What is the Mint Budgeting App?

At its core, Mint is simply a free budgeting app with tools that are designed to help you manage your money more effectively.

It is the number one downloaded personal finance app on the app store, based on all-time app downloads. That is an impressive stat.

Even today, it is still one of the most prominent, well-respected, and widely recommended budgeting apps on the market.

I have been using Mint on and off for many years now. It was one of the first budgeting apps I tried on the app store – and that’s going back some way! It’s accessibility means it’s great for beginners, as well as those that need more control.

Top features of the Mint App

- Account linking. All your checking accounts, investment accounts, credit cards and more, in one place.

- Transaction management. Search, categorize and split transactions. Very useful.

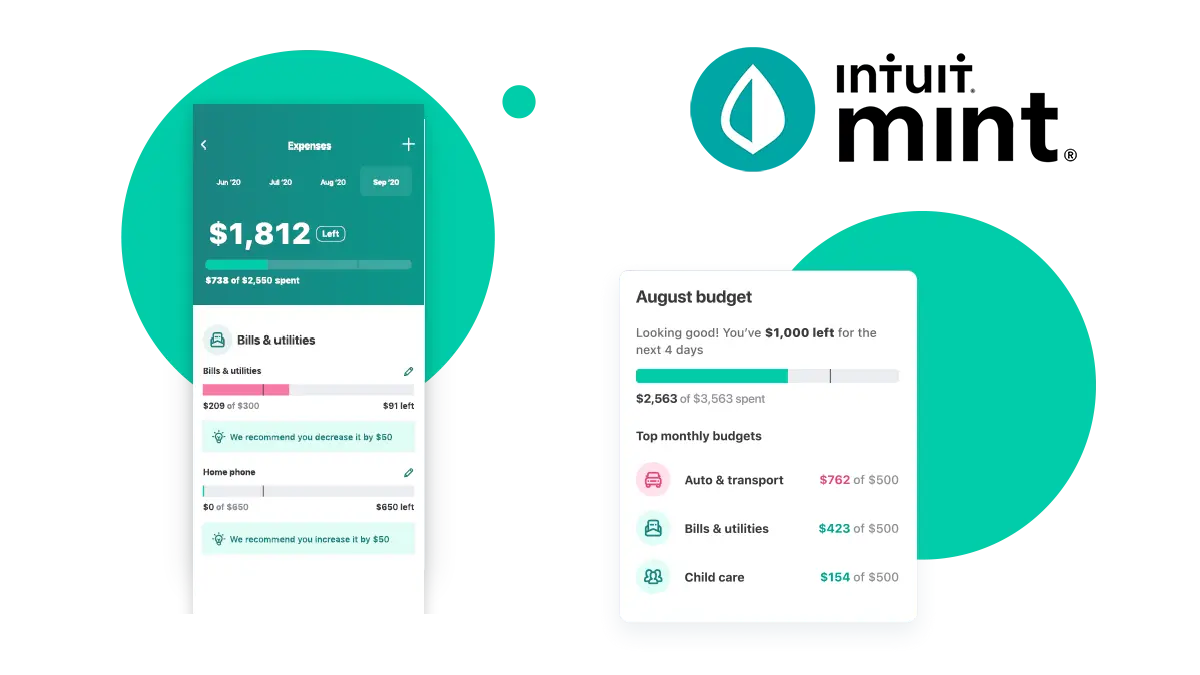

- Budgeting. Create a personalized budget with custom categories, tags and more.

- Cashflow. See your monthly cashflow – earned vs spent.

- Spending Categories. Create categories for your spend as well as targets for each category.

- Saving & Investing Goals. Set yourself targets and track your progress.

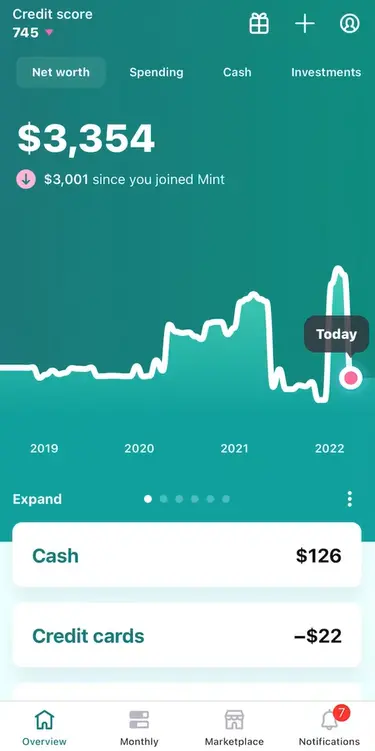

- Credit score. Gives you access to your Transunion VantageScore credit score for free – with a full breakdown.

- We call it a budgeting app, but it has an equally clean desktop version.

Let’s examine some of these features in more detail!

Account linking & personal finance overview

It perhaps goes without saying, but if you want to get the most out of this app you’ll need to link all your various accounts. That will give you the complete 360 view of your financial situation.

I found the process seamless, though occasionally I’m asked to relink accounts that have unlinked themselves.

It can be annoying to have to do all of this initially, but the payoff is worth it. The payoff is that at-a-glance overview of your personal finance situation.

The insights include a net worth tracker. This is a motivator, more than anything else. It’s the first screen on the overview tab, which makes sense as it’s arguably the most interesting as well as the most useful graph.

Transactions

One of the best things about Mint, and something I use the most, is the transactions view.

See, search, sort, and filter all of your transactions, across all of your accounts. It’s a great UI and surprisingly heavy on the features.

Some of the features that you won’t see on some of the other popular budgeting apps include the ability to add custom budget categories for certain transactions unique to you.

You can also tag certain transactions if you want to see all your vacation spending or business spending for example.

You can add notes to transactions. You can split transactions across different categories (you might have paid one fee, but part of the cost might be groceries, part of the cost might for gas).

If you really want to understand your spending, Mint lets you do that possibly better than any other app on the market. If transaction tracking is your main requirement, this is the app for you.

Budgeting

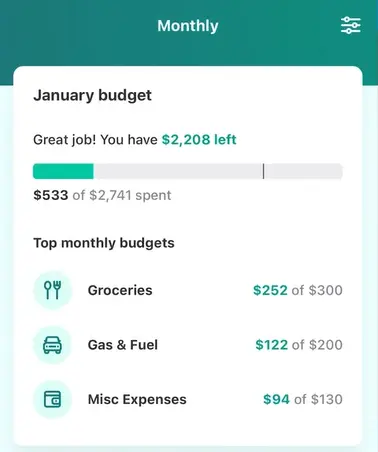

The ‘Monthly’ tab is where things get really interesting.

Here, you can create your own personal budget and they make this simple to set up. It’s as easy as taking your income, minus your expenses, leaving the rest for saving & investing.

You can get quite fancy with your budgeting; create numerous custom categories and subcategories to truly isolate and track your spending.

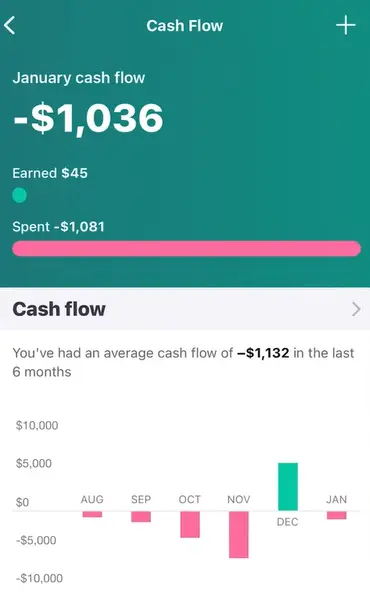

Cash flow

Within the cash flow area of the Monthly tab, you can see your overall cashflow as well as a breakdown of cashflow month-on-month for the last 6 months (see which months were positive, and which were negative.

If you have a variable income, it might not be too useful for you. But overall, it’s a clean interface for at-a-glance cash flow information.

Spending categories & targets

Mint will automatically categorize all your transactions and display them in a pie chart for you to see which categories are eating the biggest chunks of your budget.

If it gets a category wrong, which it does for me from time to time, you can jump in and edit it quite easily.

Visualizing the biggest pieces of the ‘budget pie’ might help you identify the categories of spending that you need to cut back on.

You can also set weekly spending targets. This is a clever feature that lets you set spending targets for specific categories.

In a way, it is gamifying your spending. You can try and beat your previous week or previous month’s frugality by being evermore money conscious. Any trick to make you better financially is OK in my book.

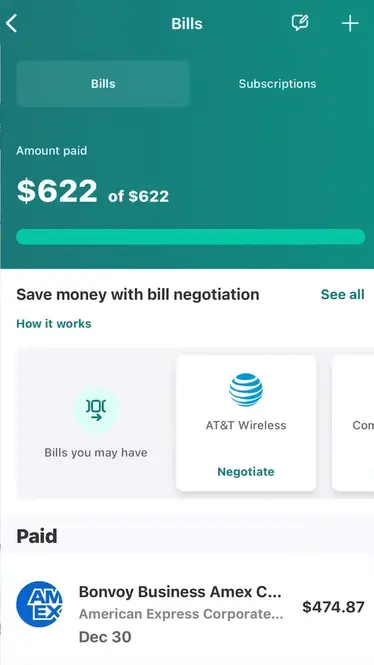

Bills and Subscriptions management

With all the cable, internet, streaming services, and gym memberships, it’s easy to lose track and be paying for something you no longer use.

I jump into this section of the app fairly regularly to check up on these subscriptions and reevaluate their usefulness.

Mint will automatically detect bills, but you can add your own subscriptions and bills manually.

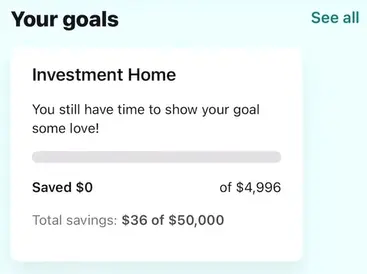

Saving & investing goals

You can set specific saving goals tailored to you. Set a target, and the date you want to reach said target.

It also lets you link an account to that specific goal, so Mint knows to track the growth of that account as progress towards your saving or investing goal.

This is another great feature that I have personally used in the past when saving for my first home. Visualizing your progress towards big purchases; vacations, weddings, cars and so on, is another big motivator.

Notifications

Mint goes beyond the occasional spammy push message, so this is a feature worth talking about.

You can get push notifications that remind you about upcoming bills, or for when the payment is actually due. You can receive email notifications for both of these use cases too.

You can also sync these reminders to the calendar on your phone, which I found quite useful. You can even sync credit score reminders to your calendar if you want to be reminded to check your score.

Web (desktop) app

I’d say 95% of my time was using the mobile app, but the desktop user interface is also well put together.

Moreover, it offers features that the app does not. You can add property to your board, adding that to your net worth for example.

The bigger screen means more space to show more detailed insights, so it’s useful to jump in to the desktop app from time to time.

The desktop app also has features such as the ‘Bill Negotiation’ service (powered by Billshark). They will negotiate lowering your bills on your behalf (and take a cut of the savings).

If you’re not great at negotiating, or you simply forget to do it, this might be a great option.

Mint Pricing

There are three tiers for the Mint app:

- Free tier (with ads). All the best bits are included.

- Ad-free tier for $0.99 a month. The ads can be intrusive, so it’s worth considering.

- Premium tier for $4.99 a month. This gives you features such as the subscription cancellation service, as well as more complex money trends and insights.

Safety & Security

Mint is designed in read-only format, meaning that if hackers were to breach the company, your financial data would not be exposed.

Of course, there is no way of transferring the money from ‘Mint’ to a would-be hackers account, as the funds do not exist in Mint.

Mint comes from the brand Intuit, who are behind software such as TurboTax and QuickBooks, so they are used to the strict requirements for storage of sensitive financial data.

Safe to say, it’s safe to use.

Who is Mint best for?

If you are looking for a clean, easy-to-use budgeting app to take control of your spending, or to give yourself spending and saving targets, or to identify pesky recurring monthly subscriptions, or all of the above, Mint might be the app for you.

I recommend Mint as a ‘gateway’ budgeting app for newbies as it’s not too overwhelming. The ‘gamification’ aspects make managing your money more fun, so you’re more likely to stick with it.

It’s simple, but the complexity is there if you want it to be. Tagging transactions, setting custom spending categories, splitting transactions, all highlight the detail you can go into, if you want to.

So, it is a comprehensive budgeting solution – but it’s just that. A budgeting app. If you want it to do other personal finance tasks, like helping manage your investments, you might need a more comprehensive offering.

Alternatives & Competitors to the Mint Budgeting App

Depending on your requirements from a financial management tool, there might be better alternatives. For example, if you’re looking for more advanced retirement planning functionality or stock trading functions, you might want to look at Empower.

- Empower: Empower is a free financial management platform that provides some more advanced features, including investing management & advice.

- Betterment: Betterment is an investment management platform that offers personalized investment advice and portfolio management services.

- Wealthfront: Wealthfront is another investment management platform that offers personalized investment advice and portfolio management services.

- Robinhood: Robinhood is a commission-free stock trading platform that also offers investment advice and portfolio management services.

Competitor feature comparison

| Feature | Empower | Mint | Betterment | Wealthfront | Robinhood |

|---|---|---|---|---|---|

| Investment tracking | ✔️ | ✔️ | ✔️ | ✔️ | ❌ |

| Budgeting | ✔️ | ✔️ | ❌ | ❌ | ❌ |

| Investment management | ✔️ | ❌ | ✔️ | ✔️ | ❌ |

| Retirement planning | ✔️ | ❌ | ✔️ | ✔️ | ❌ |

| Tax optimization | ✔️ | ❌ | ✔️ | ✔️ | ❌ |

| Commission-free trading | ❌ | ❌ | ❌ | ❌ | ✔️ |

| Stock trading | ✔️ | ❌ | ❌ | ❌ | ✔️ |

| Cryptocurrency trading | ❌ | ❌ | ❌ | ❌ | ✔️ |

| Human advisors | ✔️ | ❌ | ✔️ | ✔️ | ❌ |

Experiences of Mint from Reddit users

Reddit is a great source of (usually) unbiased opinions. Here are some of the most ‘upvoted’ comments in regards to the Mint budgeting app.

“I use mint as my single source for all my financials. it has it quirks, but has not let me down for 8 years.”

“Best part of mint is it has an excel export option. I’m not sure if mint will be around in 40 years but it’s good to know my data won’t die with it. I backup my records every so often.”

“I use Mint sometimes but then I get frustrated so switch to Google sheets. (Mint can’t connect some accounts, mis-categorizes tons of transactions, has a confusing UI.)”

The verdict – is Mint the one?

I certainly have no hesitation in recommending Mint for anyone looking for either very simple or highly tailored budget tracking.

Not only is it the number one downloaded finance app of all time, but its ratings have also stayed consistently high. On the App Store it is rated 4.8 stars out of 5 and 4.5 out of 5 on Google Play.

I have been a long-time user of Mint. But through exploring other apps like Empower, YNAB, and even DIY Excel-based solutions, I can tell you there is a bigger, wider world out there.

If you want to do more complex tasks, or even need more advanced financial solutions such as investing tools or advisory services, one of the aforementioned alternatives could be for you.

I do like the fact that you can export all the information to excel for more advanced analysis. Also, if Mint goes kaput, or you move on to a different service, you can have your financial history backed up somewhere.

Overall, it’s two thumbs up for me. Give it a try!