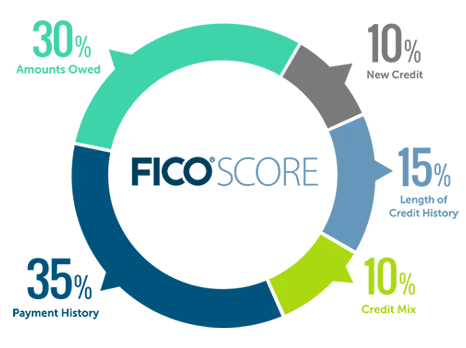

Firstly, you need a minimum credit score of 560 (Upgrade uses FICO score version 9 from TransUnion).

Several other factors are in play, including your credit usage & payment history.

They also consider the amount you are requesting for the loan and the loan term, as well as your debt-to-income ratio.

This means they are looking at how much money you earn as a percentage of how much money you owe. The maximum debt-to-income ratio they allow is 75%.

As well as meeting their minimum credit score requirement, you must be a U.S. citizen, a permanent resident, or living in the U.S. on a valid visa; be at least 18 years old or 19 in Alabama and other select states; and be able to provide verifiable bank account information and a valid email address.

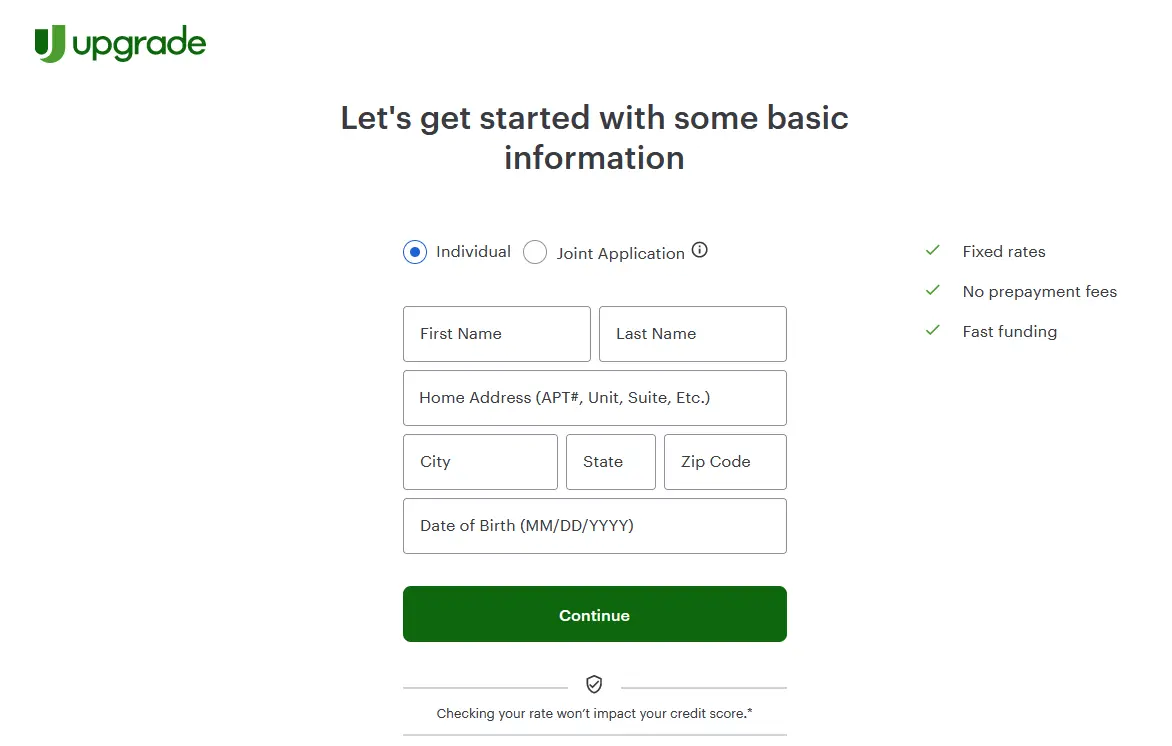

How to apply for an Upgrade personal loan

There are three simple steps to the loan application process.

- Check your rate online.

- Evaluate the offers you qualify for.

- Accept an offer and funds will be sent within 1 business day.

Start by signing up and filling out a few personal details, including your income. This is to prequalify you for the loan.

Note: this initial rate check only performs a soft search on your credit profile (this does not harm your credit score).

You can apply as an individual or with a joint account.

A joint account may help you qualify for more money or a better rate. Note that both credit profiles will be searched, and both parties are responsible for repaying the loan.

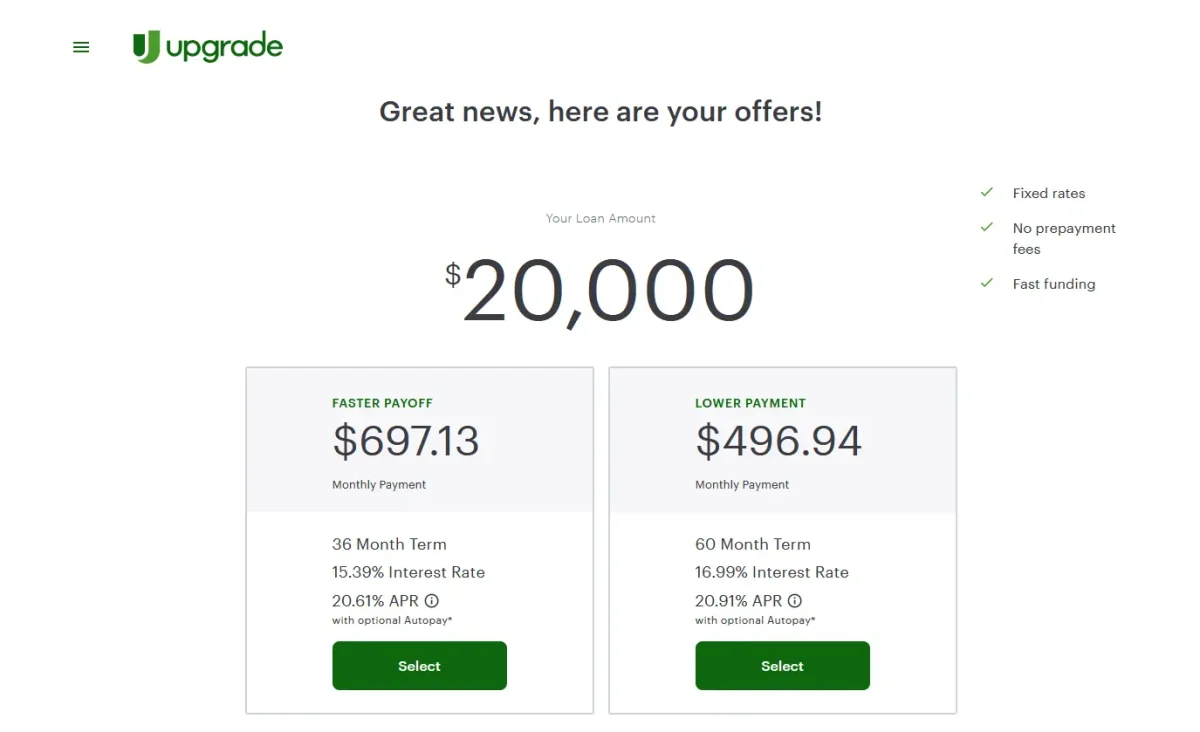

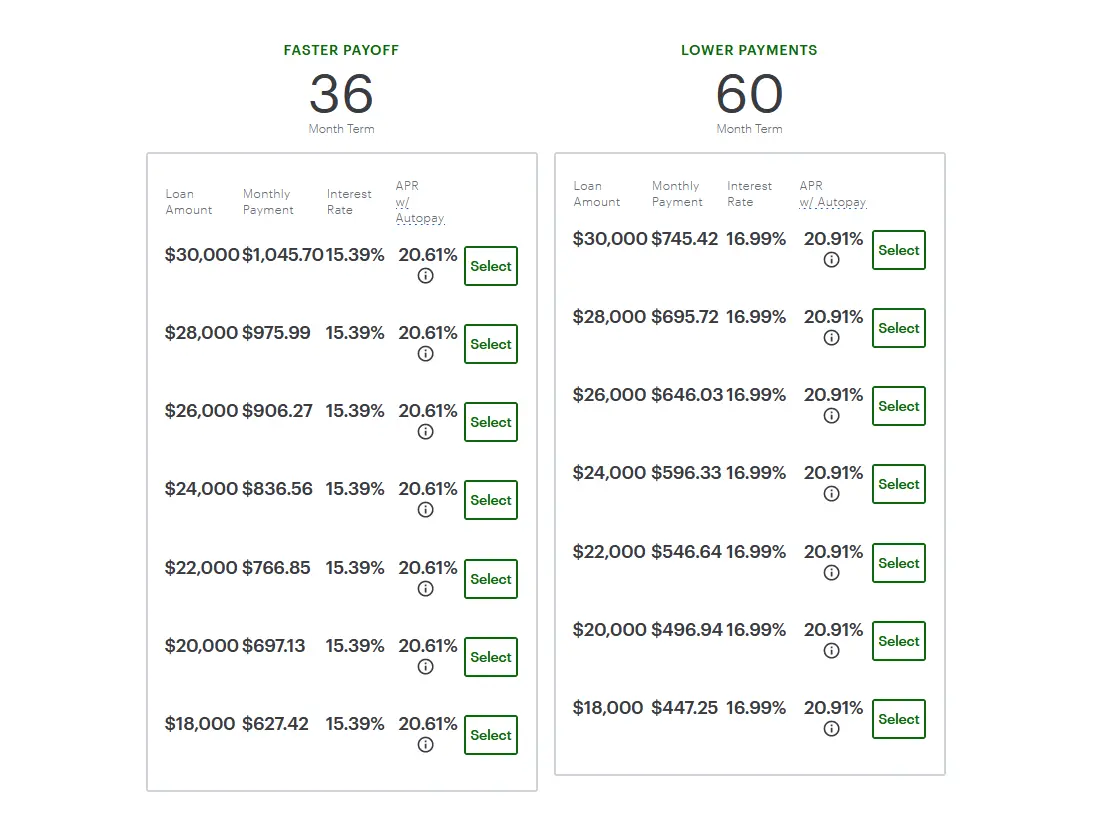

You will immediately be given loan offers. We requested a $20,000 loan and it gave us two options.

A 36-month loan with 20.61% APR, and a 60-month loan with 20.91% APR.

This includes up to a 7.99% origination fee for the longer term offer, meaning $1,598 would be deducted automatically from our $20,000 loan – we would never see this money.

Upgrade also shows you alternative offers, should you wish to borrow more or less money:

Once you choose your offer, you will be required to enter a few more personal details before agreeing to the loan terms.

Tell them where you want the money deposited, and you’re most likely done.

Upgrade may first review the offer and request more documents as needed. Check in on their dashboard for updates & requests for information.

If you choose to autopay-off the loan, the repayment amount will be deducted automatically each month.

Be sure to have enough to cover the loan payment, as missing a payment can have a negative impact on your credit score. There will also be a late fee payment of $10.

Finally, you may want to open a Rewards Checking Plus account at the same time to get a bonus.

There’s no monthly fee on this account, you get up to 2% cash back on common expenses as well as a $200 bonus. Some eligibility criteria applies.

Loan example: APR, fees and monthly payments

If you’re approved for a $10,000 loan with a 17.98% APR and 36-month term:

Your APR

The 17.98% APR includes:

- 14.32% yearly interest rate

- 5% one-time origination fee ($500)

Your money

You would get $9,500 deposited directly in your account:

- $10,000 — Loan Amount

- – $500 Origination Fee = $9,500

Your payments

Each month you would pay back $343.33 over 36 months. In total, you would pay $12,293.46. This is $2,793.46 in interest including the origination fee that was deducted.

According to Upgrade, their average borrower is as follows:

- They have a credit score of 672.

- An income of $80,000.

- Requesting a loan of $11,500.

- With a loan term of Five years.

- Credit card refinancing and debt consolidation are the most common use cases.

Safety and security

As mentioned in the first section, Upgrade do not call themselves a bank. Perhaps mostly for legal reasons, as they themselves do not provide the loan directly.

They call themselves an online marketplace platform that provides access to affordable and responsible credit, mobile banking, and payment products with free credit monitoring and education.

They partner with banks to supply the personal loans. Namely Cross River Bank and Blue Ridge Bank, both of which are member FDIC.

Upgrade is a San Francisco tech darling and has had multiple rounds of funding valuing them at more than $6bn. They have issued over 1.7 million personal loans to date, lending more than $24bn.

Suffice to say, this is no mom-and-pop shop.

Upgrade is a legitimate, fast-growing challenger ‘neobank’ – one that is challenging the norms of the traditional banking industry to great effect.

Help and support

Upgrade offer a robust range of support options, and customer reviews generally are positive regarding their support.

Choose from the options below.

| Medium | Contact | When |

|---|---|---|

| Telephone | (844) 319-3909 | M-F: 5:00 a.m.–6:00 p.m. PT Sa-Su: 6:00 a.m.–5:00 p.m. PT |

| [email protected] | 24/7 | |

| X (Formerly Twitter) | @UpgradeCredit | 24/7 |

| FAQs | 24/7 |

User reviews

As well as the tens of thousands of five-star reviews on the two app stores, Upgrade has built a strong reputation in the industry as reflected in their company reviews:

- Upgrade has a rating of 4.5/5 stars on Trustpilot with over 40,000 reviews.

- Upgrade has a rating of 4.48/5 stars on the Better Business Bureau with nearly 3,000 reviews. It also has an A+ rating and accreditation on the BBB.

When seeking out negative reviews, the most common complaint by far was regarding the credit limit on their credit cards. Users complained that the credit limit was reduced from up to $20,000 down to just a few thousand for reasons unknown.

This can harm your credit score as credit utilization (the amount of money you have borrowed vs. the amount you could borrow) is a significant factor in your credit score.

Whilst there may be legitimate reasons these individuals had their credit line reduced, it’s something to monitor if you intend to use their credit card facility.

Our advice would be to not overextend yourself when borrowing on their credit card just in case your credit line does shrink.

Competitors and alternatives to Upgrade loans

You might want to consider improving your credit score first, so that you can get a better rate on your loan.

For that, we recommend Ava finance. That’s because they can improve your credit score quickly, with nearly 75% of their customers seeing an improvement in the score in less than 7 days.

In our review of Ava we were impressed with the ingenuity of their service, offering a credit card and savings account (which functions like a loan payment) for a double boost to your credit score.

If you can level up your credit score quickly, you can often get access to much lower APR loan offers, so it’s worth considering.

See our guide to boosting your credit score and watch the video: