Investing is easy.

Despite all the apparent complexity of the financial world, if you cut through the jargon, the packaged products and hidden service fees, you are left with one clear winning strategy.

Passive investing.

Sure, you can choose to study stock charts, balance sheets and p/e ratios to try and get an edge. But time and time again, that approach (known as active investing) has proven to be a losing strategy.

This article is not just how to become an investor. It is how to become the optimal investor.

What is an investor?

An investor is a person (or organization) that puts their money into an asset with the expectation of financial return.

Usually, that financial return comes from the asset rising in value over time.

You don’t need to invest in company stocks & shares to be an investor.

You can invest in bonds, real estate, commodities like gold, or even cryptocurrency if you’re looking for a high risk play.

There are two types of investors:

- An individual – you or I – can be investors. These are known as retail investors. We buy company shares through a brokerage of some kind.

- An organization can invest on behalf of clients or themselves. These are known as institutional investors.

This article is focused on the former – how to become an effective retail investor and build your personal wealth.

You might already be an investor

A peculiar fact that many people overlook is that there’s a good chance you’re already an investor and don’t even know it.

Many states now dictate that employers must offer mandatory retirement plans for their employees.

If you’re working full-time and contribute to a 401(k) or a similar retirement plan, this pension will almost certainly be invested in the stock market, bonds, and possibly other assets too.

That’s because the financial world knows you must invest your money to grow your wealth over time.

It is not optional.

If you do not invest, your cash is eroded by inflation over time (more on this in the ‘risk’ section below).

Investing for retirement is essential, and so you essentially become an investor the day you start contributing to your retirement plan.

Choosing an investment strategy

To become an investor, you first need to pick an investment strategy.

Whether you are a beginner or a seasoned finance pro, there is one simple strategy which has proven to be optimal for 99% of people.

That is passive investing and index funds.

One of the best investors of all time, the billionaire Warren Buffett, will tell you the exact same thing.

Why is this the right option? Three reasons:

- It is cheap to do. Fees are the enemy when it comes to investing, and index funds are extraordinarily cost efficient.

- It is simple. You can set it up in minutes and leave it untouched quite literally for decades to come. We have a complete guide on how to get started here.

- Historically, the passive index fund has performed well. Extremely well, in fact – outperforming up to 90% of the so-called professionals over a 20-year period.

Do remember, past performance is no guarantee of future results. But the underlying reasons for the strong historical performance remain.

Will you become an overnight millionaire? Absolutely not.

Passive investing is the patient person’s game. More on this below.

How to become an investor

Setting up your investment account is easy:

- Open an account with an investment company. We recommend Vanguard. Make sure you open a tax-advantaged account like a Roth IRA. These accounts shelter you from some or all of the tax burden, depending on your country’s rules.

- Pick an index fund to invest in. You want a globally diversified and cheap fund. We recommend the Vanguard Total World Stock Index Fund (VTWAX).

- Set up a monthly direct deposit to invest in that fund continually, for the next few decades.

For a full detailed guide, read our passive investing guide to learn more about index funds.

How to become a successful investor

It’s not enough to pick a winning investment strategy.

Passive investing is so simple, you might be wondering how it’s possible to make any errors executing such a strategy.

But the problem in this equation is the irrational human mind. The problem is that you and I are barriers to passive investing doing its thing.

In order to be successful, there are some mistakes we need to avoid.

1. Think long-term

Investing success, particularly with the passive investing strategy, is measured in decades.

This is a long-term strategy. You must be willing to lock your money away for a long time not touch it.

You must be patient.

Many make the mistake of thinking they can invest for ‘a few years’ for a short-term financial goal. This is too risky as the stock market is a turbulent place.

Some months the market will be up, some months it will be down. Your portfolio will reflect this.

If you are only needing to invest for a few years, there are no guarantees that it will be ‘up’ after such a short period of time.

2. Don’t panic sell

That leads us on to the next point. When the market does inevitably crash (yes, recessions are inevitable), do not panic.

It can be alarming to see your investment dip below what you started with – or maybe even drop 30%. But you must expect this, it is part of the journey.

Over the long-term, the market has always returned to prosperity.

The worst thing you can do is sell at this time, but many do. The old adage is true – buy low and sell high (after a few decades, of course).

If anything, you should be buying during scary economic periods.

If the market is down 30%, it means stocks are on sale. You can get more for your money during recessions.

Seeing the market crash and your portfolio drop can almost be a good thing, in that regard. Embrace the downturns!

3. Learn about compound interest

Compound interest is your new best friend.

It’s a little dull, but it’s also the reason you could be a millionaire when you retire, so pay attention.

When you invest money, that money earns interest. Next year, that money and that interest will also earn interest. This will keep happening each year and it will start to snowball exponentially over time.

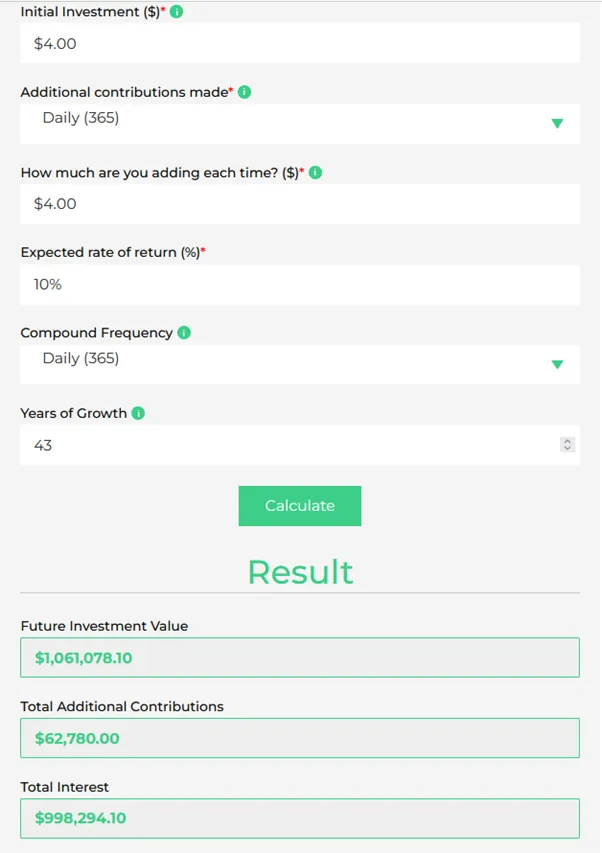

It is easier to show the power of compound investing with an example.

If you are 21 right now and you invest just $100 a month (which is less than 4$ a day) for the rest of your life, you will retire as a millionaire. That is based on average stock market returns of 10% until your retirement age of around 65/66.

See how despite only contributing $54,000 to your investments in your lifetime, you have earned over a million dollars in interest.

You can try it yourself on our investment return calculator.

If you ever feel apathy in regards to the amount of money in your portfolio, or if you lose motivation to keep up your investment, remember the power of compound interest.

That small amount of money go grow to exceeding large amounts given enough time. It will be worth in the long term.

Can anyone become an investor?

Technically, yes. You can even invest on behalf of newborn babies.

Anyone can set up an investment account, and we encourage everyone to do so.

But timing is important. It’s tempting to dive right into the investing world and start making your millions, but it might not be the right time for you right now.

Some people might have debt to clear. Some might have short term goals to save for.

There is in fact an optimal order for investing your money. Our 10 step process outlines everything you should do, in the order you should do, in order to be the most efficient.

The risk of investing

With all investing, there is a chance you can lose money.

The only way to become wealthy is to invest in assets where your capital is at risk.

Sure, you can invest in safe savings accounts which offer small amounts of interest. But this still may not even completely mitigate the effect of inflation, and it certainly will not make you wealthy.

The harmful impact of inflation on your finances cannot be overstated.

Things almost always get more expensive each year, thanks to inflation. If you keep your money in cash, the amount of money you have appears to stay the same but your real buying power decreases.

You effectively get poorer every year.

In that respect, there is more risk in not investing your money than there is investing it.

But it’s still normal to worry about the very real risk of losing money investing.

As we say above, as much as 90% of the so-called professional institutions can lose money over a 20-year period in real terms after inflation and fees. That is both a real and mind-boggling statistic.

That stat is a result of the strategies most people employ. Picking individual stocks, paying professionals extortionate fees, selling at the worst times, or other risky strategies.

On the spectrum of risk, passive index funds are far less risky than picking stocks. That’s because they are globally diversified, investing in thousands of companies around the world.

They are also cheap, so the fund does not need to perform as well to return a healthy profit.

Our guide to passive investing covers more about just how passive investing mitigates risk, so read on if you’re still unsure.

Real estate, commodities, cryptocurrencies & more

Surely becoming an investor means owning a wide range of assets in your portfolio?

And yet, we are just recommending stocks via an index fund as the only investment in our portfolio.

Correct. This is all you need.

Owning real estate can be like having a second job, and you will not need to look far to find someone who has lost money in real estate. It is almost comical.

Cryptocurrency is a wild ride that has made a few people rich and ruined many lives at the same time.

Could you make money with other asset classes? Maybe.

But index funds are simple and completely hands-off.

They are the perfect product for the person that would rather spend their time on their passions, or in their field of work or study, or doing literally anything else but analyze numbers in excel.

The only caveat here is bonds.

As you approach retirement, it is prudent to start adding in bonds to smooth the ride and mitigate some of the turbulence in the market.

But otherwise, index funds are the best choice for everyone. If you want to become an investor, there is not a single better place to start.