Recommended Loan & Credit Building Providers

4.9

Upgrade is a fantastic multi-purpose loan provider for those with credit scores of 560 or more.

4.4

PersonalLoans.com searches its wide network of lenders to find loans for those with low credit scores.

4.7

Grow Credit is not a lender. They offer a remarkably clever system to quickly build your credit score.

What is Transform Credit?

Transform Credit is a loan provider for people with a poor credit history.

That’s because your credit score does not matter with Transform Credit. Instead, they require a cosigner to agree to the loan application as well.

I personally think this is a smart idea for a loan company. It’s one that can help many Americans who would otherwise not be approved for a loan.

The cosigner is essentially lending their credit rating to someone they trust (a family member or a friend – you!) so that you can get a loan.

However, the cosigner is liable for the loan should you not be able to make the payments, so it’s a big ask of anyone. Make sure your consigner is comfortable with this – a great deal of trust is involved.

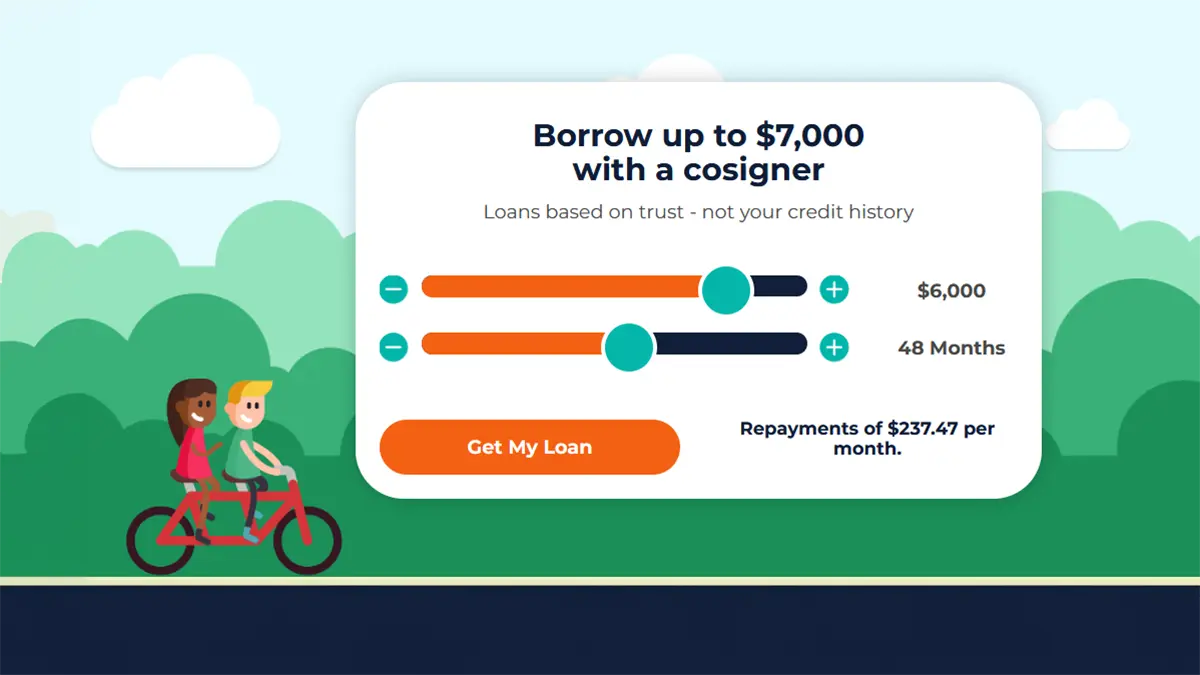

You can borrow between $3000 – $7000 and repay it over 24-60 months.

As the loan is for those with poor credit, you can expect a high APR (annual interest on the loan), meaning that you may repay much more than you borrow.

With that said, it should be a lot less than a payday loan, which is typically all that is available to those with poor credit. The APR for Transform Credit loans is capped at 35.99%.

As always, only take out a loan if it is absolutely essential. Make sure you and your cosigner understand the terms of the loan and are confident you can make the loan repayments on time each and every month.

Below is a 1-minute video explaining the concept behind Transform Credit:

Is Transform Credit a real, legitimate company?

Yes, Transform Credit is legit.

It’s still a fairly new company and the concept of having a cosigner on a loan is not exactly ‘mainstream’, but it’s absolutely a legitimate way to get a loan.

The company display all their licenses within the footer section of the site for each of the states they operate in, which at the moment is only a few:

- California

- Georgia

- Idaho

- Illinois

- New Hampshire.

- Oregon

- South Dakota

- Utah

- Wisconsin

Your cosigner does not need to reside in any of these states.

How does Transform Credit work?

The criteria for being approved for a loan is quite a short list:

- Aged 18+ in the US (in one of the states which are listed further below).

- Have some form of income to demonstrate you can repay the loan.

- Have a cosigner (this is more complicated – discussed next).

Cosigner Information

A cosigner is required for all applications.

A consigner is any US resident with a credit score of more than 750 and a good history of on-time bill payments. Homeowners are much more likely to be accepted.

Typically, this is a friend or a family member that trusts you to repay the loan in full.

This is a huge responsibility & a potential burden for your cosigner if you fail to make the payments, so do make sure you repay the loan in full.

The cosigner must also register and agree to the loan. You should make sure they understand that they are responsible for the loan in the event you are unable to make payments.

It is a legally binding contract – the money will automatically be deducted from your cosigner’s bank account just a single day past a payment due date.

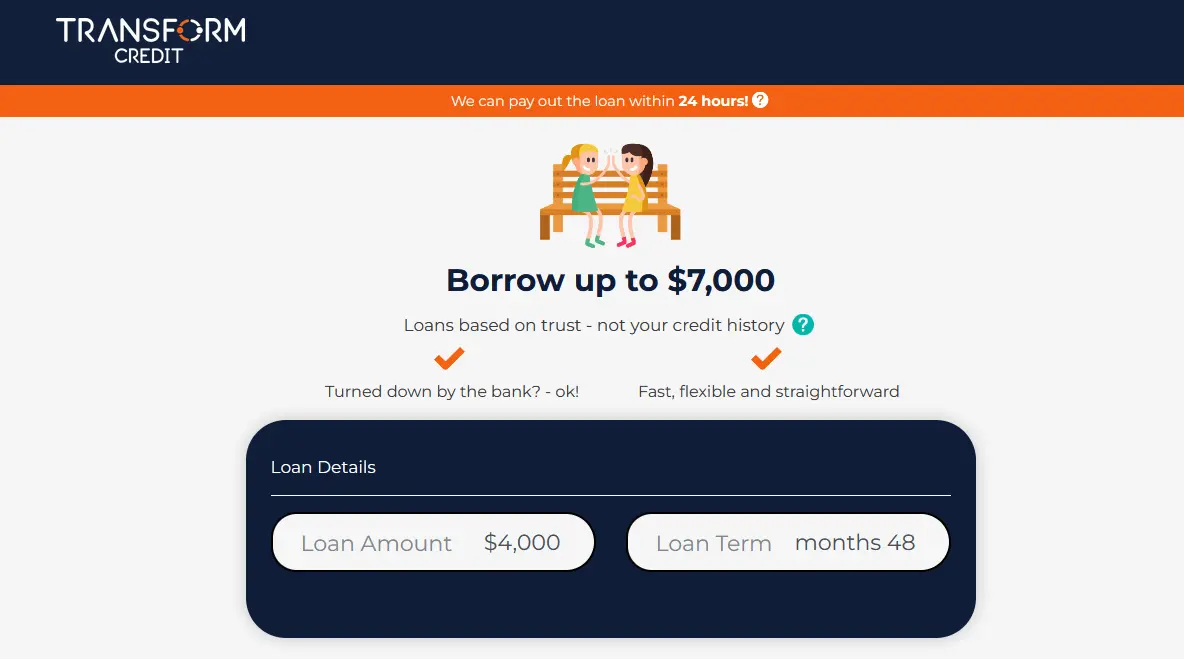

Applying for the loan

Apply for the loan on the Transform Credit website in minutes.

Simply select the amount you wish to borrow, the length of the loan and enter some personal details.

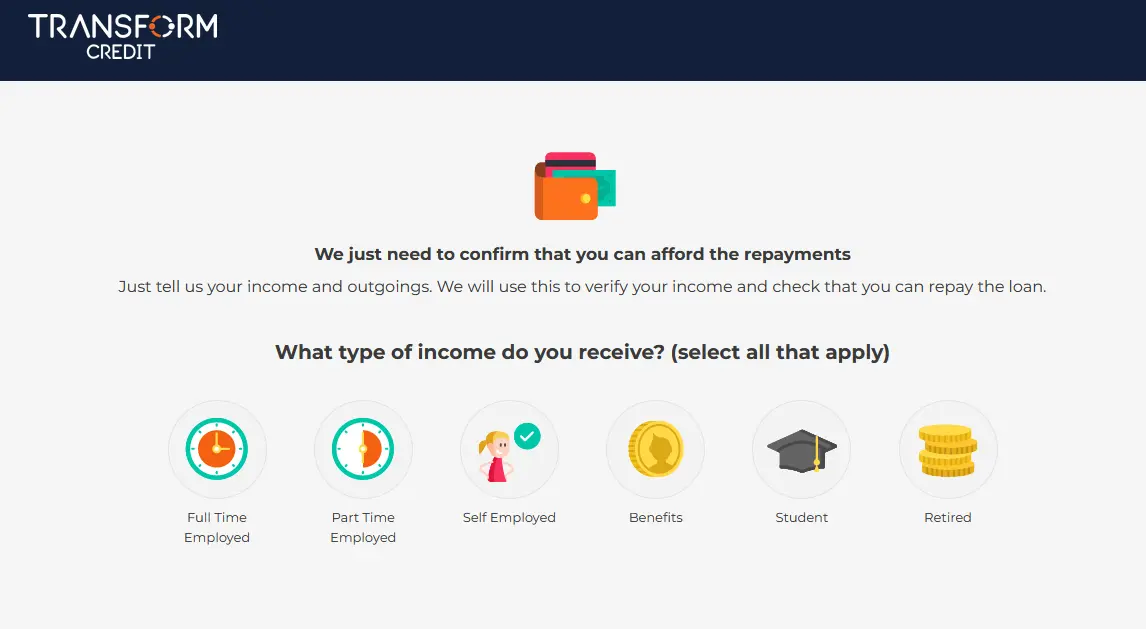

What I liked about the process is that Transform Credit takes measures to ensure you can actually afford the loan.

They ask about your income sources as part of the application – in my experience not something many loan providers do.

They even go as far as creating a personalized budget for your income and outgoings, and you can see how the loan affects that. A big thumbs up from me.

How long it takes to get the loan

After your cosigner is accepted, the money can be paid out in under 24 hours. Though if you apply over the weekend, it may be longer.

They may require some additional information if your application raises any questions, so do try to be as thorough and accurate as possible.

The loan will be paid out to your cosigner’s bank account. It’s not ideal, but it’s a good way to prevent fraud against unsuspecting consigners, so that’s how it must be done.

What banks does Transform Credit accept?

Transform Credit accepted all major banking institutions when I was setting up my loan application.

Will Transform Credit perform a soft or hard search on my credit profile?

The initial check will be a soft search, but if you go ahead with the loan, both you and the cosigner will have a hard inquiry performed on your respective profiles.

The hard search can impact both your credit scores, so do make sure your cosigner is comfortable with this happening.

Transform Credit Builder

You can also sign up to Transform Credit Builder as part of your application, but it’s not something I recommend.

You will see the following screen after submitting personal details. It’s easy to click the big orange button, but you actually will want to click ‘Or continue without setting up an account’ in grey just below.

The Transform Credit Builder is a service designed to increase your credit score. They create a small ‘loan’ for you in the background where you pay $5 a month until the entire loan (a few hundred dollars is repaid).

The idea is that you are building a credit history, with good on-time payments over a long period of time. They report these payments to the major credit agencies.

This is a smart idea in principle and will indeed build your credit score.

But the problem is you’re simply out $5 each month. You don’t receive a loan, nor will you receive your money back at the end of the ‘loan’ period.

There are services like this out there that are better in almost every way, such as the Ava Credit Builder (review here) or Grow Credit (review here) where you are getting better value for money.

Reviews & complaints

Transform Credit has a rating of 4.7 / 5 stars on Trustpilot with over 1,800 reviews, which is pretty reassuring.

However, they are not accredited by the Better Business Bureau. Their rating there is just 2.16 / 5 stars (though this is where people typically go to complain).

The BBB also has investigated complaints into Transform Credit. The key complaint, which I feel is valid, is that users are signing up to their Credit Builder service without realizing (see section above).

Those applying are seeing $5 leave their account each month having not read the above page carefully. Transform Credit claims to have made the page clearer, but it’s still easy to be misled in my opinion.

So, some shady marketing practices aside, I don’t see any reason to discount Transform Credit based on the user reviews.

Transform Credit phone number & contact information

Transform Credit’s phone number is +1 470 435 6300. Lines are open 8am-8pm CT, Monday – Friday.

You can also drop them an email on [email protected].

The cost of a loan

Below is an idea of just how much a loan can cost you in total (including the interest). I think it’s important to illustrate this so you can see just how much loans can truly cost you.

Transform Credit allow you to repay your loan early for free, so this is worth doing if you can.

| Term | Loan Amount | Rate (APR) | # of Payments | Monthly Payment | Total Payments |

|---|---|---|---|---|---|

| 2 Years | $8,500 | 6.99% | 24 | $380.53 | $9,132.68 |

| 3 Years | $10,000 | 8.34% | 36 | $314.93 | $11,337.64 |

| 4 Years | $15,000 | 10.45% | 48 | $383.69 | $18,417.05 |

| 5 Years | $20,000 | 8.54% | 60 | $410.72 | $24,646.98 |

| 6 Years | $30,000 | 7.99% | 72 | $525.85 | $37,861.25 |

Competitors and alternatives

The alternative to a cosigned loan would be a payday loan, which we do not recommend.

If you have a decent credit score (580 or higher), you might want to try a lender like Upgrade which scored highly in our testing (review here). You might be offered a better APR.

If the loan is not urgent, you might want to first consider improving your credit score using one of the services mentioned above (Ava Credit Builder and Grow Credit).

Then, you can apply for a loan from a lender like Upgrade.

You can check out our video on how to increase your credit score:

Summary: Is Transform Credit a legit option?

Yes, Transform Credit offer a decent service for those with a poor credit score.

Many Americans have experienced credit issues in the past that today prevent them from accessing loan facilities, despite now being in a financially stable situation.

Transform Credit offers a solution. A clever one at that.

You do not even need regular employment to apply, reducing more of the usual barriers to being approved a loan (though you do need to prove you have some income and that you are capable of repaying).

If you have a support network around you (i.e. a cosigner who trusts you), you can get a loan.

I agree with this idea in principle, providing you have the means to repay the loan on time. Transform Credit try to make sure your budget can accommodate the loan too, so they get extra points.

They may not offer the absolute best loan terms (high APR), but it’s better than a payday loan.

Overall, Transform Credit is a strong option.