What is an expense ratio?

An expense ratio is the annual fee that an investment company charges its shareholders (you) to cover the costs of managing and operating the fund.

No matter what you choose to invest in, there is almost always going to be a fee attached to your investment (some zero-fee Fidelity funds are part of the few exceptions).

Minimizing the expense ratio is vitally important to maximizing your investment return. It is arguably the most important factor – we discuss why below.

Expense ratios are typically expressed as a percentage of the fund’s assets and are deducted from the fund’s returns before they are distributed to shareholders.

For example, if a fund has an expense ratio of 1%, and it earns a 10% return in a given year, the net return to you, the investor, would be 9%.

How to use the expense ratio calculator

Firstly, know that the expense ratio calculator effectively works for any investment with a regular annual fee.

Index funds, mutual funds, ETF’s or even real estate. It doesn’t matter if you’re in the US or India, a percentage fee is the same everywhere.

The first step is to find and compare potential fund options within your provider, or across a range of investment providers.

This will help you get a feel for the type of expense ratio fees you can expect.

One way to start comparing expense ratios is to look at the fund’s prospectus, which should disclose the expense ratio as well as other fees and charges associated with the investment.

Then, come back to our calculator to assess how much the fee will cost you over a long-time frame.

You can compare two fees from two different funds to get an idea of their cost.

For example, you may believe fund A will perform better than fund B. But if fund A also costs more over a 20-30 year period, the higher potential returns may be negated by the costs.

Expense Ratio Calculator Excel Sheet

If you prefer to play around with the numbers in Microsoft Excel, you can download our sheet here.

The spreadsheet contains two examples on two tabs. A simple example and then a more complex one. Give it a try!

Why calculating the expense ratio is important

It sounds so minor – what is the difference between 0.2% and 1%? Surely not enough to worry about?

But that small difference in fee percentage can amount to hundreds of thousands in lost investment return.

Therefore, when evaluating investment options, it’s important to consider not only the potential returns but also the potential costs associated with investing.

As mentioned above, if you have a 1% fee and you are expecting a 10% return on investment, you actually need an 11% return in order to get the 10% net return.

But if your fee is 0.10%, you would only need a 10.1% return to achieve your goal.

Is 1% a good expense ratio? It sounds really low!

Not really, I’m afraid! Let’s see just how much a 1% fee can cost you.

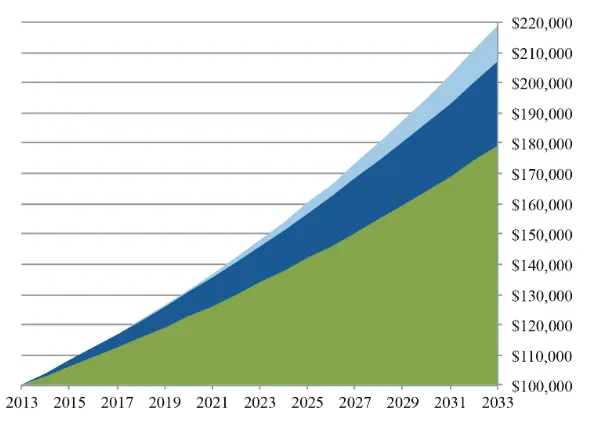

illustration of 1% ongoing fees over 20 years with 4% returns

The above chart shows a modest 4% average return on an initial $100,000 investment, over 20-year period, with a 1% fee.

- The green represents your return minus the 1% fee – around $180,000.

- The dark blue represents the fees paid – a staggering $28,000 dollars.

- The light blue shows you the additional return possible if the fees were reinvested instead – $12,000.

1% is often used as a benchmark for expense ratios, but whether or not it is a ‘good’ benchmark depends on the type of investment and other factors.

Actively managed funds typically have higher expense ratios than passively managed funds. A 1% expense ratio for an actively managed fund may be considered reasonable, while a 1% expense ratio for a passive index fund would be considered way too high.

Now, if you’ve read this blog before at all, you’ll know that we believe even a 1% for an actively managed fund is still too high. Heck, so is 0.50%. Avoid active investing all together if you can!

What is a good expense ratio?

You are looking for fractions of a percent.

How much exactly? Nowadays, you should be looking for an expense ratio between 0.10%-0.20% as a rough estimate.

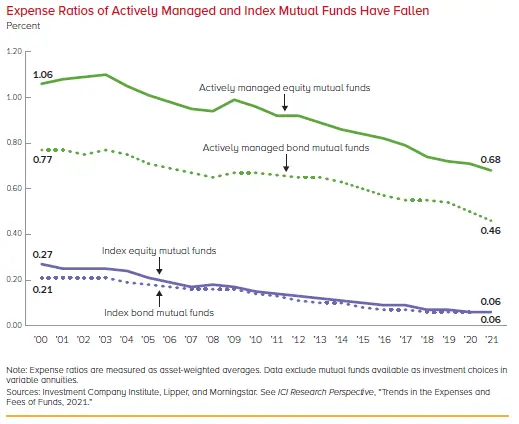

On average, the expense ratios for index funds and ETFs have been declining in recent years, which is good news for investors.

According to Morningstar, the average expense ratio for mutual funds was 0.44% in 2020, while the average expense ratio for ETFs was 0.19%.

These are the averages – which means half the available options are cheaper than this. There are some bargains out there!

We have a whole guide on the cost of passive investing (our preferred investment strategy). In there, we highlight some globally diversified and affordable funds.

Active vs. Passive fund expense ratios

Actively managed funds typically have higher expense ratios than passively managed funds (such as index funds), because they have more operational costs.

With actively managed funds, you have investment advisors, research teams, transaction costs and more. It’s a lot of bloat and can ultimately cost you thousands.

That’s because actively managed funds have been shown to underperform passively managed funds over long time periods. They deliver similar performance, but the obscene cost is what makes the difference in performance.

Passive index funds have lower overheads and can therefore be delivered relatively cheaply.

Now is a great time to start investing as prices are at all times low, and still falling. Competition in the market is one of the biggest drivers in the falling expense ratios:

Which platforms offer the cheapest expense ratios?

We advocate for Vanguard for their low fees and because we like what they stand for as an investment provider.

But there are others including Fidelity, BlackRock and others that are all fine choices. Compare the expense ratios and their respective platform fees, and find the provider that works for you.

The key is to avoid trading apps or your local bank. It might be convenient, but they typically have the highest fees and a poor selection of funds.

Using your bank is one of the 7 key mistakes passive investors make.

How expense ratios impact investment returns

What you’ll notice from playing around with the calculator is that small differences in fee amount to large differences in investment return over long periods.

Let’s say you invest $10,000 in a fund with an expense ratio of 1% and another $10,000 in a fund with an expense ratio of 0.5%.

Assuming both funds have the same annual returns of 8%, after 20 years, the first fund will have grown to $46,610, while the second fund will have grown to $56,445.

The difference in expense ratios resulted in a $9,835 difference in investment returns over 20 years.

It is crucial to minimize expenses to maximize long-term returns.

Hidden fees to watch out for

Besides the expense ratio, there are other fees that may not be included in the expense ratio.

For example, some funds may charge a sales charge or commission when you buy or sell shares. Others may charge a redemption fee if you sell shares within a specified time frame.

These fees can reduce investment returns, especially for investors who trade frequently.

To avoid hidden fees, you should carefully read the fund’s prospectus and other disclosure documents. You should ask questions and clarify any doubts before investing – go ahead and drop the investment provider an email if unsure.

Another slightly less hidden but very much important fee is your tax.

Different types of investments are taxed differently, and you should consider tax-efficient investing to minimize taxes.

For example, investing in tax-advantaged accounts like Individual Retirement Accounts (IRAs) or 401(k)s can help reduce the impact of taxes on your investment returns.

Summary

If you’re looking for simple, hands-off and affordable investing, an index fund is the right way to go.

As long as it is globally diversified and between 0.10%-0.20% expense ratio (fee), then you’re on the right track.

You honestly can’t go too wrong if the above criteria is met. Focusing on finding the lowest fee is a good guiding principle.

However, expense ratios are not be the only factor you consider when evaluating an investment option.

Other factors to consider include past performance, risk, and the fund manager’s track record.

Traditionally, when evaluating different investment options, you would consider all of these factors together. It’s more important in the active investing world to go into this level of detail, but less important when going for a passive investing strategy.

To learn more, see our passive investing guide on the best platforms & funds and get started investing the right way!