Active investing vs Passive Investing

Put simply, active investors aim to beat the market whilst passive investors attempt to match the average market return.

‘The market’ here is usually a benchmark or index, such as the S&P 500. The S&P 500 contains the 500 largest companies in America. The combined increase or decrease in share price of these companies comprises the index or ‘the market’ in this case.

An active investor may try to pick a handful of 15-20 stocks in the S&P 500, in the hope that the majority of these stocks outperform all the others in the index. They may frequently trade stocks as new information becomes available and pricing changes.

On the other hand, a passive investor might own the entire index; they split their investment across all 500 companies (weighted by size). This helps mitigate risk and attain an ‘average’ market return.

The passive investor does not actively trade stocks throughout the year. They may add funds into their investment each month, but do not actively buy and sell particular funds or individual stocks.

This is also known as ‘buy and hold investing’; and the investment product of choice is usually an index fund.

With both strategies, a money manager can be used to make trading decisions on behalf of the investor.

With active investment management, the investor may or may not be involved in the decision-making process as to what investments are selected. On the other hand, passive investors are typically completely hands-off.

Active & passive investing fee comparison

Fees are integral to the discussion about investment performance. That’s because the greater the expense ratio (annual fee) the greater the investment performance required to cover said fee.

Fees eat heavily into investment performance. Investors should be keen to minimize them as much as possible.

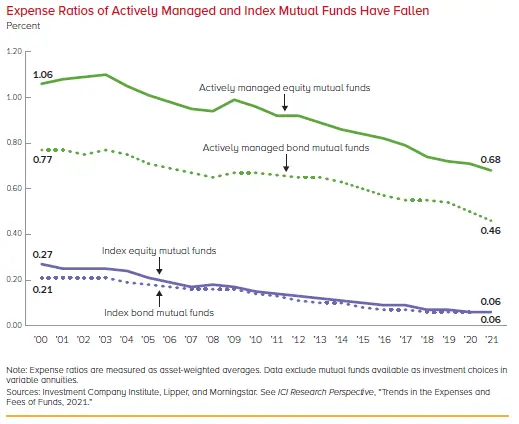

The below chart from the ICI (2022) looks at the cost of both actively managed funds and passively managed index funds over time. In both cases, the expense ratio (the fees applicable when investing in the fund) have fallen significantly. However, actively managed funds are still on average much more expensive.

The chart shows the average actively managed mutual fund having a 0.68% expense ratio in 2021, versus a 0.06% expense ratio for passively managed index funds.

The difference seems small, but small fractions of a percent can make a huge difference over time.

Active and passive fees: an example

Let’s compare how much these two fees would cost someone with $500,000 over 30 years, assuming no additional contributions/increases from investment returns:

- 0.68% fee on $500,000 over 30 years is $92,552.81.

- 0.06% fee on $500,000 over 30 years is $8,922.14.

The actively managed fee costs an additional $83630.67 over the 30-year period. Nearly a fifth of the wealth of the individual in the active managed fund is taken by fees.

Why are active funds more expensive than passive funds?

Active investment management usually has a greater fee attached to it as, besides the allure of greater investment returns, the overheads demand it.

There is the need for an expensive active investment manager and sometimes a team of analysts. There are transaction fees due to the more frequent ongoing trading.

On the other hand, passive investment typically has less overheads. Though there will be a single fund manager, they are making fewer decisions about rebalancing the fund; perhaps on a quarterly basis.

They are also not doing particularly in depth performance analysis. Most of the investment distribution is determined by the weighted size of the companies in that index.

With fewer tasks and personnel involved in passive investing, the costs are inevitably lower. The aim of delivering ‘only’ average market returns makes it difficult to demand a premium fee for passive investing.

Vanguard are the passive investment fund pioneers who operate their business at-cost, meaning there is little incentive to price gouge and generate higher and higher profits. They intentionally try to stay lean in order to pass the savings on to the customers.

Read more on the cost of passive investing here.

Active investing vs passive investing performance over time

The obvious reason for choosing active investing is if you are looking for a return greater than market average. Active investing costs more on average, so it should deliver higher returns, right?

Not necessarily. Let’s first look at the likelihood active investment managers will outperform the market and passive investors.

SPIVA report

The latest S&P Indices Versus Active (SPIVA) report from S&P Dow Jones Indices suggests, on any given year, an international active fund has a roughly 50% chance of underperforming the S&P. This grows to 90% over a 20-year period:

| Time period | Percentage chance of beating S&P |

|---|---|

| 1 year | 50% |

| 3 years | 40% |

| 5 years | 30% |

| 20 years | 10% |

The challenge, therefore, is can you pick a winning active investment manager and fund? Can you find a 1 in 10 manager that will deliver over 20 years?

Remember, just because an active investment manager has beaten the market over the last few years, there is no guarantee they will continue to do so. Statistically, it’s likely they won’t.

The alure of high-performing funds is also due to survivorship bias. The same S&P Indices Versus Active (SPIVA) report suggests that the majority of underperforming funds are simply merged or liquidated. This gives the impression of higher odds of success at any given company.

“Over 20 years, nearly 70% of domestic equity funds and two-thirds of internationally focused equity funds across segments were confined to the history books.”

There is a good chance the active fund you choose will be erased after its underwhelming performance.

Morningstar’s Active/Passive Barometer report

Morningstar’s Active vs. Passive Investing Report (2022) looks at the net performance of active and passive funds (i.e. after fees).

Morningstar calculate a benchmark that represents the return of all the passively managed funds on average, and use that benchmark to assess whether active managers have underperformed or overperformed the market.

It’s an extensive report – including nearly 4,400 funds and representing approximately $15.9 trillion USD in assets (that’s about two-thirds of the U.S. mutual fund market).

They also correct for the aforementioned ‘survivorship bias’. If a fund fails and is erased, Morningstar still includes it in their results.

The barometer found that only 23% of active funds were able to exceed the returns of their average passive rivals over a 10 year period.

They also found that a staggering 92% of U.S. large-cap funds underperformed the benchmark over the last decade.

Mathematically, Passive Investing must beat Active Investing

Active investors as a group are destined to underperform passive investors. William F. Sharpe proved this mathematically in his 1991 paper, The Arithmetic of Active Management.

Sharpe’s argument is based on some key principles:

- The total market size is the sum of all active and passive investments.

- As a group, active investors must own each stock in the same proportion as the total stock market.

- Passive investors by definition own each stock in the same proportion as the weighted average of the total stock market.

- Therefore, before costs, the return on the average actively managed dollar will equal the return on the average passively managed dollar.

- Therefore, after costs, the return on the average actively managed dollar will be less than the return on the average passively managed dollar.

It’s difficult to accept that active returns must equal passive returns, before costs. Sharpe explains:

“Over any specified time period, the market return will be a weighted average of the returns on the securities within the market, using beginning market values as weights. Each passive manager will obtain precisely the market return, before costs. From this, it follows (as the night from the day) that the return on the average actively managed dollar must equal the market return. Why? Because the market return must equal a weighted average of the returns on the passive and active segments of the market. If the first two returns are the same, the third must be also.”

So active and passive returns on average are equal. When you take into account larger costs of active investing, the net return of passive investing is greater.

As William himself says:

“Properly measured, the average actively managed dollar must underperform the average passively managed dollar, net of costs. Empirical analyses that appear to refute this principle are guilty of improper measurement.”

But remember, we are saying that passive investors will beat active investors as a group. Individual active investors may outperform the market:

“It is perfectly possible for some active managers to beat their passive brethren, even after costs.”

William F. Sharpe

They are simply few and far between. Where there is an active investor winner, i.e., beating the market average, there is at least 1 active investor loser.

Is active investing better than passive investing?

There is no doubt that if you are looking to get exceptional, market-beating returns, active investing is the strategy for you. However, know that the chance of consistently beating the market over an extended period is extremely slim.

You need to put hubris aside here, you are not Warren Buffett.

You need to be aware of the influence of marketing and how companies can easily portray the success of active fund managers whilst hiding their losses.

You need to understand how just a 1% can dramatically, insidiously, drain your investment returns over a lifetime.

In both theory and in practice, passive investing beats active investing. If you’re interested in learning more about passive investing, check out our beginners guide here.