Recommended Loan & Credit Building Providers

4.9

Upgrade is a fantastic multi-purpose loan provider for those with credit scores of 560 or more.

4.4

PersonalLoans.com searches its wide network of lenders to find loans for those with low credit scores.

4.7

Grow Credit is not a lender. They offer a remarkably clever system to quickly build your credit score.

Overview

LendYou is a payday loan matching service.

That is, they are not a direct lender. Instead, they search their network of lenders to find offers from willing lenders.

LendYou promise fast approval and next-business-day cash, with loans between $100 and $2,500 typically. Though you can request personal loans up to $35,000 depending on your credit score.

With that said, this is generally a short-term lending solution. The APR on these loans may be extremely high.

These short-term loans are not a solution for long-term debt and credit difficulties. Payday loans can quickly become very expensive.

If you must borrow, only borrow an amount that can be repaid on the date of your next pay period.

How it works

In order to apply you must meet the following criteria:

- 18 years of age or older

- Valid checking or savings account with direct deposit

- Minimum regular income of $1,000 per month

- Not be a regular or reserve member of the Air Force, Army, Coast Guard, Marine Corps or Navy (or be a dependent of someone who is,) serving on active duty under a call or order that does not specify a period of 30 days or fewer.

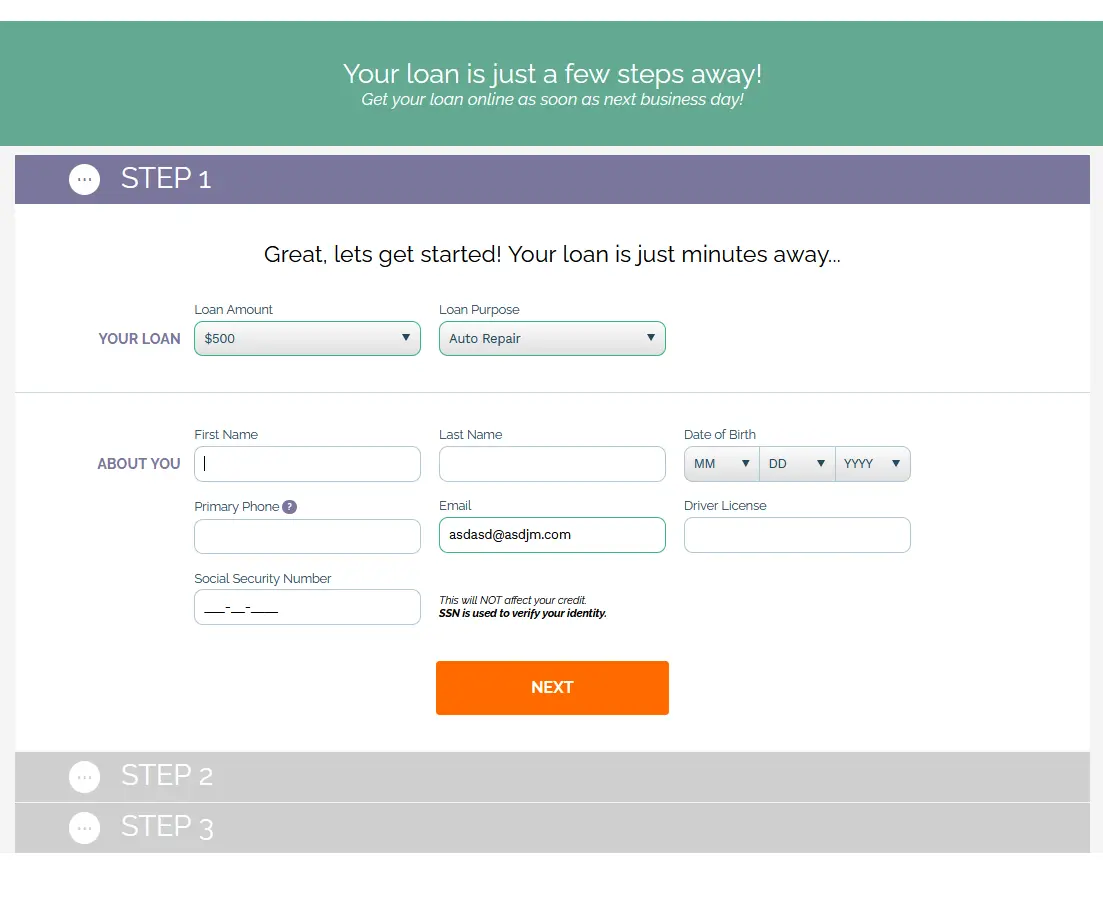

Apply on their website, first by selecting the loan amount.

Then, enter your personal details. This includes your SSN, checking account details, and employer details. It took us about 10 minutes to complete in total.

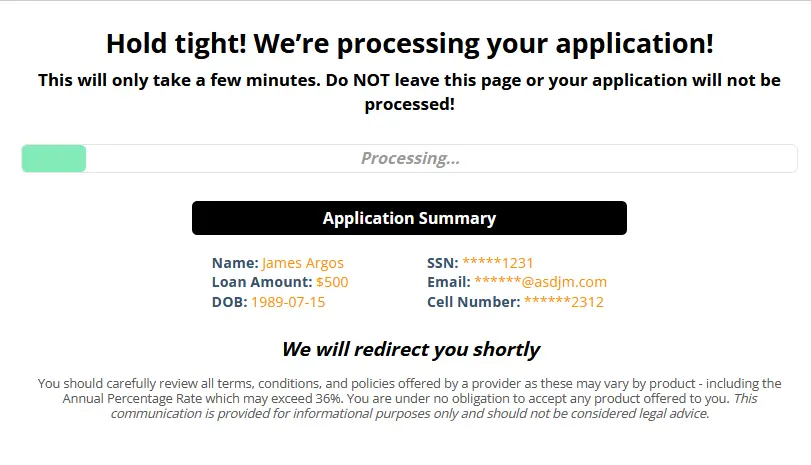

Once complete, LendYou will search for loan suppliers. This might take a few minutes.

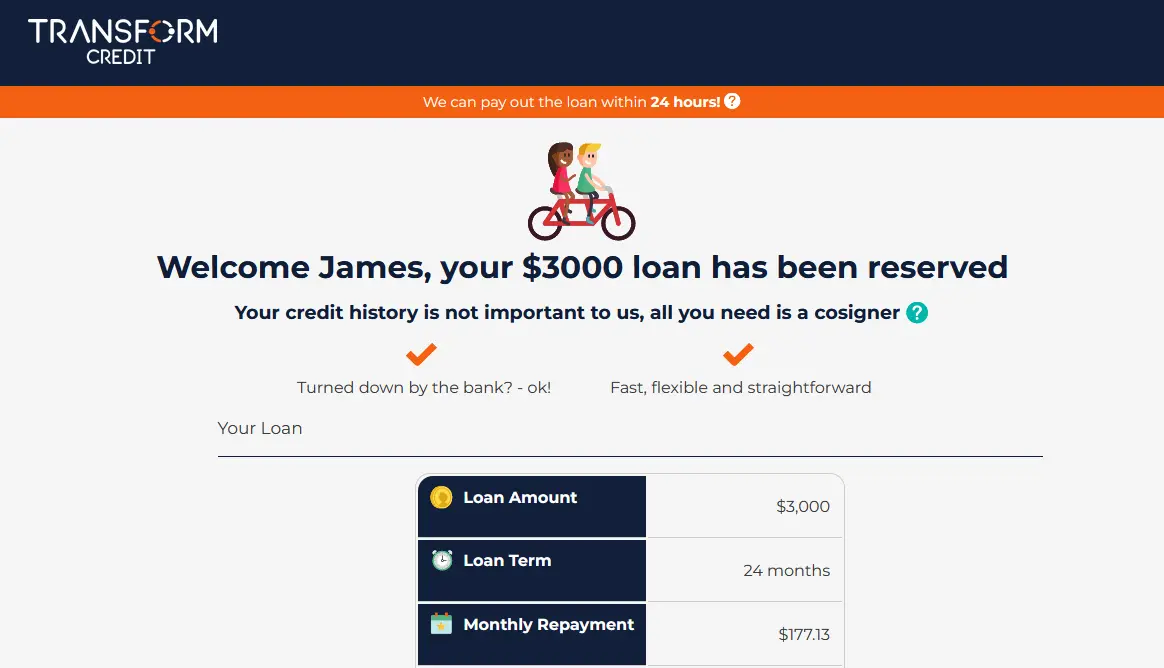

In our case, we were redirected to Transform Credit. We have reviewed Transform Credit and it scored reasonably well.

Transform Credit is an interesting provider as it does not look at your credit score at all.

However, they are a loan provider that requires a cosigner. That is, someone with a good credit score who is willing to ‘guarantee’ the loan should you be unable to repay it.

Finally, once the actual lender approves you, you can receive funds fairly quickly (sometimes as quick as 1 business day). However, each lender will have their own terms and requirements, so read the agreement carefully.

Is LendYou.com safe to use?

LendYou is a legitimate company. They are part of the Zero Parallel LLC affiliate network.

In other words, LendYou is the front-facing brand, but they use Zero Parallel’s network of lenders behind the scenes to find a willing loan provider.

Zero Parallel are a company promoted by the Online Lenders Alliance.

The only controversial information I could find about the company is that in 2017, they were found to be selling payday loans to consumers in unlicensed states.

That appears to be rectified as we were correctly not sent to a payday loan provider in our search.

As seen above, we were redirected to Transform Credit, a good provider with a solid reputation. But not every provider may be equally as reputable.

We simply cannot be certain that is the case for all users, in all states, and particularly for those with low credit scores.

While LendYou is perfectly safe to use, you must research the provider you are assigned after you submit your application and read their terms carefully. Pay special attention to the APR of your loan offer and any other costs or requirements before you accept the offer.

Furthermore, let’s not forget that it is risky to take a payday loan in general. The interest on these loans, particularly if you do not pay back quickly, can be shockingly high.

With all that said, LendYou is safe to use when searching for a short-term loan.

LendYou credit score requirements

This is a service primarily targeted at those with poor credit scores. As such, there is no minimum requirement.

This does not guarantee you will be accepted, however. Furthermore, if you are accepted, it may only be with interest rates astronomically high.

Alternatively, they may direct you to a cosigner service (like the one we mention above) instead.

If you have bad credit, the best thing you can do is first increase your score. A better score will give you access to better loan offers.

You can try services such as Grow Credit (review here) or Ava (review here) to increase your credit score fast. Both scored highly in our testing.

The lenders in Lend You’s network may initially perform a soft credit check but then a hard credit pull will be performed in the majority of cases before they issue you a loan.

This can negatively impact your credit score, so only apply for the loan if you truly need it. On the flipside, paying the loan off with on time payments can be a net positive for your credit score.

Cost and charges

It is free to apply for a loan. LendYou makes their money through referrals to the lenders in their network.

The resulting loan, of course, is not free. The interest on the resulting loan can be astronomically high.

- APRs for cash advance loans range from 200% to 1386%

- APRs for installment loans range from 6.63% to 485%

- APRs for personal loans range from 4.99% to 450%

It is illegal to offer loans with interest rates this high in many states. It is deemed a predatory loan practice as it can land users in huge amounts of debt.

My assumption is that there are some of tribal lenders in LendYou’s sit outside the law here, hence they can offer loans to those with poor credit with high APR.

To give you an idea just how much a small loan can cost, see the below example:

| Payment Number | Principle Amount | Interest Amount | Payment Amount | When Payment is Due |

|---|---|---|---|---|

| 1 | $3.60 | $94.25 | $99.00 | 10/16/2024 |

| 2 | $4.75 | $94.25 | $99.00 | 10/30/2024 |

| 3 | $6.26 | $92.74 | $99.00 | 11/13/2024 |

| 4 | $8.25 | $90.75 | $99.00 | 11/27/2024 |

| 5 | $10.87 | $88.13 | $99.00 | 12/11/2024 |

| 6 | $14.33 | $84.67 | $99.00 | 12/28/2024 |

| 7 | $18.89 | $80.12 | $99.00 | 01/08/2025 |

| 8 | $24.89 | $74.11 | $99.00 | 1/22/2025 |

| 9 | $32.81 | $66.18 | $99.00 | 02/05/2025 |

| 10 | $43.24 | $55.75 | $99.00 | 2/19/2025 |

| 11 | $56.99 | $42.00 | $99.00 | 03/04/2025 |

| 12 | $75.12 | $23.88 | $99.00 | 3/18/2025 |

| TOTAL | $300.00 | $888.00 | $1,188.00 | 3/18/2025 |

You must repay payday loans extremely quickly – by your next pay date. If not, the amount of interest accrued can be crippling.

There may be other charges for late payments or rejected payments, so make sure you have enough money in your bank account to repay the loan. Missing a payment can seriously affect your credit rating.

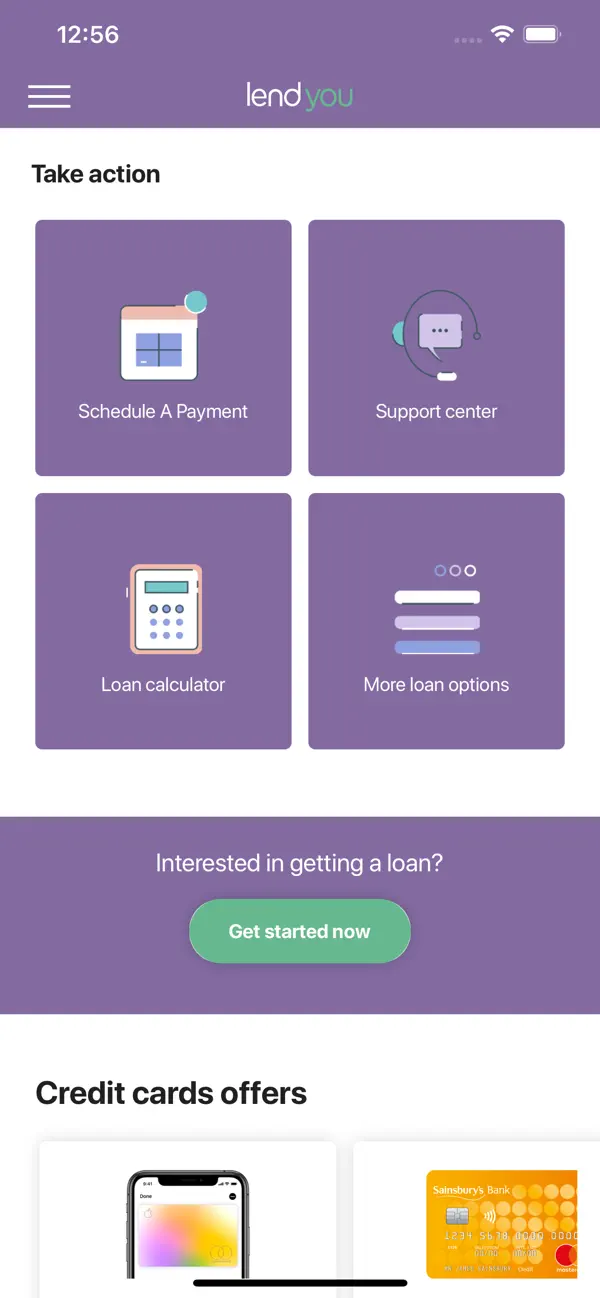

LendYou Google Play (android) & iOS app

I have reviewed quite possibly hundreds of loan providers, and LendYou is one of the very I have seen to offer an app for managing your loan and requesting future loans.

The experience using the app is just okay. Reviews of the apps are mixed, citing the inability to perform certain actions, which was also my experience.

But for a payday lender, it’s pretty decent. Anything that increases the transparency of loans, and the accessibility for repaying loans, is a good thing in my book.

LendYou Reviews & Complaints

The BBB (Better Business Bureau) has LendYou listed under an alternative name ‘Wisdomlending’ and it is not accredited or reviewed, though it is a fairly new profile.

The affiliate partner we mention above, Zero Parallel, has an A+ rating on BBB though is not accredited. There is just a single complaint from an alleged serial complainer (most likely a false complaint).

Typical comments on internet forums like Reddit discuss the astonishingly high fees LendYou loan offers come with. These are completely valid, but also avoidable if people take the time to read and understand the terms of the loan.

Otherwise, there is not much in the way of consumer reviews, perhaps owing to them being a fairly new business.

Customer service & support

As LendYou is just the middleman, they are not responsible for any payments or customer support for the resulting loan.

If you have any issues, you will need to get in touch with the lender that supplied your loan.

However, you can still contact LendYou if you prefer to apply for the loan over the phone: (888) 361-4303. LendYou seem very forthcoming about offering support where needed, which is good sign.

Competitors and alternatives

The downside to Modo Loan can be the high APR – the interest rate you pay on the loan. These high APR offers are usually the result of having a low credit score.

One thing you might consider is a service to boost your credit score. Ava finance is one such service, and they say 74% of their users see a credit boost within 7 days.

They do this through a rather ingenious method to report two on-time payments to the major credit bureaus – and fast. Read our full review of Ava here.

Learn more about how to boost your credit quickly with our guide:

Alternatively, a loan provider which has scored higher in our testing is Upgrade. This is a company who themselves are offering the loan (unlike Modo Loan which is simply a service to find loan providers).

With Upgrade, you know upfront which company will be servicing the loan – them! With Modo Loan, it’s not certain who you will be “matched up” with.

Upgrade offer loans up to $50,000, and you might get a better rate from this provider. If nothing else, it’s worth getting another quote from them as a comparison.

You can read our full review of Upgrade here.

Summary: Is LendYou worth a go?

If you understand that this is a short-term loan and that you must pay the loan back quickly to avoid high interest charges, then LendYou is a perfectly fine choice.

Remember, Lend You is not the loan provider, they are a middleman of sorts. You must read the terms of your specific loan from your specific provider carefully.

We always advise building your credit score first if the loan can wait.

But if you have an emergency, need a loan quickly, and have a plan to pay it back quickly, LendYou is worth a look.