Recommended Loan & Credit Building Providers

4.9

Upgrade is a fantastic multi-purpose loan provider for those with credit scores of 560 or more.

4.4

PersonalLoans.com searches its wide network of lenders to find loans for those with low credit scores.

4.7

Grow Credit is not a lender. They offer a remarkably clever system to quickly build your credit score.

What is Zoca Loans?

Zoca Loans is a small personal loans provider offering loans between $200 and $1,500.

They are for short-term use only.

In their own words, in the footer of their site, they state:

“This is an expensive form of borrowing and is not intended to be a long-term financial solution.”

In other words, you can expect a high interest rate (APR) when applying for this loan. If you cannot pay the loan back in full very quickly, you can expect to be charged a great deal of money.

Is Zoca Loans Legal?

Ultimately, Zoca Loans is legal and it is a legitimate business. But there are some things you should know.

High interest rates that come with these ‘pay day loan’ providers are typically not permitted.

However, Zoca Loans is a tribal lender.

Zoca Loans is a brand within Rosebud Lending LZO, a tribal lending agency of Rosebud Lending.

Rosebud Lending is a subsidiary of the Rosebud Economic Development Corporation, an economic development arm and entity of the Rosebud Sioux Tribe, a sovereign nation located within the United States of America and operating within the Tribe’s reservation.

What does this all mean?

As a tribal lender, they sit outside of certain laws which normally prevent firms from offering pay day loans – loans with interest rates above 30-40%.

It means can be charged hundreds of percent in APR – particularly if you have a very poor credit score.

As they are a tribal lender, they may sit outside of your state’s laws & jurisdictions, meaning you have little recourse should things go awry.

You can see legal cases against Zoca Loans around the web. The allegation being that Zoca Loans is using the tribal status of Rosebud Lending to skirt the law.

Read the terms of your loan agreement carefully and make sure you can afford to repay the loan in full plus any interest before you agree to proceed.

How it works

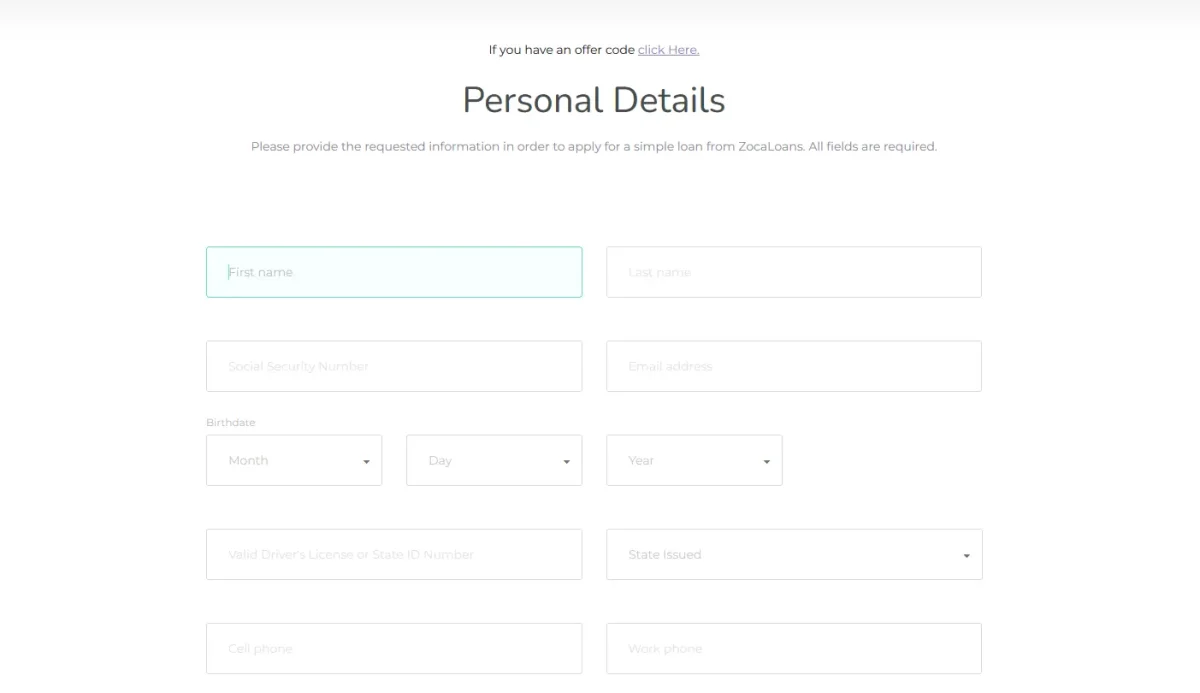

To apply, you will need:

- Your Driver’s License Number

- Your Checking Account (ABA) Number

- Your Routing Number

- Your Debit Card Number

Fill out the online form. It took us less than 10 minutes to complete.

A key benefit of using a short-term loan provider like Zoca Loans is that you will get an instant decision. You’ll know straight away if you have been approved, and for how much credit.

Before you accept and sign the loan agreement, read the terms of your loan carefully and make sure you understand how much you will be repaying in interest.

Once signed, you can receive the funds in your bank account in as little as 15 minutes according to Zoca Loans, which is ludicrously quick. They deliver on that promise.

Does Zoca Loans do a hard credit pull?

When you are initially applying for the loan, Zoca will do a soft pull to determine eligibility. If you wish to then proceed with the loans, they will do a hard pull – like nearly all loan providers.

Credit score requirements for Zoca Loans

There is no minimum credit score requirement for Zoca Loans, meaning it is a good option for those with bad credit.

However, this does not mean you are guaranteed to be accepted. It also means that the lower your score, the higher your APR is likely to be.

Just because you have been accepted for a loan, does not mean you will be getting a good deal. Be sure to read the terms of your loan carefully to understand how much you will repay in interest.

Zoca Loans BBB (Better Business Bureau) & Reviews

Zoca Loans is not accredited on the BBB and has a rating of B.

They currently have a rating of 1.31 / 5 stars and 45 complaints closed within the last 3 years.

Many of the negative reviews refer to the high interest rate they were required to pay (example in the next section). These disgruntled customers did not read and understand the terms of their loans – make sure you are not one of them.

Cost & fees

It is free to apply for the loan, but there will of course be interest applied to your loan.

The interest (APR) can be extremely high.

As an example, here is the payment schedule for a loan for $300 with an APR of 795%.

The loan will be repaid over 6 months, with repayments twice a month (bi-weekly).

| Payment Number | Principle Amount | Interest Amount | Payment Amount | When Payment is Due |

|---|---|---|---|---|

| 1 | $3.60 | $94.25 | $99.00 | 10/16/2024 |

| 2 | $4.75 | $94.25 | $99.00 | 10/30/2024 |

| 3 | $6.26 | $92.74 | $99.00 | 11/13/2024 |

| 4 | $8.25 | $90.75 | $99.00 | 11/27/2024 |

| 5 | $10.87 | $88.13 | $99.00 | 12/11/2024 |

| 6 | $14.33 | $84.67 | $99.00 | 12/28/2024 |

| 7 | $18.89 | $80.12 | $99.00 | 01/08/2025 |

| 8 | $24.89 | $74.11 | $99.00 | 1/22/2025 |

| 9 | $32.81 | $66.18 | $99.00 | 02/05/2025 |

| 10 | $43.24 | $55.75 | $99.00 | 2/19/2025 |

| 11 | $56.99 | $42.00 | $99.00 | 03/04/2025 |

| 12 | $75.12 | $23.88 | $99.00 | 3/18/2025 |

| TOTAL | $300.00 | $888.00 | $1,188.00 | 3/18/2025 |

See how for just a $300 loan, the total repaid over 6 months is $1,188.00. That’s your original loan of $300 plus $888 in interest.

Late payments / insufficient funds

Furthermore, if you make a late payment or there are insufficient funds in your account, there will likely be an NSF fee of $25. If any payment is late by more than two days after the due date, then you will be responsible for an additional $25 late fee.

Late or missing payments will also have a negative impact on your credit score, so make sure you have enough funds in your account and pay on time, every time.

If you know you will be unable to make a loan repayment on time, Zoca Loans will give you one complimentary extension. You must call at least 2 days before your scheduled pay date in order to set up a payment extension.

Early repayment

The one shining light here is that there is no early repayment fee, which means you can save a great deal of money by repaying the loan early.

Contact Zoca Loans early to set up your early repayment. You must schedule the payment at least 2 days prior to your scheduled pay date.

Safety & security

As a tribal lender, the company sits outside of certain federal laws. However, this does not mean the company is unsafe to use.

Zoca Loans is a legitimate company. As long as you are comfortable working with a tribal lender, there is no reason to discount them from a safety & security perspective.

Customer service & support

Whilst there are negative reviews & complaints surrounding Zoca Loans, we found that the customer support team was pretty good at addressing each and every issue.

On the BBB, the company has replied to all the reviews & complaints with detailed and reasonable explanations.

You can easily get in touch with team using phone or email:

Call 1-888-980-1532 or email [email protected]

Competitors & alternatives

The best option for you depends on your credit score.

If you have a low credit score, you might want to first consider improving your score before applying for a loan. That’s because a low credit score limits your options and will likely result in any loan offers coming with a high APR.

Ava finance is one service we recommend for building your credit score quickly. They say 74% of their users see a credit boost within 7 days.

They do this through a rather ingenious method to report two on-time payments to the major credit bureaus – and fast. Read our full review of Ava here.

You can also watch our video on how to increase your credit score:

Alternatively, a loan provider which has scored high in our testing is Upgrade. This is a company we feel has higher trust than Zoca Loans.

They also offer loans of higher value than $2,000 – up to $50,000.

You can read our full review of Upgrade here.

Summary: Is Zoca Loans a good option?

If you need a loan fast and have poor credit, Zoca Loans may be a good option.

However, the high interest rates mean you could end up repaying thousands of dollars on a loan of just a few hundred dollars.

Make sure you understand the terms of the loan, the loan schedule, and have a plan to repay the loan in full.

The tribal-lender status puts Zoca Loans in an extremely grey area legally. They are taking advantage of a loophole allowing them to offer loans to those with low credit scores, which is viewed as a predatory practice in the rest of the US.

Whilst this does not discount them as a loan provider option, we recommend trying to improve your credit score and applying for a loan from a more reputable provider mentioned above.