Have you saved $1,000 and want to start your investing journey? Here are the sensible steps you need to take.

Why you should invest $1,000

$1,000 is the perfect amount of money to invest.

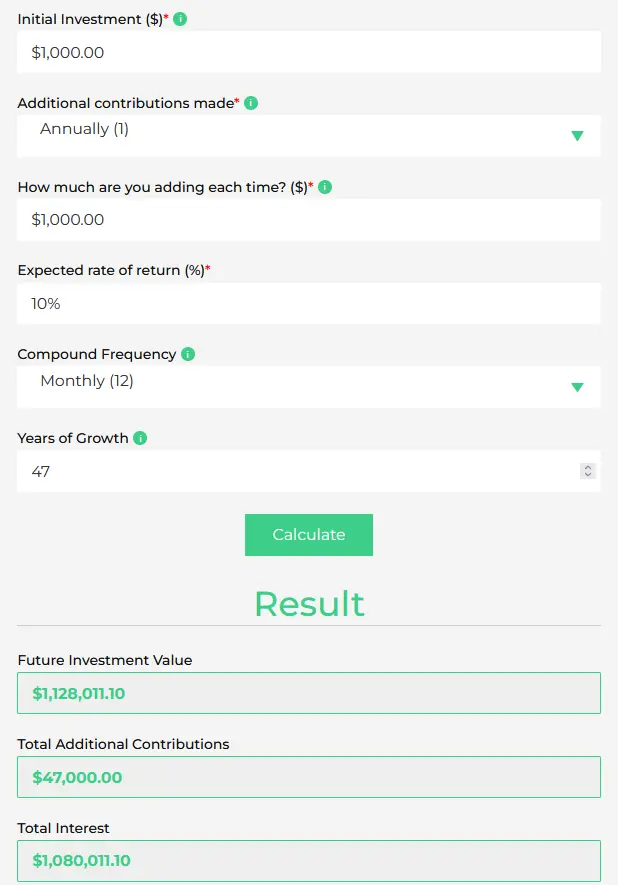

Why? Because if you can afford to invest just $1,000 a year, every year from your early 20’s, you can retire as a millionaire.

That’s due to the power of compound investing. The interest on your investment causes your investment value to grow. Try it out on our investment return calculator (screenshot below).

Can you really invest that $1,000?

Firstly, check your personal finance situation is sound and that you actually have $1,000 to invest. It’s so tempting to dive in, but you really should have your personal finance situation in order first.

- Make sure you have no high-interest debt. You will likely get a better return from paying off a loan or credit card with (for example) 13% interest than you will from investing in the stock market.

- Make sure you have an emergency fund. Is this really a spare $1,000? If you invest the money, then suddenly have a dental emergency, what money will you use? Make sure you have ideally 3-6 months of salary saved up in an account you can easily access. Your investment account is not the place for an emergency fund. It takes time to get your money out, and there’s no guarantee it will have a positive return at the time you need the money.

Learn about passive investing and index funds

You will be investing your $1,000 into something called an index fund.

You would be forgiven for thinking that investing is about buying low and selling high, investing in Apple and then buying shares in Google instead, and making money fast.

This way of investing, active investing, is a fool’s errand. Do not be a fool.

>> Read: Active vs. Passive investing performance.

Passive investing with index funds is how you are going to grow your $1,000 slowly and sensibly over time. There is a full guide here for beginners like yourself, but read on for an abridged version.

The index fund is great because you can invest in thousands of companies with one purchase. It is a basket of (usually) the largest companies around the world.

Why invest in thousands of companies around the world? Because diversification in this way reduces risk.

If you invest $1,000 in one company, then that is a tremendous amount of risk. It’s a risk because the company might not grow at all, or worse, it might collapse completely, and you lose your investment. It happens all the time.

When you invest in an index fund, you are buying a small piece of many companies. If a few go bust, you don’t lose all your money. The idea is that, on average, as a group, the companies will grow. Historically this is true, and capitalism is going nowhere.

Ultimately, if you are going to be successful you should understand why this works deeply, so you don’t give up on it during tough times. Don’t worry, it’s a simple strategy to understand.

Overwhelmed by the terminology? Check out the glossary.

Three reasons passive investing is great for investing $1,000

- Simplicity.

The great thing about passive investing is that, without any investing knowledge, you can very easily set yourself up with one of the major investment providers and invest into a high performing index fund with a few clicks.

It’s so simple, but more importantly, it requires almost no ongoing maintenance. Once it’s set up, you are set for decades to come.

- High performance.

We all want great performance out of our investments. Historically, passive investing into index funds has performed very well.

Now, past performance is not indicative of future returns and there are never any guarantees in investing. But once again, over a long enough timeframe, the market has always returned.

- Low fees.

Fees are your enemy when it comes to investing. Small fractions of a percent can result in hundreds of thousands of dollars in fee payments over your investing lifetime.

The low fees that come with passive investing help keep most of the returns in your pocket.

Three mistakes you can make with your first $1,000

- Panicking during recessions

Investing your $1,000 successfully means not panicking when the market falls. Yes, that’s when not if. The market goes through boom-and-bust cycles, and some years will be worse than others. But you must not take the money out during the bad years.

Ride it out, and trust that the market will return to prosperity.

- Waiting for ‘the right time’ to invest

You are likely one of two types of people reading this.

A) You think now is a bad time to invest as we are in (or entering) a recession

B) You think now is a bad time to invest as the market is at, or approaching, an all-time high.

Do not try to time the market. Countless research has shown that it is almost impossible to get this right.

Time in the market beats timing the market. Invest as soon as you’re ready.

- Thinking you can pay someone to do it all for you

This is one thing you must do yourself. This is not like hiring a plumber or an electrician. A financial advisor will charge you a ton of money and will likely take a cut of future profits if you use them for managing your investments. This can cost you a fortune.

You do not get what you pay for in the financial advice world until your wealth reaches very high levels.

Passive investing is easy. Take the time to learn it for yourself. It’s your hard-earned money, don’t let anyone else take it away from you.

You can check out some more common mistakes here, if you so please.

Enough talk, I have $1k burning a hole in my pocket. How do I get started?

It’s simple. You need to choose:

- An investment provider, and

- An account type, and

- A fund to invest in.

Let’s go through each now.

Research providers for your region where the minimum is $1,000 or less

Each country might have slightly different providers, but for the US and the UK, we recommend Vanguard.

If Vanguard is not in your country, research reliable investment providers. Look for providers with low fees, a wide choice of funds (or just choose the one we recommend in the next section) and a great reputation. As a general rule, your local bank is not a good place to start.

Of course, the minimum investment should be $1,000 or less (some providers only accept clients with high levels of wealth).

Choose an account type to protect the gains on $1,000 from tax

Unfortunately, investment gains are subject to tax. But luckily, there are tax-advantaged accounts that can shield those gains from Uncle Sam.

These accounts are similar to other bank accounts you own but for investing (and for giving you tax-free or tax-deferred gains).

In the US, you are likely going to want to open a Roth IRA. In the UK, it will be a stocks and shares ISA.

Invest your $1k in a cheap, globally diversified index fund

Now it’s time to invest in thousands of companies, with one purchase. You will soon own a piece of Apple, Google and many other successful businesses around the world. If they do well, you do well.

We recommend the Vanguard Total World Stock Index Fund (VTWAX). If you cannot meet the minimum investment amount for the index fund, there is an ETF equivalent called Vanguard Total World Stock ETF (VT). An ETF is essentially a cousin of index funds, it will get you the same thing.

For UK readers, you want the Vanguard FTSE Global All Cap Index Fund Acc. The “Acc.” Stands for accumulation. It means dividends are automatically reinvested, which is the best option for someone looking to grow their wealth.

Both of these are 100% equities, meaning you are investing purely in stocks, no bonds. This is the best for growth in your wealth accumulation phase of life.

Should I invest the full $1,000 or drip feed (dollar cost average)?

Invest the full $1,000, right away.

Research has shown that dollar cost averaging, that is, spreading your investment out over many months, is actually more risky than investing in full.

As JL Collins writes, the market is ‘up’ about three quarters of the time, or every 3 out of 4 years. You are more likely to miss a full year of growth by dollar cost averaging, leaving you poorer.

What else should I do to grow my $1,000?

You can set up a monthly direct deposit with whatever you can afford to keep buying the same fund, automatically each month.

Just like the way you pay your bills or rent on the first of the month, you can pay into your index fund investment too.

Starting early and regularly will pay dividends (literally and metaphorically, though the actual dividends are reinvested!). It’s a great habit to get in to and will help your money compound even faster and to a larger degree.

Why SHOULDN’T I invest $1,0000

The above advice is almost a no-brainer.

The billionaire investor Warren Buffett believes it is the right strategy for 99% of people.

But even if you have your emergency fund, no debt, and you feel you are ready to invest, it still might not be the best option to grow your wealth.

If you’re reading this article, it probably means you haven’t invested before. As you only have $1,000 to spare, you’re probably in your 20’s or maybe 30’s and still climbing the corporate ladder or dipping your feet in the entrepreneurial world.

At this point in your life, $1,000 is a lot of money. If you invest it in an index fund, it might be worth $5 or even 10,000 in a couple decades if the market does well, which is pretty good.

But you might get a ton more value investing in yourself.

I believe you should take that $1,000 and invest in a course or another way to further your personal development.

For example, nearly 15 years ago I spent £450 on an SEO course that ultimately helped me land my first job in marketing. Just a two-day course gave me more knowledge than all the marketers at the company I joined, and I became the go-to person for an important function of marketing. This gave me a unique skill and unique value to the company, which helped me climb the corporate ladder.

My belief is that, until you have the ability to invest closer to $1,000 a month, not just $1,000 as a one off, you should probably be focusing on increasing your income.

Your ability to generate an extra $1,000 a month will go up dramatically in line with your skill set and the value you can offer people. Early adulthood is a time to invest in yourself.

At the end of the day, starting a saving and investing habit today is a good idea, and it will set you up well for the future. It doesn’t have to be $1,000 it can be as little as $50 a month.

But unless you have the disposable income to keep this habit up each and every month, until then, you might get more value from investing in yourself.

Maybe not immediately, but over time, it just might pay a higher dividend.

———————-

OK, so let’s say you’ve gone ahead and got $1,000 invested. How do you turn that in to $100,000? Read about how to 100x your money.